The government of India never stop looking out for their citizens. Therefore, they kept on launching schemes that benefit the lives of their citizens. Similarly, they pitched a plan in May 2015 that will work for the welfare of people who died or are having a permanent or partial disability due to accidents. This scheme is known as Pradhan Mantri Suraksha Bima Yojana (PMSBY).

We have written about the enrollment process, eligibility, document requirement, and benefits of being a part of Pradhan Mantri Suraksha Bima Yojana.

Table of contents

- Characteristics of the PMSBY Scheme

- Benefits of Pradhan Mantri Suraksha Bima Yojana

- PM Suraksha Bima Yojana Eligibility Criteria

- PM Suraksha Bima Yojana Documents Required

- Pradhan Mantri Suraksha Bima Yojana Coverage

- Non – Coverage under Pradhan Mantri Suraksha Bima Yojana

- PMSBY Scheme: List of Participating Banks

- Enrollment Process for Pradhan Mantri Suraksha Bima Yojana

- Pradhan Mantri Suraksha Bima Yojana Certificate Download

- PM Suraksha Bima Yojana: Termination Conditions

- How to Claim PMSBY?

- Pradhan Mantri Suraksha Bima – How to Check Application Status?

- Don’t Miss Other Govt. Schemes

- Frequently Asked Questions (FAQs)

Characteristics of the PMSBY Scheme

Here are some features of the PMSBY scheme. These features are valuable for people who have gone through an accident.

- Pradhan Mantri Bima Yojana is annual renewable insurance that covers accidental deaths or partial or permanent damages.

- The PMSBY is a 12 Rs insurance scheme without a 14% service tax.

- If the individual under the PMSBY scheme dies in an accident, the nominee will get the cover of Rs. 2 lakhs.

- The 12 Rs insurance money will be auto-debited from the account.

- The person covered under the scheme can exit the scheme anytime and sign up anytime.

Benefits of Pradhan Mantri Suraksha Bima Yojana

- The PMSBY scheme is an accidental cover without giving any bank or insurance company a hefty amount.

- The scheme works as financial aid to the people depending on you for their livelihood.

- It has an auto-debit option which means auto-renewal of the scheme annually.

- You can anytime enter or step out of the scheme.

- The scheme is secure and has continuous coverage.

Note: The subscriber can ask for the deduction under Section 80C for the premium. Also, the sum of Rs. 1 lakh received will be tax-free under Section 10 (10D) from the Income Tax Act 1961.

PM Suraksha Bima Yojana Eligibility Criteria

- The minimum age bar is 18, and the maximum age bar is 70 years.

- People under 18 and 70 must have a savings bank account.

- The savings bank account must be linked with the Aadhaar card.

- The applicant must not have more than one bank account.

- The PMSBY premium must be paid Rs. 12 annually.

- The premium amount will be auto-debited from your account.

- The PMSBY insurance is valid for a year only. After that, you have to do a PMSBY renewal of your plan.

PM Suraksha Bima Yojana Documents Required

- A proof ID

- An Aadhar card

- Active Mobile Number

- Active Email Address

- Complete information about the Nominee

An aadhaar card copy will be submitted along with the application form if your bank account and Aadhaar are not linked.

Pradhan Mantri Suraksha Bima Yojana Coverage

- Rs. 2 lakhs will be paid to the nominee if the person under PM Bima Yojana dies in an accident.

- If an accident leads to permanent damage to the subscriber’s limbs and eyes, then compensation of Rs. 2 lakhs will be paid to that individual.

- If the accident causes irrecoverable losses in any eye or limb, then Rs. one lakh will be given to them.

Non – Coverage under Pradhan Mantri Suraksha Bima Yojana

If a person under the PMSBY scheme dies by suicide, there will be an amount given to the nominee or the legal heir of that applicant unless specified otherwise.

