The Income Tax Department of India issues a 10 digit alphanumeric number, a unique number for every individual. Permanent Account Number (PAN) is one of the most powerful cards in India.

To apply for this, Indian citizens have to fill the Form 49AA. Additionally, the non-residential Indians or foreigners who want to establish their business in India or deal with any Indian company also have to fill out the PAN Form 49AA.

What is Form 49AA?

Form 49AA is an application form filled by Non-Residential Indians or foreign citizens to get a Permanent Account Number (PAN) card. PAN is a mandatory document for foreign citizens and companies outside India.

Structure of Form 49AA

Here we have explained the entire process of filling the Form 49AA.

- The AO Code – You have to write the information about the Assessing Officer code in this part of Form 49AA. Also, pen down the details about your area code, type of accounts office, code range, and the number of accounts officers.

- Complete name – You have to mention your complete name (First, middle, and last name) with the appropriate spelling in this part. Make sure to write one block letter in one column.

- Name Abbreviation – Here, you have to write the abbreviation (if) just as you wanted to see on your PAN card.

- Other Names– If you have any other name apart from the one written on the PAN Form 49AA, be sure to provide all the information about it.

- Gender – Select your gender from the three options male, female, and transgender.

- Birth Date – Write your birth date, month, and year, using the format given in this part of the PAN Form 49AA. Further, companies will write the date of partnership or trust deed or agreement was signed.

- Name of Your Father – You have to mention the complete name of your father, even if you are a married woman.

- Complete Address – Carefully write your address, residential or commercial, in this section of the form.

- Communication Address – Select the communication address where you want your PAN card to be delivered, after its issuance.

- Contact Details – Write your mobile number, email address, state code, and Country code. Make sure the contact number and email address are active, as they will help convey information (if any) and updates about your PAN card.

- Applicant Status – Enter whether you are a HUF person or an individual or a company, establishment, or partnership firm.

- Registration Number – In this part, you have to mention the registration number of your company, firm, organisation, LLP, etc.

- Your Citizenship – Write the ISD code of the country you are living as a citizen and the name of your country.

- Your Indian Representative – Write the complete address and name of the person representing you in India.

- Submission of Documents – You have to attest all the documents to be submitted with Form 49AA.

- KYC Information – A Qualified Foreign Investor will fill this part of the form, according to the rules of SEBI. This section of Form 49AA will also have information about your marital status, business, citizenship, and others.

Documents Requirement of Form 49AA

Identity Proof

Here are the following documents, you can use as identity proofs.

- Passport

- Driving Licence

- Evidence of Person of Indian Origin

- Evidence of Overseas Citizen of India

- Evidence of Tax Identification

- Duly attested by the Indian Embassy or Apostille

Points to Remember

- Make sure the documents are self-attested.

- The document must have the candidate’s complete name and be relevant to the Passport.

- In case, the PAN applicant is a minor all the above documents shall be used as identity proof by any of the parents of that minor.

Address Proof –

Here is the address proof a foreign candidate is entitled to produce

- Passport

- Bank Statements (residence of the country, the applicant belongs to)

- External bank account statement in India of a non-resident.

- Evidence of a certificate of residence in India.

- Evidence of residence issued by state authorities.

- Registration certificate evidence granted by the Foreigner’s office at an Indian address.

- Copy of Visa or Contract with the Indian Company.

Points to Remember

- The documents must not be more than three months old.

- Documents must be self-attested.

- All the documents must have the candidate’s full name.

- In case, the foreigner is a minor, all the documents to be used as identity proof must belong to parents or guardians of the minor.

Birth Date Proof –

Here are some of the birth date proofs, you can use as a foreign applicant while applying for a PAN card.

- Passport

- Evidence of affidavit confirming the date of birth

- Birth certificate

- Resident certificate

- Driving licence

- Matriculation certificate

- Proof of pension payment order

Points to Remember

- All the documents must be self-attested and have your complete name as a foreigner.

How to Download Form 49AA?

