Since the initiative of providing reasonably priced housing for the economically marginalised family has been taken, a lot of people are getting a shelter to survive properly. In this article, we will come across a detailed view of this Yojana, PMAY eligibility calculator, PMAY subsidy calculator, PMAY Gramin, PMAY Urban, PMAY benefits, and few more important information.

Introduction to PMAY ( Pradhan Mantri Awas Yojana )

Pradhan Mantri Awas Yojana was initiated on June 25th 2015 and had an aim of providing “Housing for All by 2022” to overcome the shortage of housing among rural and urban poor. PMAY aspire to complete 02 crore housing units by year 2022. Under the scheme it offers a subsidised rate of interest on loans availed by individuals from different lower-income groups, for building houses.

PMAY-G has an objective to provide 1.00 crore housing units of 25 sq.m areas to the houseless, or kutcha/dilapidated households along with hygienic cooking area, toilets, water supply, electricity, and a proper living environment. The Pradhan Mantri Awas Yojana subsidy calculator for urban poor indicates a 6.5% subsidy on the rate of interest for loans applied by EWS and LIG, 4% subsidy for MIG – I, and 3% for MIG – II.

What are the eligibility criteria?

To get enlisted in the PMAY list the following conditions are mandatory.

- The maximum age of the beneficiary is 70 years.

- The beneficiary belonging to EWS, must have an annual family income of Rs. 6 lakh, for MIG-I the income range is within Rs. 6 lakh to Rs. 12 lakh and for MIG-II it is Rs 12 lakh to Rs 18 lakh.

- Applicants can be from scheduled caste, scheduled tribe, or a woman.

- The beneficiary cannot have a housing unit in any part of India, including all the family members.

- He/She cannot avail any central or state government subsidy or benefits under PMAY scheme.

- Only the EWS and LIG category can apply for home renovation or improvement loans, and self home construction loans.

Categories of households under PMAY – Gramin List includes –

- No male members between 16 to 59 years of age (both numbers inclusive) and is headed by females.

- No literate members above 25 years of age.

- No adult members within 16-59 years of age.

- No able-bodied individual above 18 years and is having a disabled member.

- Houseless families working as casual labourers.

For the same deprivation scores, certain parameters are set by the concerned authority to decide beneficiaries as per priority. The highest priority is given to landless or homeless families. The others in the priority list include –

- Families having widows and closest living relatives of police forces or defence/paramilitary killed during the action.

- Families having a single female child.

- Individuals belonging to the Transgender community.

- Families belonging to a scheduled tribe and other traditional forest dwellers.

- Families with members suffering from diseases like cancer or leprosy or HIV (PLHIV).

If the beneficiary is having a Kisan Credit Card with a spending limit of Rs. 50,000 and above, or any of the family members is a government employee with monthly earning more than Rs. 10,000, or is paying professional / income tax, or owns a landline connection and refrigerator, is excluded from the PMAY-G list.

Benefits of Pradhan Mantri Awas Yojana.

One of the major benefits of PMAY is the subsidy offered on home loans. The subsidy amount is incurred on the principal home loan outstanding amount and will be directly credited in the loan account in the beginning. Almost all Government and Private Banks including NBFCs offer home loans under PMAY. The home loan subsidy calculator checks the loan amount and offers a proper subsidy on the rate of interest. This is a general self-help planning tool that gives individuals an approximate understanding of the loan amount to be repaid after eliminating the subsidy amount.

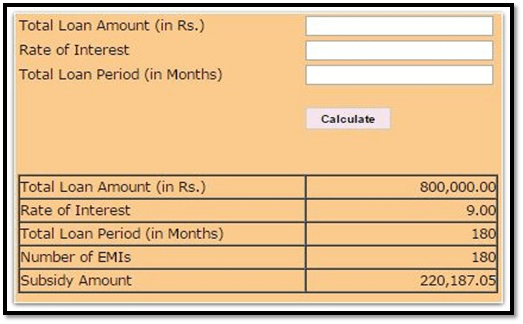

Here is an example of how the subsidy is offered under PMAY and PMAY subsidy calculator –

