PAN cards and Aadhaar cards are important documents provided by the Income Tax Department (ITD) and the UIDAI (Unique Identification Authority of India), respectively. For an Indian citizen, both of these documents serve as identity and income tax.

In Budget 2020, Finance Minister Nirmala Sitharaman announced a new service; Instant e-PAN. It allows people to avail PAN card through Aadhaar card number. The service was created to make the process of obtaining a PAN easier for customers instead of filling out lengthy paperwork. The e-PAN is available for free through the income tax e-filing website. This article emphasises how to get a PAN card through Aadhaar card.

Table of contents

Get PAN Card with Your Aadhaar Card

Since the UIDAI launched the Aadhaar card. It has been easier for Aadhaar holders to get a PAN with your Aadhaar card and apply for various services like account opening, getting a driver’s license, applying for a passport, and so on. The Aadhaar card number can be used several times to identify and confirm identification via electronic methods, effectively making application processes easier. To get an avail PAN card through Aadhaar card, follow these steps:

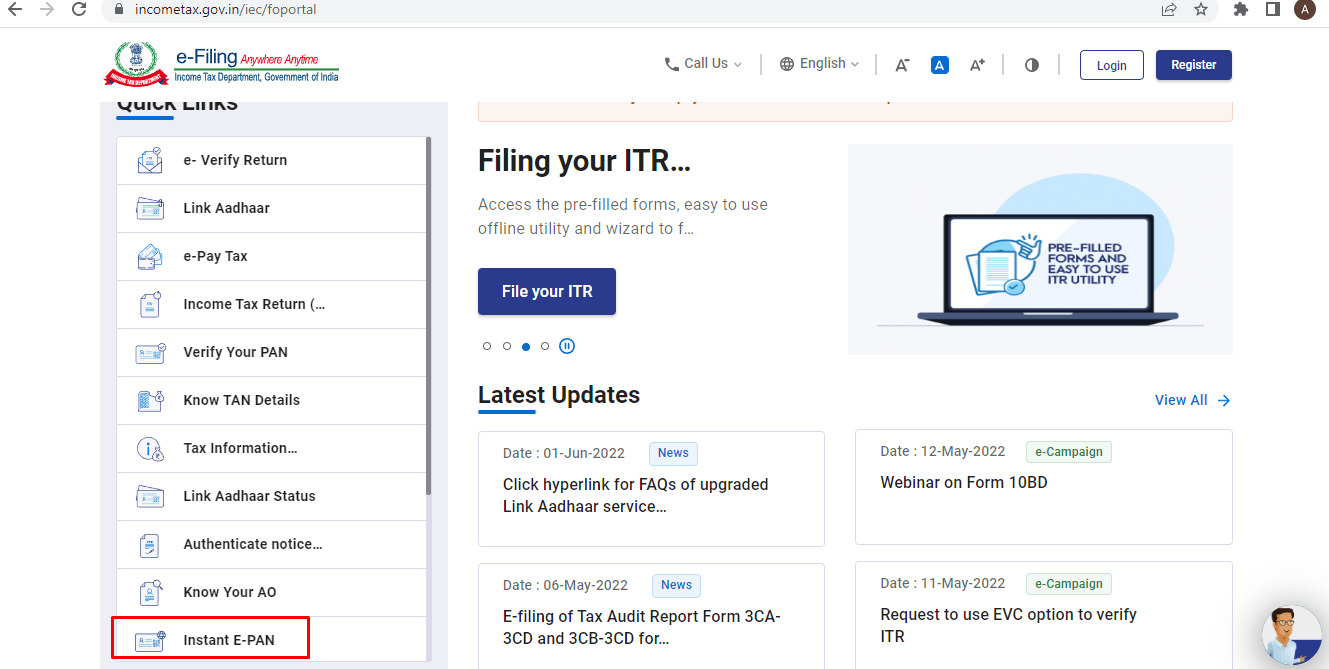

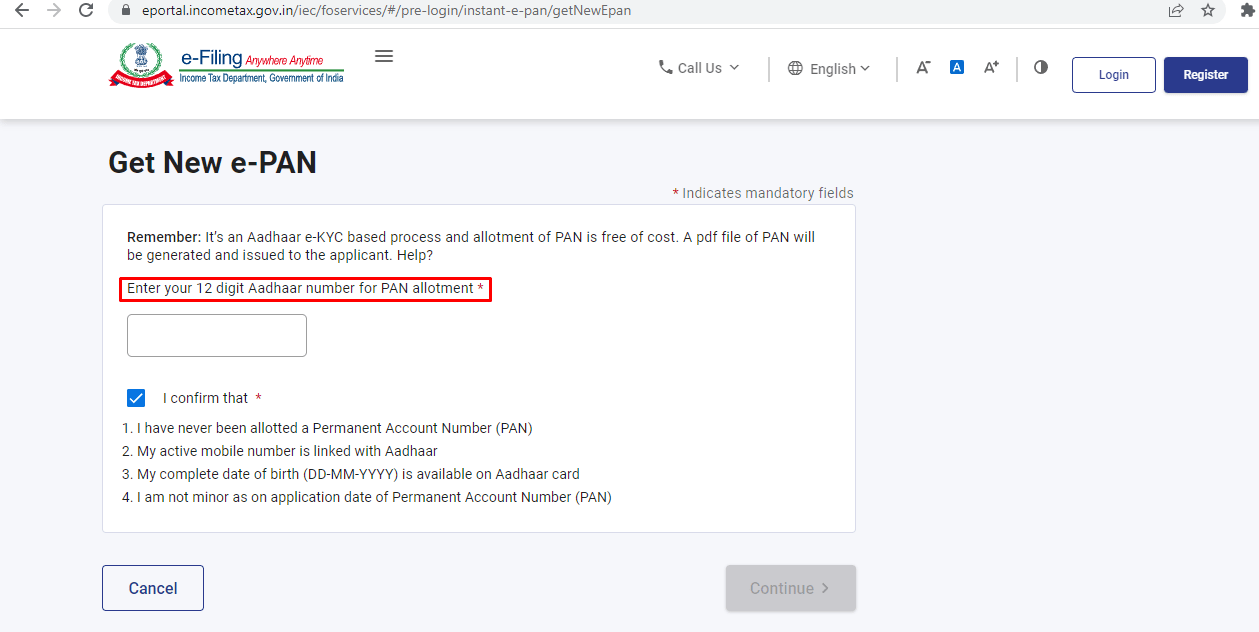

- Go to the official website of ITR (Income Tax Return). https://www.incometax.gov.in/iec/foportal

- Select the ‘Instant E-PAN’ option on the left.