You can download the Form 49AA by visiting any of the websites NSDL or UTIITSL.

Here are the steps to follow.

Using NSDL Portal

- Visit the official website of NSDL.

- Select the option of PAN under the downloads

- Click on the Form 49AA option.

- You will be directed to a new page.

- From there you can press the download option.

Using UTIITSL Portal

- Visit the official online portal of UTIITSL.

- From the drop-down menu of tab PAN card services, select apply for PAN card.

- You will be directed to a new page. From there select the option PAN card for foreign citizens.

- Click on the option Download blank PAN form 49AA.

How to Apply For Form 49AA?

There are two ways to apply for Form 49AA, online and offline. Online you can use either the NSDL portal or the UTIITSL portal.

The online process is very easy as it saves time and hard work. Using this digital process, any foreign applicant can fill out the PAN application form. Follow the steps and learn how to fill PAN application Form 49AA using NSDL and UTIITSL portal.

How to fill Form 49AA Online on NSDL Portal

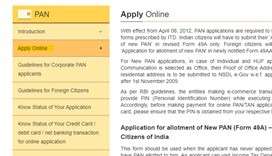

Step 1: Visit the website of NSDL. Hover over the services tab and select the option of PAN.

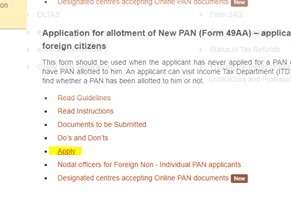

Step 2: Select the Apply Online option. Scroll the screen and read under the heading – Application for allotment of New PAN (Form 49AA) – applicable for foreign citizens. Press the fifth option, APPLY.

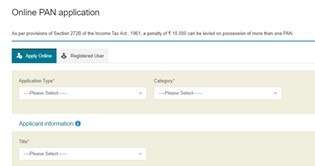

Step 3: You will be directed to a new tab page. You have to fill in the details as asked. Make sure to select the New PAN Form 49AA option under the drop-down of application type.

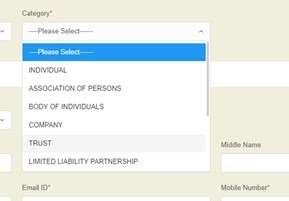

Step 4: Make sure to select the right category type. This will define why you are applying for a PAN card.

Step 5: After filling the complete form enter the captcha code and press the submit button. You will receive an application number on a new page. Keep this number safe and press the continue button to continue with the application form.

Step 6: Now, submit all the documents you want to provide as your identity proof, resident proof, birth date proof, Citizen proof of your country. You can use either the e-KYC or simply scan the documents and upload them.

Step 7: Mention all the information as asked after you are directed to a new page.

Step 8: Now, enter the details like your income source, communication address, residence address, contact details, and email address.

Step 9: Enter your Area Code, AO type, AO number that will be accessible by your nearest ITD Office.

Step 10: Upload the signature, photographs, and documents as per the favourable sizes.

Step 11: You will be directed to the payment gateway after uploading all the documents. You have to pay the chargeable fee as asked including GST.

Step 12: After paying the fee make sure to take out the print of the receipt. Paste your photograph and sign on it.

Step 13: In an envelope, attach your documents with the form, write APPLICATION FOR PAN -15 DIGIT ACKNOWLEDGEMENT NUMBER and submit the same to your nearest NSDL office.

Step 14: Within 15 days, you will receive your PAN card at your communication address.

How to fill Form 49AA Online on UTIITSL Portal

Step 1: Visit the UTIITSL website.

Step 2: Select the option of PAN card Services. From the menu of services click on Apply PAN Card.

Step 3: You will be redirected to a new page. Scroll the screen and click on the PAN Card as Foreign Citizen.

Step 4: Again, you will be directed to a new page. Select the option Apply for a new PAN Card (Form 49AA).

Step 5: Select the option whether you need PAN or e-PAN. You have to enter your AO type, AO number, AO code accessible by the nearest Income Tax Department office.