PMSBY Scheme: List of Participating Banks

- Allahabad Bank

- Axis Bank

- Bank of India

- Bank of Maharashtra

- Bharatiya Mahila Bank

- Canara Bank

- Central Bank

- Corporation Bank

- Dena Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- IndusInd Bank

- Kotak Bank

- Kerala Gramin Bank

- Oriental Bank of Commerce

- Punjab National Bank

- Punjab and Sind Bank

- State Bank of India

- South Indian Bank

- State Bank of Hyderabad

- Syndicate Bank

- State Bank of Travancore

- Union Bank of India

- UCO Bank

- United Bank of India

- Vijaya Bank

Some other Insurance companies who are a part of Pradhan Mantri Suraksha Bima Yojana are as follows:

- Bajaj Allianz

- ICICI Lombard

- Reliance General Insurance

- United India Insurance

- Cholamandalam MS

- National Insurance

- New India Assurance

- Universal Sompo

Enrollment Process for Pradhan Mantri Suraksha Bima Yojana

To enroll for Pradhan Mantri Suraksha Bima Yojana you can either use the SMS service or for Pradhan Mantri Suraksha Bima Yojana online apply is also an option.

Activating through SMS

- Call on the toll-free number of your insurance company or your bank.

- You will receive an SMS number on the registered mobile number.

- You must send a message back as ‘PMSBY Y.’

- Your service will open.

- Now, you will receive the information over the SMS.

Activating through the Internet Banking Facility

Step 1: You have to log in to your PMSBY banking account.

Step 2: Hit the PMSBY insurance option.

Step 3: Select your bank and hit the confirmation option.

Step 4: Check the details shown on the screen.

Step 5: You can now download the receipt and note down the reference number.

Here is the list of States and toll-free numbers of all corresponding banks.

