Well, if you have a property in Pimpri Chinchwad, Pune, and that too, in your name, then you will have to pay the PCMC property tax.

The PCMC (Pimpri-Chinchwad Municipal Corporation) is one of the popular Enterprises in Maharashtra. The Pimpri-Chinchwad Municipal Corporation (PCMC) is reckoned as a valuable civic figure, due to a huge number of multinational producing units operative in the region. There are 17.3 lakhs people in Pimpri Chinchwad city, and the region of PCMC is almost 181 square kilometers in area. Hence, they need to make the payment for the taxes every year because the management or the government charges an extra amount for the late payment after the due date.

The tax is received from the property owners depending on the property location characteristics, such as region, position, resident type, tenant type, building type, construction type, etc.

Formula to measure Pimpri-Chinchwad Municipal Corporation (PCMC) property tax

A property tax is not consolidated over the entire nation, and thus, it alters over different places, towns, and states. Thereby, other tax managing groups have different ways to calculate the House Tax. However, a common guideline considering the calculation of a PCMC property tax is dependent on the below formula.PCMC Property tax = developed area × Age factor × core value × kind of construction × category of use × ground factor.

Thus, the PCMC Property Tax calculation factors such as the ground value of the property; possession factors, whether self-owned or leased; estate type, whether domestic or industrial; the term of the PCMC property or the age of development; construction sort, whether multi-floored or just one floor, etc.

Depending on these factors, one can determine the PCMC property tax he or she is obliged to pay; utilizing the PCMC House Tax online computers free at the Municipal corporations’ online website, taxpayers can determine the due tax.

Steps to pay PCMC property tax

The online and offline means for payment of Municipal Corporation (PCMC) Property tax amounts are possible for the residents of Pimpri Chinchwad. But the most appropriate and convenient way to make the payment of all types of taxes is online, if feasible. Following are the steps to perform the amount for the property tax easily and conveniently:

Step1: Go to the Pimpri-Chinchwad Municipal Corporation (PCMC) property tax payment website: https://www.pcmcindia.gov.in/index.php

Step2: Beneath the ‘Residents’ tab, tick on the ‘Property Tax’ tab.

Step3: On the succeeding page click on the ‘Property Bill’ option.

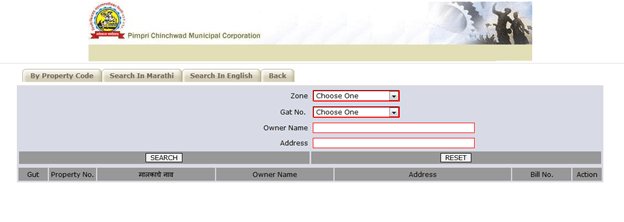

Step4: You will be able to view four options to scrutinize your property details – Below are the four options:

- By Property Code

- Search in Marathi

- Search in English

- Back to Home page

Step5: Fill in the details of Zone, GAT number, landowner name, and address.

Step6: Continue with the payment details.

Step7: Fill in your email address and your mobile number, select the payment choice and do the payment.

Many Taxpayers are giving their House taxes using online steps and methods and with the guidance of the PCMC Sarathi Website. However, many of them are practicing offline payment options too. To pay Taxes offline, you need to go to your Municipal Corporation office. Estate both residential, as well as commercial, can pay the tax by going to the official website (https://www.pcmcindia.gov.in/index.php) or visiting the Municipal Corporation office.

Paying PCMC property tax online via Paytm

Follow the below steps, to submit the property tax online using the Paytm application:

- Choose the company

- Give all the essential details such as Property ID, Owner’s Name, Address, Email address, and Phone Number.

- Tick on the ‘Get Tax Amount’ option.

- After selecting the payable tax amount, choose your favored method of transaction i.e., Debit Card, Net Banking, Credit Card, Paytm, or UPI (UPI is only available with Google pay, Phone pay, and Paytm App)

- Continue with the payment and you are done with the tax payment.

Pimpri-Chinchwad Municipal Corporation (PCMC) property tax e-receipt

The e-receipt is generated immediately after you are done with the payment. In case the tax payment is not performed, or if the receipt is not generated due to issues in connectivity or any technical difficulties, users need to verify the bank account details and statement for amount debit details.

If the statement states that the amount from the bank is debited but the receipt isn’t generated, you can come after some time to verify and generate the receipt again later, in a minimum of 3 working days. The preview of the receipt shall be available under the ‘Make Payment’ option on the property information page. Users can download the receipt after three days if the bank account is debited with the property tax amount.

