In this article, we will provide you with an overview of the PMAY scheme along with the necessary criteria to need to meet to enrol yourself as a beneficiary. Moreover, we will also discuss the process of applying and the benefits of the scheme.

An Overview on the Pradhan Mantri Awas Yojana

The Government of India, in the year 2015 had launched a scheme called the PMAY Scheme for the inhabitants of our country. The scheme stated the policy of “Housing for All” under which the government promises to ensure all households to have pucca houses in urban settlements by 2022. This program was launched in the special interest of providing pucca houses to the people in the category of low and middle-income group along with the EWS (economically weaker section) people.

For people buying houses under the PMAY Scheme are subjected to benefit from the Credit Link Subsidy Scheme (CLSS). This scheme further adds weight to the PMAY by providing an interest subsidy for up to 2.67 lakhs for the people seeking to buy units under the affordable housing plan.

Eligibility criteria for enrolling in the PMAY scheme

Even though the scheme states its policy to be housing for all, yet there are some exceptions to be kept in mind while being eligible to apply for a loan under the PMAY Scheme.

- You or any of your family members (like your spouse or children) should not own a house in any part of the country.

- Any of your family members should not be in assistance of both the central and the state government for any other housing plan scheduled.

- Your Aadhar Card which is one of the important documents required for enrolment.

- For applying for loans under the EWS category, your annual income should be less than or up to Rs. 3 lakhs.

- For applying for loans under the LIG or the Low-income group households, your annual income should be between Rs. 3 lakhs to Rs. 6 lakhs.

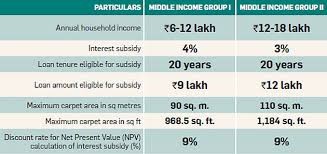

- The middle-income group households are sub-categorised as MIG I and MIG II. People with an annual income of Rs. 6 to 12 lakhs fall under the MIG I category, whereas the ones earning Rs. 12 to 18 lakhs per year are categorised as MIG II households.

- Households applying for the PMAY Scheme subsidy must ensure that they have an adult female member as the applicant or the co-applicant for easier enrolment procedure.

Process for enrolling yourself as a beneficiary in the PMAY

Note that the deadline to enrol in the PMAY scheme is dated to be 31 March 2021. Therefore, all applications must be filed before the deadline. Applying for enrolment in the PMAY scheme can be done in both online and offline ways such as:

- You can easily visit the official website of the scheme for online application provided you have a valid Aadhar card with your unique identification number in it.

- For the offline method, you can easily get hold of the forms for Rs. 25 + GST from a common government service centre.

- Sometimes when you apply for a home loan from reputed banks, they voluntarily undertake the process of enrolling you under the PMAY scheme based on your annual income.

- To check your name in the beneficiary list, you can look up the official website of the PMAY. By simply inputting your Aadhar number, you can check whether or not you are enrolled in the list.

Benefits of PMAY Scheme

Having stated the eligibility criteria along with the process for application, let us now take a closer look at the benefits of having a shelter under the PMAY scheme.

- Buying houses are now easier as you can get a CLSS and reduced interest rates on the EMIs.

- Buying properties or households under the PMAY scheme can also be used for taking a LAP or Loan Against Property that in turn would benefit you to fund other monetary needs of your household such as your child’s education fund, business, marriage, etc.

- EWS group can get a home loan subsidy for up to Rs. 6 lakhs for a housing unit of 30 sq. m.

- LIG households are eligible to get Rs. 6 lakhs loan amount for a carpet area build-up of 60 sq. m.

- MIG I households can get up to Rs. 9 lakhs as housing loan for 160 sq. m housing unit, whereas MIG II households are eligible to get up to Rs. 12 lakhs for a 200 sq. m housing unit.

FAQs

Q1. How many cuts did the RBI announce on its Repo Rate?

Ans. The RBI Repo Rate was brought down from 4.5% to 4% this year due to the fluctuating market rates under the Covid-19 conditions.

Q2. What is Stamp Duty?

Ans. Stamp duty can be called a state levy that is paid to a legal document stating a legal settlement or agreement between two or more parties in the office of the sub-registrar.

Q3. Can home loans and interest rates be calculated beforehand?

Ans. Home loans and interest rate calculations are now made easier with the online tool of a home loan calculator. Almost all the websites of the banks now have this online tool for a better experience of the visitors. For example, the SBI Home Loan EMI calculator can easily calculate the SBI Home Loan Interest Rates 2020 for the people seeking home loans this year.