| State | Banks | Toll-Free number |

| West Bengal and Tripura | United Bank of India | 1800-345-3343 |

| Uttarakhand | State Bank of India | 1800-180-4167 |

| Sikkim | State Bank of India | 1800-345-3256 |

| Nagaland | State Bank of India | 1800-345-3708 |

| Mizoram | State Bank of India | 1800-345-3660 |

| Meghalaya | State Bank of India | 1800-345-3658 |

| Manipur | State Bank of India | 1800-345-3858 |

| Goa | State Bank of India | 1800-2333-202 |

| Bihar | State Bank of India | 1800-345-6195 |

| Assam | State Bank of India | 1800-345-3756 |

| Arunachal Pradesh | State Bank of India | 1800-345-3616 |

| Chhattisgarh | State Bank of India | 1800-233-4358 |

| Andaman and Nicobar Island | State Bank of India | 1800-345-4545 |

| Daman and Diu | Dena Bank | 1800-225-885 |

| Dadra and Nagar Haveli | Dena Bank | 1800-225-885 |

| Gujarat | Dena Bank | 1800-255-885 |

| Lakshadweep | Syndicate Bank | 1800-4259-7777 |

| Karnataka | Syndicate Bank | 1800-4259-7777 |

| Uttar Pradesh | Bank of Baroda | 1800-102-4455 or 1800-223-344 |

| Rajasthan | Bank of Baroda | 1800-180-6546 |

| Haryana | Punjab National Bank | 1800-180-1111 |

| Chandigarh | Punjab National Bank | 1800-180-1111 |

| Punjab | Punjab National Bank | 1800-180-1111 |

| Puducherry | Indian Bank | 1800-4250-0000 |

| Odisha | UCO Bank | 1800-345-6551 |

| Maharashtra | Bank of Maharashtra | 1800-102-2636 |

| Madhya Pradesh | Central Bank of India | 1800-233-4035 |

| Kerala | Canara Bank | 1800-425-11222 |

| Jharkhand | Bank of India | 1800-345-6576 |

| Himachal Pradesh | UCO Bank | 1800-180-8053 |

| Delhi | Oriental Bank of Commerce | 1800-1800-124 |

| Andhra Pradesh | Andhra Bank | 1800-425-8525 |

| Tamil Nadu | Indian Overseas Bank | 1800-425-4415 |

| Telangana | State Bank of Hyderabad | 1800-425-8933 |

Pradhan Mantri Suraksha Bima Yojana Certificate Download

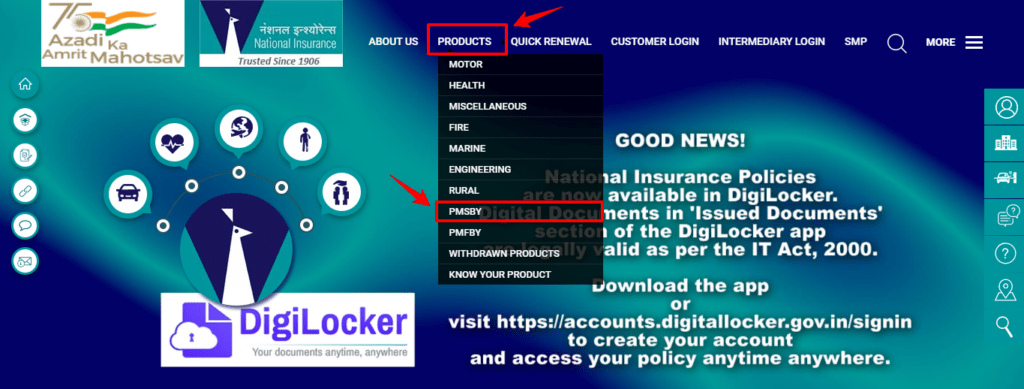

Step 1: The first step is to visit the official website, nationalinsurance.nic.co.in

Step 2: You have to hover over the product’s option and select the PMSBY option.

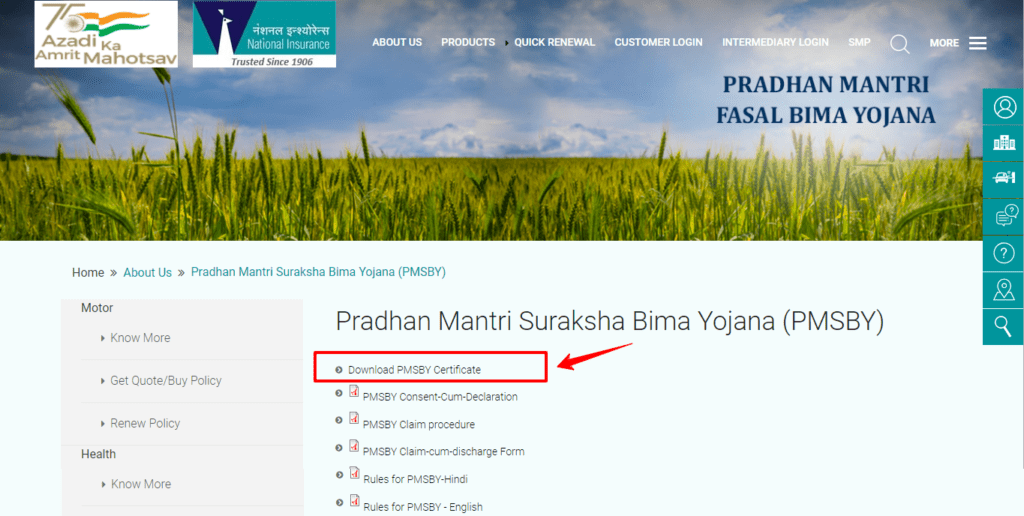

Step 3: You will be redirected to a new page where you have to click on the first heading – Download PMSBY Certificate.

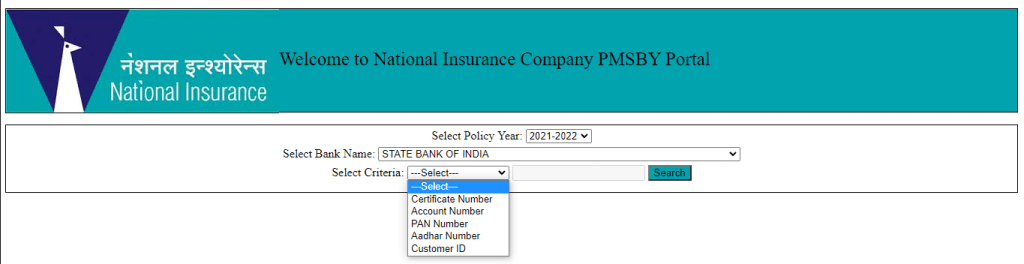

Step 4: Once you click it you will be redirected to a new page. There you have to select the policy year.

Step 5: Select your Bank name. The next option will open.