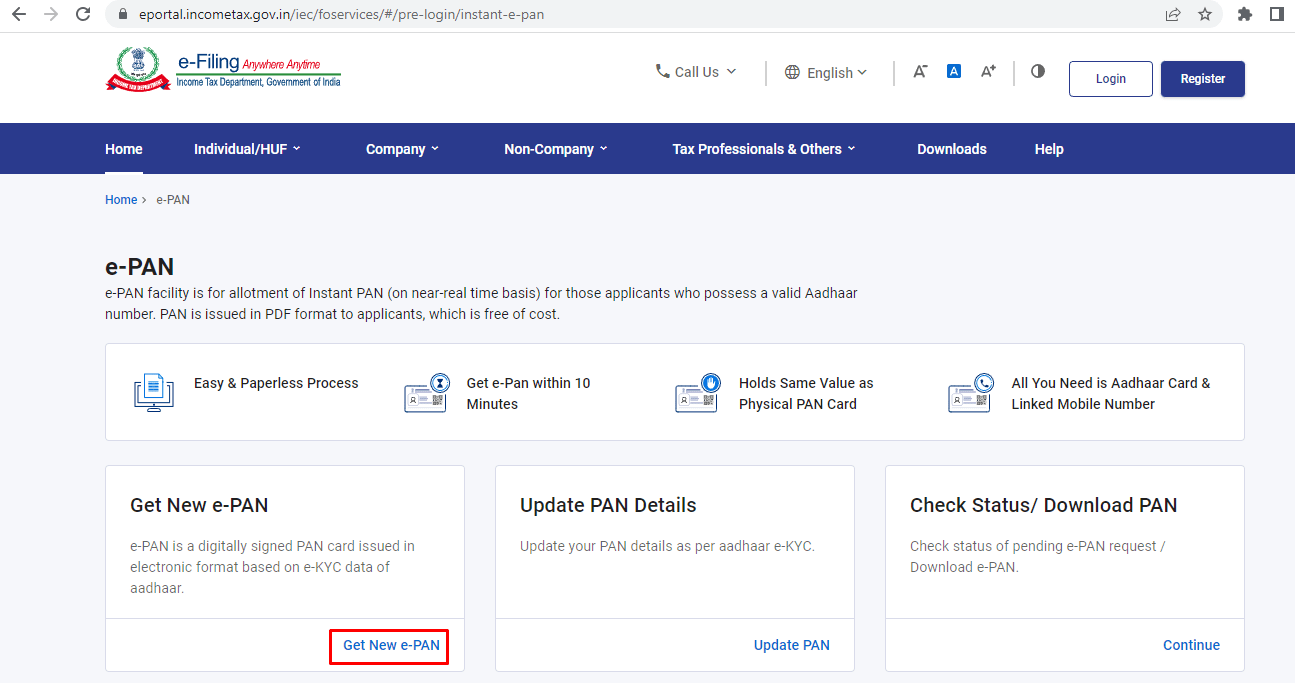

- Click on the ‘Get New e-PAN’ option.

Note: e-PAN is a digitally signed PAN card issued in an electronic formatbased on e-KYC data from Aadhaar.

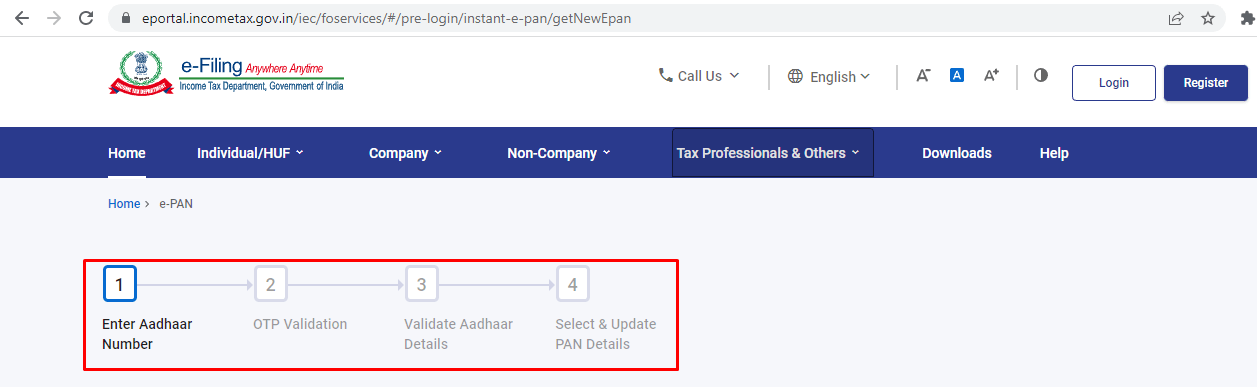

- To complete the linking process to get PAN with your Aadhaar card, you have to complete four basic steps.

- Enter your 12-digit Aadhaar card number for PAN card allotment, confirm the conditions, and press on ‘Continue.’

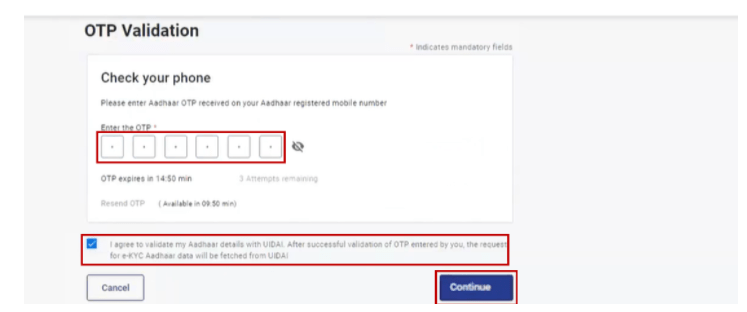

- You will receive an OTP on your registered mobile phone number. Fill out the OTP and submit it.

