1,500+ properties will be auctioned by Bank of Baroda (BoB) and SBI (State Bank of India) this month. Should buyers be investing in these properties. Both banks will host their property e-auctions on the 22nd and 25th of October, 2021. Banks put up mortgaged units for auction whenever there are serious defaults by borrowers. Banks put these up through the IBAPI (Indian Banks Auctions Mortgaged Properties Information) portal. BoB will have more than 570 residential and commercial properties on offer while SBI will put up 1,000+ properties on auction. The banks have confirmed how loan defaults have increased considerably due to the coronavirus pandemic.

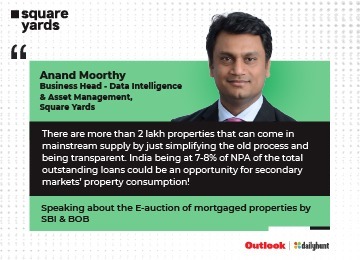

Prospective buyers may invest in these units at comparatively lower rates although there are several aspects to keep in mind. Business Head, Data Intelligence and Asset Management, Square Yards, Anand Moorthy, stated that there is a perception that auctioned properties are cheaper although an expectation lapse may be there for potential buyers. Since documentation may not be suitably available, buyers should undertake higher due diligence according to him. The bidding procedure is not popular amongst buyers since there are several operational hurdles including inability to physically visit the property. There are two types of auctioned properties, i.e. defaults on home loans and defaults on corporate loans or LRD (Lease Rental Discounting) loans.

The pricing may be attractive for home loan properties with 5-10% discounts for buyers if the bank possesses all documents according to Moorthy. The corporate loan default properties may not be as popular since they may cost well upwards of Rs. 2 crore according to him. Experts feel that buyers should read all legal terms and conditions with care before investing. The security of the loan will have the right to offer defaulted amount to the bank until the last stage of the sale process for mortgage properties. In such scenarios, even if the successful bidder has paid up the earnest money and the deposit, if the borrower offers to repay a higher amount to the bank, then the sale may be cancelled with the property given back to the defaulter.

You should also watch out for any other pending tax payments or encumbrances on the property. These are taken as arrears from the property buyers and are over and above the final successful bid. The bidder will purchase on the as is where is legal basis and these encumbrances may lead to costs increasing significantly while increasing the time required for complete ownership according to experts.

For a detailed report on this read the articles we were featured in:

Outlook India: https://bit.ly/3CeNNye

Published Date: Oct 21, 2021