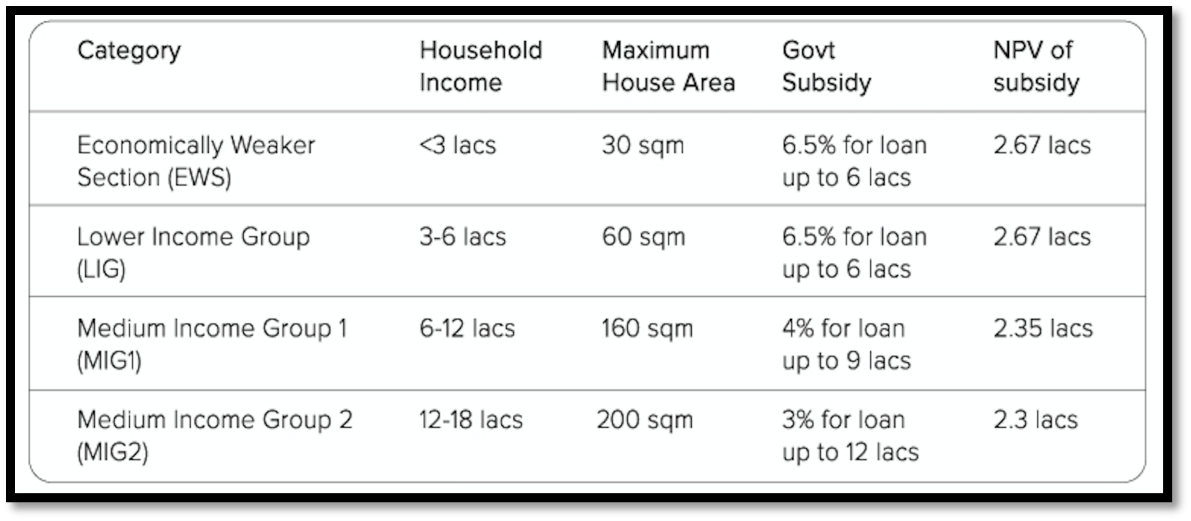

From the above table, it is understandable that families having less than 3 lakhs income, having 30 sq.m maximum house area, and Rs. 3-6 lakhs income, having 60 sq.m maximum house area, receives 6.5% subsidy from the government on a loan amount up to Rs. 6 lakh and the NPV of subsidy becomes Rs. 2.67 lakh. These are individuals belonging to the Economically Weaker Section (EWS) and the Lower Income Groups (LIG). Families belonging to MIG-I, having a household income of Rs. 6-12 lakh and 160 sq.m housing area, will get 4% subsidy for a loan up to Rs. 9 lakh and the NPV of subsidy becomes Rs. 2.35 lakh. For families from MIG-II, have a household income of Rs. 12-18 lakh, house area of 200 sq.m, gets 3% govt subsidy on a loan amount of Rs. 12 lakh, and the NPV of subsidy becomes Rs. 2.3 lakh.

The other benefits are –

- Rural beneficiaries are offered Rs. 90.95 per day of unskilled labour from MGNREGS.

- The houses are made from eco-friendly materials that are of good quality and are constructed by skilled masons.

- Rural beneficiaries can avail a loan up to Rs. 70,000.

- The tenure for loan repayment is 20 years.

- Under PMAY scheme, disabled and senior citizens are provided at the ground floor of a house.

How to apply for PMAY Scheme?

Step 1 – Visit the official website of PMAY.

Step 2 – Find the ‘citizen assessment’ from the ‘Menu’ tab and click on it.

Step 3 – Enter the Aadhar card number of the applicant.

Step 4 – Enter all of the information correctly on the application page. On successful Aadhar number submission, the application page will be automatically directed. Recheck and Submit.

Step 5 – Download the application form.

Step 6 – Deposit the form along with all the required documents to the nearby CSC office or an authorized bank branch which is applicable under the scheme.

For PMAY-G, the individuals need to collect application forms from respective Gram Panchayats. For the beneficiaries’ registration process, there are four vertices – Personal details, Bank account details, Convergence details, and Details obtained from the concerned office. To have a clear idea of the process, individuals can contact their ward members or Gram Panchayats.

Document requirements

- Identity Proof like Aadhar Card, or Voter ID card.

- Address Proof.

- PAN card.

- Income proof

How to check PMAY list?

If you have applied for P list 2019, and you want to check your application status then you need to follow the steps. Before that, you need to keep in mind that PMAY has two parts Rural and Urban, both are having different checking procedures.

For PMAY – U list,

Step 1 – Visit the official website of PMAY.

Step 2 – Find ‘Search Beneficiary’ and click on the option ‘Search by the name’.

Step 3 – Enter the full name properly and the entire details will be displayed properly.

For PMAY – R list,

- With Registration number

Step 1 – Visit the official website of Pradhan Mantri Awas Yojana – Gramin.

Step 2 – Enter the proper registration number to access the list.

Step 3 – Further details can be accessed only by the beneficiary.

- Without Registration number

Step 1 – Visit the PMAY – Gramin official website.

Step 2 – Select ‘Advanced Search’ tab.

Step 3 – Fill up the form properly and click on ‘Search’.

Step 4 – Information regarding the selected applicants will be displayed.

Few other important schemes launched by the India Government in 2020 are Atmanirbhar Bharat Abhiyan, PM-KISAN Scheme, Pradhan Mantri Kisan Maan Dhan Yojana, PM Garib Kalyan Yojana, Jan Dhan Yojana, PM Mudra Yojna, Atal Pension Yojana, Prime Minister Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana, Gold Monetization Scheme, Prime Minister’s Citizen Assistance and Relief in Emergency Situation, and much more schemes are launched to solve the socio-economic problems of the Indian society.

FAQs

Q1. How are the various Income categories made?

Ans.

1. Annual household income below Rs. 6 lakh fall under EWS or LIG category

2. Annual household income ranging between Rs. 6 lakh to 12 lakh is considered as MIG – I.

3. For households having an annual income between Rs. 12 lakh to 18 lakh is considered as MIG – II.

Q2. What is the deprivation score?

Ans. It is the living condition of a household-based on socio-economic factors.

Q3. What are the tax benefits under PMAY?

Ans. There are several tax benefits levied on the scheme.

● Under Section 80C, an individual can get a deduction up to Rs. 1.50 lakh on the home loan principal repayment.

● Under Section 24 (b), an individual can get a deduction up to Rs. 2 lakh on home loan interest payment.

● Under Section 80EE, a first time home buyer can avail a tax relief of Rs. 50,000 annually.

● Under Section 80EEA, if the property of the beneficiary comes under the affordable housing category then a deduction up to Rs. 1.50 lakh is offered on the home loan interest paid annually.

Also read : LIG Housing India – Income Criteria LIG Housing Standards