Checking the PCMC property tax property bill on the website/portal

Step 1: Go to the PCMC Property Tax website and select the ‘Property Bill’ option.

Step 2: Search your estate information by filling in the Gat number, zone number, and the landowner's/owner’s name.

Step 3: Tick on the ‘Show’ tab, to preview your property bill.

Step 4: Search for the option ‘Total Amount to Pay (Amount with Concession-Fazil Amount)’ in the bill. This shall be the price you need to pay as property tax, for the selected time period.

Modifying the credentials in property tax records

The method of correcting or changing your name in the official property tax report is easy and can be easily done by the candidate if all the required papers are in place. Keep these papers handy:

- Most recent property tax receipt.

- Attested a copy of the sale agreement, which needs to be in the name of the candidate.

- No-objection Certification from the housing community.

- Application form, which is obtainable from the property tax office.

Add all the details in the application form and give it with all the above documents to the Commissioner of Revenue at the Pimpri-Chinchwad Municipal Corporation (PCMC) office. The application form will be checked and the credentials will be modified in 15-20 working days.

PCMC Rebates on the Payment Of Property Tax On Time

If the whole property tax is handed in by the date 31st May of every year, the below rebates are possible:

- For domestic properties/ non-residential/open plots especially recorded as household buildings 10% deduction on general tax in case of yearly ratable worth up to Rs 25,000 and 5% deduction on general tax in case of the yearly ratable worth of Rs 25,001 and higher.

- In the matter of private residential estates owning solar, vermiculture, and rain-water accumulation 5% deduction on municipal tax (eliminating water tax and government taxes) in one of these plans and 10% reduction on municipal tax (eliminating water tax and government taxes) in the matter of two of the mentioned projects.

Properties exempted from property tax

There are several types of assets, which are exempted from property tax. This involves places used for religious offerings, public funerals or burials, and cultural land. Aside from this, any construction that is utilized for charitable, institutional, or farming purposes, is also spared from property tax. In summation to this, the PCMC has also spared residential buildings of smaller than 500 sq. ft area from estate taxes. This transit advantages over 1.5 lakh houses in the area.

PCMC property tax news

- Lately, PCMC published a 79% drop in taxation due to the coronavirus pandemic. The gathering reportedly dropped from Rs 57 crore to Rs 11 crore for the corresponding period, year-on-year. The government also intends to hold the plan for a property tax rise, as property owners are asking for an explanation for this year, due to financial problems during the COVID-19 pandemic.

- On 7th April 2020, PCMC Property Tax Department proposed a tax of Rs 198 crore through an online payment method, delivering it the largest part of the total wealth tax accumulation of Rs 490.11 crore for the business year 2019-20.

- On May 31st, the municipal body has stretched the last date of payment of property tax to June 30, providing much-needed assistance to people. Earlier the last date was May 31, 2020, due to several causes including the lockdown because of the Coronavirus epidemic.

- Property tax on domestic and non-residential premises has been increased by the PCMC. The latest modifications in property tax will be relevant from April 1, 2021. As per the latest information, resources that have been acquired before 2005, will see an increase of up to Rs 800 to Rs 1,200 for domestic properties and Rs 1,500 to Rs 3,000 for non-domestic properties for 500 sq ft plot. For assets purchased between 2006 and 2020, which are recognized as fresh, the price is Rs 17.18 to Rs 29.94 per sq ft. The price will go up to Rs 31.44, depending on the latest tax plan.

- In order to gain additional funds to fill the shortfall, the civic organization has started a study to evaluate illegal properties in the area, which could be settled and taxed. According to an evaluation, there are over 50,000 assets, out of which 30,000 have been recognized in the study, while the others will be recognized soon. The study has been stretched for three more months, to identify such premises. Apart from this, the municipal body has recognized assets where the landlords have unfinished property taxes of Rs 25 lakhs or higher. So far, about 325 properties have been imposed, which could be sealed if the tax dues are not cleared.

Important Notes on PCMC Property Tax e-Payment Receipt

If the receipt is not generated as a result of connectivity issues or technical difficulty while doing an online payment, please review your bank account statement for the debited amount and then move to the e-payment.

If the bank account shows that the amount has been debited and the receipt has not been made available, kindly review the update with the PCMC portal, a receipt will be generated within the upcoming 3 working days.

