The Pradhan Mantri Awas Yojana (PMAY) Urban operation was initiated on June 25, 2015. The goal of the scheme is to provide homes for all residents of urban areas by 2022. The mission offers government help and support to development partners via States, Union Territories (UTs) and Central Nodal Agencies (CNAs). In order to provide residences to all eligible family members and beneficiaries with regards to the substantiated housing scheme. In addition, the central government has issued a cost estimate of approximately Rs. 1.12 crore in funding.

Furthermore, according to PMAY Urban guidance, the surface area of a residence for the EWS (Economically Weaker Section) can be extended up to 30 sq. m. of floor area. Nevertheless, states/UTs have the authority to increase the size of homes with the Ministry’s deliberation and permission.

Table of contents

PMAY Urban: New Deadline

In comparison to the official projected growth, 102 lakh residences have been built or are under development. Furthermore, 62 lakh housing units have been completed. In addition to the total 123 lakh households sanctioned, 40 lakh proposed changes were obtained late from states/UTs, requiring a further two years to finish.

On August 10, 2022, the union cabinet extended the deadline for the administration’s mainstay Pradhan Mantri Awas Yojana-Urban (PMAY) goal until December 31, 2024. The step will assist Indian states in finishing residences that are already authorised under the massive housing scheme.

Features & Benefits

Some of the features and benefits of the PMAY Urban are as follows:

- A person can receive a 6.5% mortgage rate subsidy on home loans based on their income level

- Loans can be obtained for the new home development or for the buy of a reselling home

- The loan term can last till 20 years

- Priority will be given to senior citizens and people with disabilities for ground-floor accommodation

- The houses will be constructed using environmentally friendly and long-lasting techniques

- Basic utilities such as water, power generation, and gas will additionally be given

Document Required for PMAY Urban

The list of documents required for PMAY Urban is as follows:

- Proof of identity like Aadhaar card, PAN card, Driving Licence and so on

- Proof of address such as electricity bill, salary slips etc.

- Builder Buyer Agreement (BBA)

- Affidavit and stamp paper

- Letter for the sanctioned loan

PMAY Urban: Components

Some of the components for the PMAY Urban are listed below:

- Affordability of Credit Connection Subsidy: Underneath this framework, beneficiaries receive a subsidy interest of up to ₹ 2.67 lakh, the amount of which is defined by their income group.

- ISSR(In-Situ Slum Redevelopment): The Indian government will collaborate with commercial companies to build residences for slum residents on the property where the slum is situated. Each qualified home will receive recovery funding of ₹ 1 lakh.

- Subsidiary for BLC (Beneficiary-Led Construction): This is given to EWS category households in order for them to build a new house or improve a current one. Central financial support of up to ₹1.5 lakh is available for this purpose. An estimate of 9.0 square metres of carpet must be added to the housing unit.

PMAY Urban Guidelines

- Beneficiary holder of family members including the husband/wife, along with any unmarried sons/daughters

- In any part of India, no other person from the family must own pucca homes by their one‘s name

- Beneficiaries should not embrace any other administration-subsidised housing

- If an individual earners member; regardless of marital status, does not have a pucca residence anywhere in India, they will be granted a separate housing unit

- During the loan application procedure, the Aadhaar card of the family members will be presented

- Married couples may apply for a single property under the joint or sole framework

Eligibility: PMAY Urban

The overall income of a household is used to define eligibility for the PMAY Urban strategy, which is given below:

| Income of the Group’s | Household Earning (₹) |

| Economically Weaker Sections (EWS) | Up to ₹3 lakh |

| Low Income Group (LIG) | ₹ 3 lakh to ₹ 6 lakh |

| Middle Income Group-I (MIG-I) | ₹ 6 lakh to ₹ 12 lakh |

| Middle Income Group-I (MIG-II) | ₹ 12 lakh to ₹ 18 lakh |

Members of the Low Income Group (LIG), Middle Income Group (MIG-I), and Middle Income Group (MIG-II) subgroups are eligible for the PMAY Urban Credit-Linked Subsidy Scheme (CLSS). Candidates who fall under the LIG section are entitled to full PMAY support.

How to Calculate Subsidy under PMAY-U?

A home mortgage subsidy calculator is a programme that calculates the discount. You can get on a house loan achieved through the PMAY framework. To determine the financial assistance on your PMAY Urban plan, simply input the loan features such as interest rate, principal, and so on.

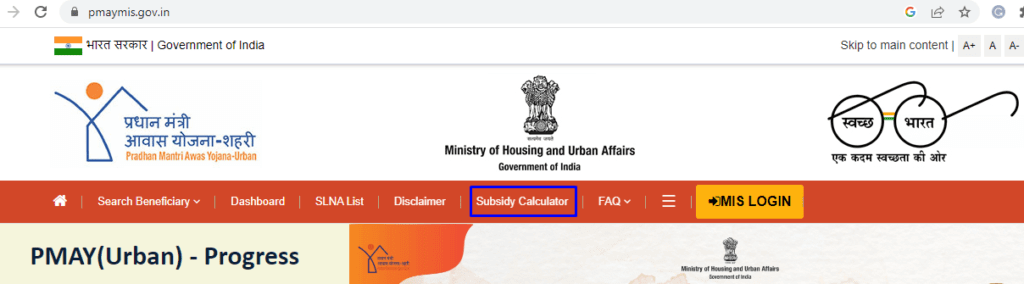

Step 1:Refer to the official website of the PMAY.