Step 6: Select the document verification option from the drop-down menu and enter the corresponding identification number.

Step 7: After the above step, your PMSBY account details will display on your screen. And on the right-hand side, you will see the option of Generate Certificate.

Step 8: Click on it and your PMSBY certificate download will start.

PM Suraksha Bima Yojana: Termination Conditions

Following reasons can terminate your accidental coverage and benefits from the PMSBY scheme:

- When the individual reaches the age of 70 years old.

- If the savings bank account closed due to poor maintenance of the minimum amount required for the renewal of the insurance.

- If the individual has more than one savings bank account.

- The bank has to deduct a premium insurance amount of Rs. 12 during the time when auto-debit permission was given.

- If the insurance is discontinued due to a technical glitch or insufficient amount, it can start after paying the full premium. During this time, the PMSBY scheme will freeze and resume after the complete payment.

How to Claim PMSBY?

If you are partially or entirely disabled, you can mark your claim against the PMSBY. However, in case of death, the nominee must claim. Also, if there is no nominee, the amount can be given to the legal heir of the deceased person.

Step 1: The nominee must visit the bank or the insurance company (wherever the policy was purchased) to claim the amount.

Step 2: Once you obtain the claim form, you must fill it out. You have to write the name, address, contact number, email address, hospital details, etc. The claim form is available in several languages.

Step 3: You have to submit the form with relevant documents like a death certificate (if) or disability certificate.

Step 4: Your bank or insurance company will confirm all the information.

Step 5: If all the information in the form and documents are appropriate, the partially disabled person or the nominee of the deceased person will receive the amount. And that’s how the claim will be settled.

Pradhan Mantri Suraksha Bima – How to Check Application Status?

- You have to visit the website of your bank.

- Log in with your credentials.

- Click the PMSBY section and enter your account number.

- Enter your PMSBY application number.

- Hit the submit button.

- The status of the PMSBY application can be seen on the screen.

Don’t Miss Other Govt. Schemes

- Saksham Yuva Yojana

- Kanya Sumangala Yojana

- Pradhan Mantri Awas Yojana

- Atal Pension Yojana

- PM Kisan Samman Nidhi Yojana

- Pradhan Mantri Vaya Vandana Yojana

- Bharatmala Pariyojana

- Basava Vasati Yojana

Frequently Asked Questions (FAQs)

What is PMSBY?

PMSBY’s full form is Pradhan Mantri Suraksha Bima Yojana. It is a government-aided program as a backup that covers all accidental deaths and permanent or partial disabilities. The PMSBY age limit is between 18 to 70.

What are the documents required for PMSBY?

You have to submit one ID proof, Aadhaar card, contact details, details of the nominee, and an application form. The application form can be filled out in eight languages: English, Hindi, Marathi, Bengali, Oriya, Tamil, Telegu, and Gujarati.

Should the FIR be obtained to receive benefits?

Yes, to claim PMSBY benefits, you have to show the FIR.

Who is Eligible for Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

Any person aged between 18 to 70 years, owning a single bank account, an Aadhaar card linked with a bank account, and paying PMSBY premium amount of Rs. 12 annually is eligible.

Will the insured individual be compensated for an irrecoverable partial handicap?

Yes, if an individual suffers from partial disabilities due to any mishap, they will receive compensation of Rs.1 lakh.

What is a partial handicap under the PMSBY scheme?

If there is a loss of any limb or an eye, this is a partial handicap under the PMSBY scheme. The individual will be given Rs. 1 lakh as risk cover.

What is a total disability under the PMSBY scheme?

The total disability risk covered under the PMSBY scheme is Rs. 1 lakh. And permanent disability will be defined as total or irrecoverable loss of both eyes or limbs or their use.

Can the hospitalization expenses be reimbursed under this scheme?

No, the hospital expenses cannot be reimbursed under the PMSBY scheme.

Can the nominee claim the benefits if the subscriber is missing or death is not confirmed?

No, because insurance benefits will be only given to the nominee once the death of a person is confirmed. However, after seven years of missing, that individual’s death will be confirmed as per the law.

Where can you get the PMSBY scheme from?

The individual can register by contacting the affiliated bank or an insurance company or can download the form from the Government website.