Registering a complaint on PCMC Suvidha

All residents can record their complaints associated with Pimpri-Chinchwad Municipal Corporation on the PCMC platform. Users need to register to record a complaint on the website or the portal. The portal can also be utilized for tracing the status of complaints registered. All the problems related to property tax, apartment plan approval, official works, and public development systems can be registered on the Suvidha platform.

PCMC contact details

The PCMC property tax payment method is simple as well as user-friendly, the user can talk to the civic body, in any situation of confusion.

PCMC Sarathi Helpline Number: 8888 00 6666

PCMC Sarathi portal/website: http://www.pcmchelpline.in/download.html

Payee/users can download FAQs, mobile apps, and PDF manuals in Marathi as well as in English, to solve their questions.

What Is A Property Tax?

When you have the ownership, that is, you have a property in your name, then, you will have to pay some tax for that particular piece of property. Now, this payment needs to be made on an annual or semi-annual basis to the PCMC or the Pimpri-Chinchwad Municipal Corporation. This is the municipal corporation for Pune and it is considered to be one of the richest in the country, after the one in Mumbai. Pune is a residential area primarily, or rather it developed into one with time and hence the need for a separate municipal corporation, to keep things in order. So, whenever you pay your property tax you pay it through the PCMC property tax online payment.

What Happens With The Revenue Collected From Property Taxes?

The money that is collected from the property taxes is generally used for various civic welfare amenities, like repairing parks and road, beautification, etc. So basically, the money that you pay as your property tax is used for your civic benefits.

How Much Property Tax Should I Pay?

Now, this is a very important question. How much should you be paying for your property taxes? The point to remember here is that the amount will vary from state to state, city to city, and sometimes even from municipality to municipality, but that is hardly ever the case. Every city more or less has a plan of collecting taxes and they are done mostly through 3 systems. In one system the property tax is collected based on the market value of the property.

This form of calculation is seen in Mumbai, which is why maintaining your property in Mumbai is an expensive affair. In other cases, the calculation is done based on the per sqft value of the property, as we see in Kolkata. There is also a third system in which the calculation of the property tax is done based on the rentable value of the property. What this means is that how much rent would the property fetch, if it is rented – the calculation is done based on that. The property does not need to be rented. In all three systems, the property tax is to be paid by the one who owns it, not by the person who has rented it. So, how does the PCMC property tax online make its calculations?

The PCMC calculates its property tax values following the same one as in Mumbai. So, it calculates the property tax amount on the ready reckoner value which is determined by the market value of the property. So the amount is calculated based on that. So, this is a calculation that you can do for yourself as well. Let’s find out how.

First, you will have to visit the https://www.pcmcindia.gov.in/ptax_calc/index.html

Over here, you will have to enter the zone for which you want to calculate the taxes, like say whether it is residential, NRI, etc.

Once you have selected the zone, you will have to select the sub-use type, like what kind of property it is, where the property is, etc.

With that done, your property tax will be calculated automatically.

This is known as self-assessment which can be done before the PCMC property tax payment. If you get the self-assessment done, then you will be able to know from beforehand, how much tax do you need to pay and you can prepare yourself accordingly as well. This is necessary for you to be prepared and since it can be done online, it is hassle-free.

Do We Have Rebates On Property Taxes?

While every property owner will have to pay property taxes, there are different kinds of rebates as well which one can enjoy when it comes to them. These rebates or discounts are dependent on a lot of factors. The Pimpri-Chinchwad Municipal Corporation has its own set of rebates. Let’s take a look at the various PCMC property tax rebates one can enjoy:

If you have a residential property or a plot of land or a non-residential property then you can also apply for rebates. You will get a 10% discount on the general tax being paid if the rateable value of the property is within Rs.25,000/-. If the rateable value is more than Rs. 25,000/-, then you will be eligible for a discount of 5%. The PCMC has a very interesting rebate method for environmentally friendly and conscious households as well. If you have solar power or practice rainwater harvesting or vermiculture, at your residence, then you will get a rebate of 5%-10%. The percentage of rebate on the PCMC property tax payment will be decided by how many eco-friendly projects as mentioned before, is there at your residence.

There are a few types of properties that do not have to pay any property tax at all. Let’s take a look at the list of such properties:

- Public burial grounds

- Places of religious worship

- Educational institutes

- Crematorium

- Heritage land

- Charitable organizations

- Agricultural lands

These are some of the basic pointers that one needs to keep in mind when it comes to the PCMC property tax. But there are a few other important pointers that you need to bear in mind as well.