Step 6: Fill in all the mandatory information as asked in the form. You have to write your residential address and communication address.

Step 7: You have to select your citizen type and enter the ISO code. And, also mention the source of income.

Step 8: You have to submit the essential documents to complete the KYC process. After completing the KYC process, fill in the declaration and enter the captcha code. Hit on the submit button.

Step 9: You will be redirected to a new page. Here you will get the acknowledgement number. Keep the acknowledgement number safe.

Step 10: Download the PDF format and also take out a printout. You have to now upload the scanned documents. Make your way towards the payment.

Step 11: You can pay using cheque or DD or using net banking, credit card and debit card.

Step 12: You can further track your PAN application using your Application Number. Within 15 days, you will receive your PAN card.

How to fill Form 49AA Offline

- Due to any reason, if a foreign applicant is not able to submit Form 49AA using an online process they can apply the same using the offline method.

- The first step is to download the form either from UTIITSL or NSDL online portal.

- After downloading the form, take its printout and fill in all the obligatory and personal details. Make sure that all the information submitted by you is appropriate and correct.

- As a foreign applicant, you have to sign a declaration stating that all the information provided by you is true.

- Along with your signature or left thumb impression, write your date and place as well.

- Attach your passport size photo in the given space.

- Once review the form and submit it along with the required documents to the nearest UTIITSL or NSDL office. Pay the chargeable fee using DD or cash or e-payment.

- Within 15 working days, you will receive your PAN card.

What are the Things to Avoid While Filing Form 49AA?

Here are a few things to avoid while filling out the PAN application Form 49AA.

- Avoid overwriting and any changes after filling the Form 49AA. However, if anything similar to this happens, the application form will be rejected by authorities.

- Make sure not to write POI or POA in the name section in the PAN Form 49AA.

- You don’t have to give personal details, like birthmarks, designation, and additional information.

- If you are a female, avoid writing your husband’s name in the father’s name column.

- You don’t have to use abbreviations of your name or initials.

- Make sure if you are applying for PAN, you don’t owe any from the past. If you have an additional PAN card, surrender it and apply for a new one.

- However, if you own more than one PAN card, you will be charged a hefty penalty of Rs. 10,000 under Section 272B of Income Tax Act, 1961.

PAN Card Forms Related Articles

| PAN Card Forms | Rule 114B |

| Form 49A | Rule 114E |

| Form 60 | Amendment Rules for PAN transactions |

| Form 61 | Intructions for Form Filling |

Frequently Asked Questions (FAQs)

What is the primary meaning of Form 49AA in PAN application?

The primary means of Form 49AA is to allot a Permanent Account Number to every individual who belongs to a different nation or is an NRI or wants to do business in India or an Indian company.

Can I fill up Form 49AA in my native language?

No, you cannot fill Form 49AA in your regional language. Form 49AA can only be filled up using the English language only. Make sure that the form must be filled up using block letters.

Is it essential to provide all contact numbers?

Yes, it is mandatory to provide more options for communications, so that any information can be easily transmitted to you whenever required.

How to apply for a PAN Card?

To apply for a PAN card, you have to fill the online form 49AA or form 49A either from the NSDL portal or UTIITSL online portal.

Is representative assesses compulsory?

Yes, if the foreign applicant is deceased, minor, or mentally diabled then filling the representative assessee field is compulsory. In the form, columns from 1 to 13 have all the information of the applicant on whose behalf the application is submitted. In all the above cases, identity proof and address proof is also mandatory for the representative assessee.

What are the different payment channels available for making a payment?

A PAN applicant can make payment using a DD, cheque, credit card, debit card, or net banking.

If the foreign applicant is disabled, can he or she use the left thumb for signing the application form?

Yes, if the applicant is disabled or unable to sign, he or she can use their left thumb impression for signing the PAN card application form 49AA. However, NSDL released the guidelines that irrespective of disability the applicant has to give the left thumb impression. It helps in making the changes or corrections in the existing card issued by the Income Tax Department of India.