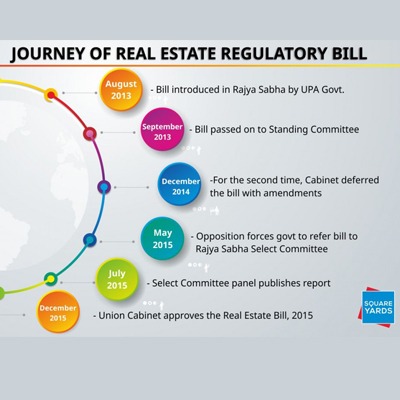

Case 1: Rakesh Juneja is getting retired in 2019. Currently, he lives in a govt. quarter that is decently big. He is looking for a home of equal size where he can shift post retirement but is too doubtful to invest in current market scenario. What is stopping him from buying is the usual project delays which would leave him cash strapped if the delivery isn’t on time. Sadly, he can’t afford a ready to move in property as he isn’t eligible for bank loans since Juneja is approaching sixty. Case 2: Pooja Sharma aspires to invest in real estate, she is just 28. But, she doesn’t know how to shortlist the broker which can offer her the best advice and give her legally verified properties. Sadly, she is also holding up her investment! There are many cases like Juneja and Sharma where buyers are holding back their money because of lack of confidence in the Indian realty market. So what good can the Real Estate Regulatory Bill that has been approved in the Cabinet in December last year can do? Here is the brief:- The Real Estate Regulatory Bill was initially introduced in the Rajya Sabha by the UPA Govt. in August 2013. It has undergone certain degree of amendments henceforth. What makes this bill a standalone change-maker is its twofold core objectives. On one hand it ensures sales of immovable properties in an efficient and transparent manner, at the same time it will protect interest of consumers who are looking to invest in the real estate sector. The bill is expected to make a wider implications for all the significant players involved in the eco-system. Applicability of the Bill The Bill includes both residential & commercial projects in its purview and will involve stronger & effective measures that can make the overall real estate industry more transparent & buyer friendly. It is touted as a strong initiative towards promoting fair-play in the real estate industry & timely execution of the project. The bill calls upon the developer for mandatory disclosure of all registered projects. This includes details of the promoter, project, layout plan, land status, approvals, agreements along with details of real estate agents, contractors, architect, & structural engineer & promoters to the buyers. This is done through registration of real estate projects with the Real Estate Regulatory Authority (RERA). Developers will be liable for structural defects for five years that was earlier two years. In order to further ensure the safety of the money invested, the bill has set the guideline to invest 70% of the amount raised from buyers into an escrow account. This will ensure in timely delivery of the project & curb the malpractice of transferring investment meant for one project into something else. Similarly the bill has numerous other significant proposals in relation to the interest, structural defects, possession & regulatory frameworks. The bill will also create state level regulatory authorities to whom buyers can complain. The Bill also has positive news for the developer community as well. It has proposed single window clearance that will help in faster execution of the projects. Square Yards View  The bill once put in action is expected to make a wider impact on the real estate dynamics of the country that is notoriously known for being overpriced, ambiguous and unwanted delays. This will indirectly result in boosting of positive sentiments amongst the buyer fraternity. Likewise the overall positivity in the market will also ensure more FDIs & Private Equity (PE) investments. However, on another side there is a requirement of more reforms. At present it is believed that over 1500 building construction certificates enter into the system for clearance out of which less than 50% gets clearance. The system calls for more reforms. Hence, it would be interesting to wait and watch whether political will make the sector a better place to invest with a win & win for all or Indian Real Estate industry will continue to be in the state of dilemma.

The bill once put in action is expected to make a wider impact on the real estate dynamics of the country that is notoriously known for being overpriced, ambiguous and unwanted delays. This will indirectly result in boosting of positive sentiments amongst the buyer fraternity. Likewise the overall positivity in the market will also ensure more FDIs & Private Equity (PE) investments. However, on another side there is a requirement of more reforms. At present it is believed that over 1500 building construction certificates enter into the system for clearance out of which less than 50% gets clearance. The system calls for more reforms. Hence, it would be interesting to wait and watch whether political will make the sector a better place to invest with a win & win for all or Indian Real Estate industry will continue to be in the state of dilemma.

Real Estate Regulatory Bill: What if it becomes a reality?