Changing Ownership and How to Change the Name?

Now, suppose there is a change in ownership of the property land. Then you will have to transfer the name of the owner from the old one to the new one. Now, how will you go about that process? It is also quite a simple one and can be processed if you have some of the basic documents in order. Let us find out how that is done.

First and foremost, there is a list of documents that you will need to have, which if you go about the process in the right manner, you will have with you. First, you will need a receipt of the last paid property tax. You will also require a no-objection form from the housing society stating and acknowledging the ownership transfer. This will not be required in the case of individual house ownership transfer for PCMC property tax payment. You will also need the sale deed. The sale deed needs to be in order, which states that the owner of the property is you, the applicant, not the previous owner. You will also need to collect the application form for name transfer from the PCMC office.

Once you have all the documents, their copies attested and the application form filled out, you will need to submit it to the Commissioner of Revenue, who sits at the PCMC office. Just to be on the safe side, make sure that you have a Xerox copy of the entire set of the application with yourself as a record that you have submitted it.

Special Rebates for Women

The Pimpri-Chinchwad Municipal Corporation offers a concession on property tax for women. It was on 8th March 2011, that this is announcement was made and the concession put in place. Women do get a lot of concessions when it comes to property ownership and transfer and this was just another step to make the process easier for them because for women to rise and claim ownership in the first place is a rather difficult proposition. So, how do the PCMC property tax online grant concessions?

First and foremost, a woman has to be the owner of the property.

To inform the municipal corporation that one is eligible for the rebate, one will have to fill out a particular form known as the MAHILA REBATE PROPERTY FORM. This form is available online at https://www.pcmcindia.gov.in/ptax_forms.php

Once you have downloaded and filled out the form, you will then need to get a stamp paper of Rs.100/- to get it verified and submit it along with the form.

It will be processed with a period of 2-3 weeks and if all the documents are found to be in order, then one will start enjoying the rebates from the next cycle of PCMC property tax online payment. It is best that when you are applying for this concession, you do not sit on your application for long. Get it done as soon as possible and if there is any difficulty in processing it, get it sorted. So it is best that you file the application way ahead of the payment cycle. It is also important to note here that, the woman in whose name the property is, has to have no pending civic dues.

This brings us to another important question –

What happens when you have a payment default?

Well, though it is not at all advisable, sometimes people do forget to file their PCMC property tax. What can you do when you have not filed for or even paid your taxes? Well, you will have to clear your dues in the next cycle and it is best that you do it as early as possible. It is important to remember here that in case of payment defaults you will attract penalties, a sum which you will have to pay while paying the dues. So, when you have a default, you will have to end up paying way more than your usual property tax rate, and what is the point in doing that? You will have to fill out forms stating your default payment and then submit it and file for a late submission. It is an unnecessary hassle that can be avoided. So, how can you save yourself from being late with the payments?

To begin with, you will have to set a reminder. If you have an agent who looks after these matters, remind him to remind you, so that you do not miss out on the date. Self-assessment dates end before the last date of PCMC property tax online payment, so you need to keep a track of that too. It is best that you be systematic about this and not deal with it lightly. Defaulting will put a strain on your pocket, hence it is best to avoid it as much as possible. And when you are transferring a property to your name right before the tax payment cycle, make sure that your last owner pays it or you can negotiate with them and sort out the details. Do not miss out on that.

So, now that you have all the information that you need when it comes to PCMC property tax, be very particular about filing it, and do not miss out on the most important steps.

FAQs

What is the value or meaning of property taxes?

Property tax supports local bodies with supplies to give you economic services such as sweeping the area, a decent supply of water, preservation of roads, sewerage, etc. It also benefits you in the state of any estate dispute to confirm your ownership of the property.

Is property tax relevant to vacant areas or property?

Property tax implements any type of vacant property unless the land is utilized only for farming purposes.

Which real estate properties are spared from the property taxes?

Any property that is utilized for religious offering, public funeral, burial, and cultural land is excluded from the property tax. Any construction that is utilized for charitable, institutional, or farming purposes is also excluded from the property tax.

Who is responsible for paying the Property Tax in the case Of joint ownership?

Both the landowners are accountable to pay a portion of the property tax as per their shareholding in the real estate property.

How do I get a discount on PCMC property tax?

If you have domestic property, land, or commercial property then you can also petition for rebates. You will receive a 10% reduction on the general tax being given if the ratable worth of the estate is inside Rs. 25,000/-.