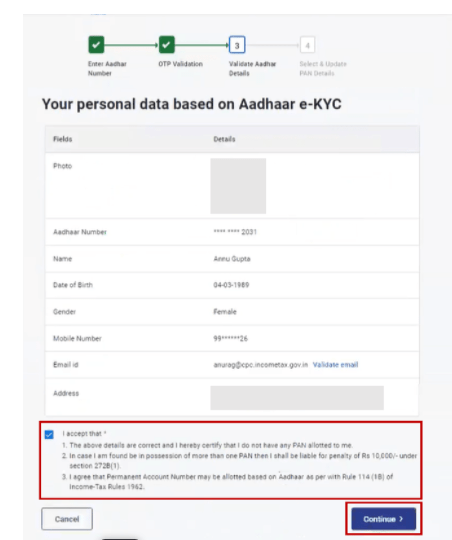

- Check and confirm your details, such as your Aadhaar card number and email ID.

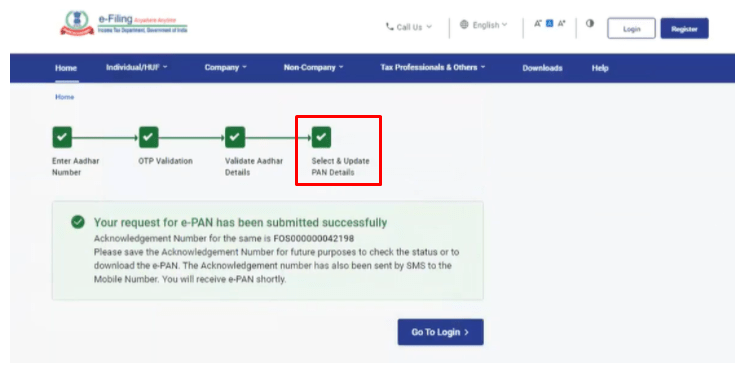

- After updating the details of the Aadhaar card, you will get an acknowledgment number. You can check the PAN card status by filling out your Aadhaar card number.

Note: An Aadhaar e-KYC method and allotment of PAN card is free of cost. A pdf file of the PAN card can be downloaded from the registered email id.

Documents required to Avail PAN Card through Aadhaar Card

To get PAN with your Aadhaar Card KYC, numerous documents are required:

- The applicant must have a valid Aadhaar Card and it should not be linked to another PAN Card.

- The valid contact number should be linked to the customer’s Aadhaar Card.

- The linking of PAN Card through Aadhaar Card can be done online, a paperless method.

- The applicant should not hold more than one PAN card. If in a case, under section 272B(1), the Income-tax Act will impose penalty charges.

How to Check the Status of a PAN Card?

Some of the following steps are mentioned below to check the status of the PAN card through Aadhaar Card.

- Go to the official website of the Income Tax Department. “https://www.incometax.gov.in/iec/foportal”

- Click on the ‘Instant E- PAN’ option on the left.

- A new page will appear, select the ‘Check Status/ Download PAN’ option and click the ‘Continue’ button.

- Enter the ‘Aadhaar card number’ to know the status.

- You will receive an OTP on your registered mobile number and email ID. Enter the OTP and submit it.

- After entering the OTP, you can view the status or download the PAN card.

PAN Card Linking Related Articles

Frequently Asked Questions (FAQs)

Is it necessary to avail of a PAN card through Aadhaar card when you're not a tax-payer?

Yes, even though you’re not a taxpayer, you must link your Aadhaar number to your Permanent Account Number (PAN).

When does the government announce the immediate PAN registration service with Aadhaar?

The Central Government officially introduced the instant PAN Card allocation capability based on an Aadhaar e-KYC on May 28, 2020.

What are the penalties for not linking your PAN card to your Aadhaar card?

The applicant must link their PAN card with their Aadhaar card. By March 31, 2022, it will be made compulsory by the government. If any customer does not adhere to the timeframe, their PAN card will become invalid and a penalty of ₹10,000 will be imposed. Furthermore, such PAN cardholders will be unable to open a bank account, invest in stocks or mutual funds, or engage in any other PAN-related activity.

Name the app that was launched by the Income Tax Department.

The Income Tax Department has introduced the Ayakar Setu, a smartphone app designed to make tax payments and grievance resolution easier. The Google Play Store is where you can get this software for Android smartphones.

How to check if my Aadhaar is linked with my mobile number?

To see if your Aadhaar is registered to your phone number. Go to the UIDAI official portal. Select ‘Aadhaar Services’ under My Aadhaar and follow the instructions.