Step 2: Choose the ‘Subsidy Calculator’ present on the navigation panel.

Step 3: Fill out the details, such as loan amount, tenure months, annual family income, etc and submit it.

Step 4: On the current page, you can easily see information about your subsidy amount.

Process for Applying PMAY-U Scheme

Some of the steps are listed below to apply for the PMAY-U:

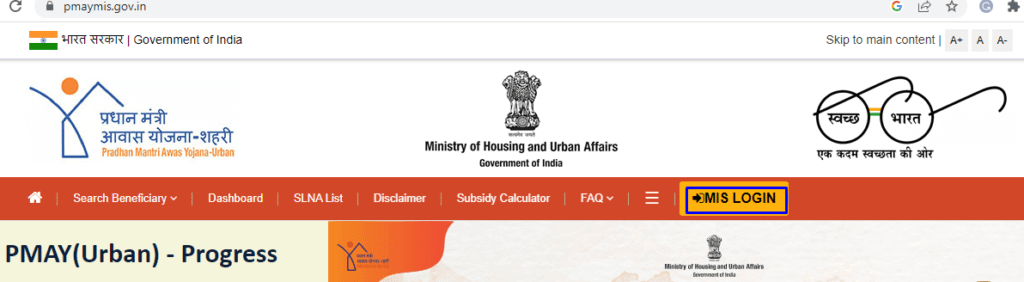

Step 1: Go to the official portal of the PMAY.

Step 2: Click on the MIS login tab, present on the navigation panel.

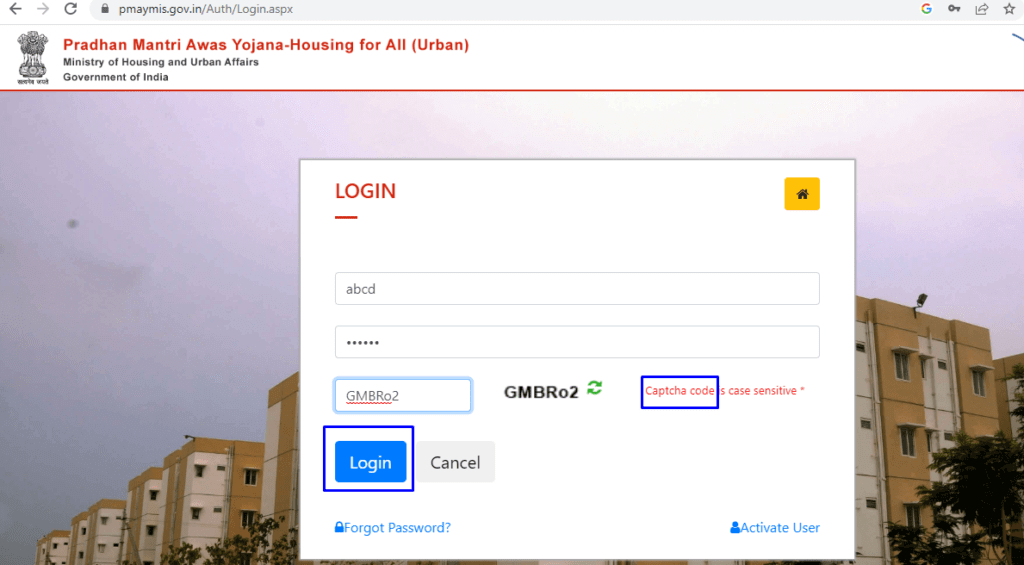

Step 3: You will be redirected to the new page; enter the details like the user name, password, and valid captcha.

Step 4: Fill out the form and submit it.

Conclusion

The rural and urban aspects of the Pradhan Mantri Awas Yojana diverge in fiscal and operational parts. They both seek PMAY’s main goal of ‘Housing for All’ by 2022, particularly for the economically challenged and low-income groups. In this regard, the third and final phase of the scheme’s implementation is underway, and stakeholders involved can apply for a new mortgage under the framework to realise their desire to own a home.

Frequently Asked Questions (FAQ’s)

How can a person be eligible for PMAY-Urban if he/she has a plot of land?

Yes, if you meet all of the other eligibility requirements, you can receive the subsidy through the Recipient Personal Home Building strategy.

Who is eligible for the PMAY-Urban scheme?

Under MIG I eligibility, if a person holds a yearly average income ranging from 6 lakhs to 12 lakhs with residence sizes ranging from 160 sq. m.

What is the difference between PMAY-urban and Gramin?

The PMAY-Urban will provide central assistance to all union territories and states in India via multiple agencies. In order to accomplish the goals of the authorities of India to provide housing for urban people. On the other hand, PMAY- Gramin provides homes for rural people in India.