Filing a revised income tax return is possible in the event that the taxpayer has made any mistake in the original filing. Revised returns are the second chance that the Income-tax Department gives taxpayers to refile the returns error-free. The provision of section 139(5) allows the taxpayer to make revisions in the Income Tax Return filing. Another reason is if the taxpayer forgets to disclose other income or makes a mistake in claiming tax deductions. In this blog, we will walk you through important points, provisions, and procedures to file a revised income tax return.

Table of contents

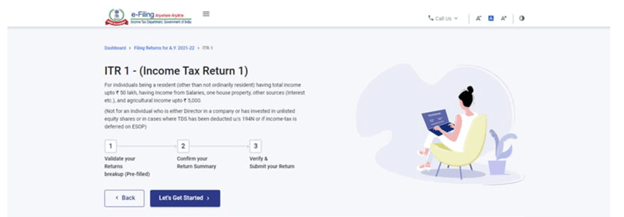

Procedure to e-file revised ITR on the Income Tax Portal

An individual who has filed the original ITR via the online mode can file the revised income tax return via the e-filing mode. The procedure to file a revised ITR via the online portal is as follows:

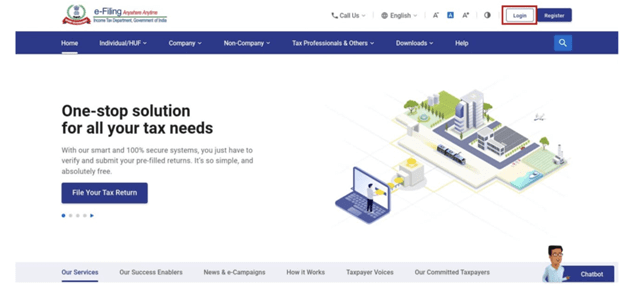

Step 1: Visit the official portal of the Income Tax Department.

Step 2: Log in to your account by filling in the used ID, password, and security code on the homepage.

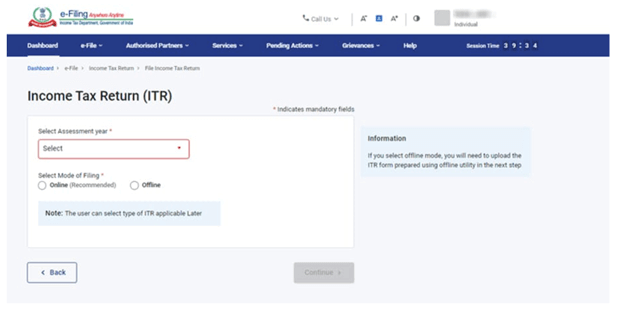

Step 3: After logging in, click on the ‘E-File’ option and choose the ‘Income Tax Return’ option.

Step 4: Now select the assessment year and online mode for filing a revised income tax return.

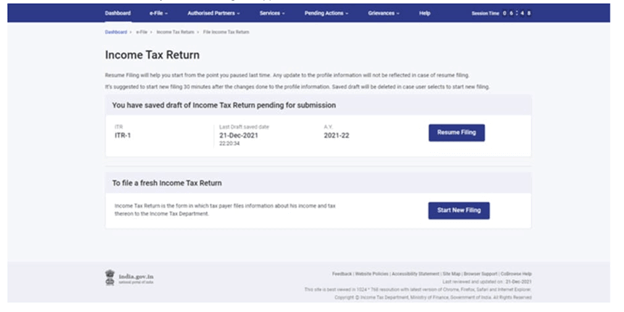

Step 5: You will be redirected to another where you have to select from the available options, i.e., ‘Resume Pending Submission’ and ‘File a Fresh Income Tax Return’.

Step 6: Select the status to continue the process.

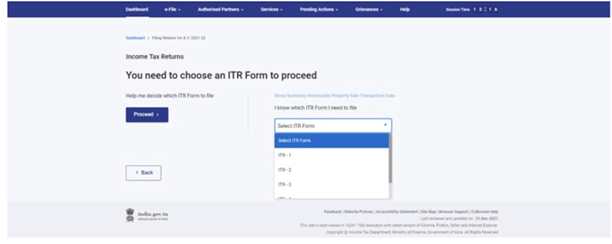

Step 7: Select your form type correctly, which may be different from the original ITR.

Step 8: After the selection process, the ITR form may appear. Now, you need to correct the errors in the original return and file it the same way it was filed. You will also need to verify your return offline via the Centralised Processing Centre of the IT Department in Bengaluru through the speed post.

Things to Consider Before Filing Revised Income Tax Return

There are multiple things that an individual must take into consideration before filing a revised income tax return. There is no limit on the number of filed revised income tax returns. However, filing multiple returns unnecessarily can land you in trouble. An individual should only file a revised income tax return if there is an error in the original filing. More things that one should be mindful of are mentioned below:

- You need to file a revised return via the same mode as the original ITR. If you have filed the original return via the offline mode, then you are not supposed to file the revised one via the online mode.

- If you have filed the original return after July 31 and the due date, then you cannot file a revised income tax return.

- You won’t be able to file a revised return if the IT Department has already processed your original return.

- An individual taxpayer is allowed to file as many Reuters as they want. However, filing multiple returns indicates an inconsistency in their account, which may result in the IT Department suspecting the individual.

- An individual can refile the IRT in case there is a mistake in the original one. If you refile the ITR after an assessor from the ID Department, then it won’t be valid.

- If there is a discrepancy in the income declared in the original or revised income tax return, then you might have to pay a higher penalty.

- An individual will be liable to pay a huge penalty if there is any irregularity in the investment or wilful hiding of income if found by the IT Department.

- In order to tackle this situation of refiling a revised income tax return ensure the first time, you file the ITR correctly. Refiling the IRT may land you in trouble. However, if there is an unintentional error in your ITR form, then you can refile a revised income tax return on that behalf without landing yourself in trouble with the IT Department.

- A revised ITR would be a complete replacement of the original ITR. Thus, post-filing the revised one, it would be considered the final ITR of the taxpayer.

- A revised return cannot be filed if the assessment of your ITR is completed under Section 143-(3) of the IT Act, 1961.

One must be mindful of the fact that if they are filing a revised income tax return due to a mistake or error in the previous one, then there will be no charges or penalties levied on the individual by the IT Department.

Provisions for Filing of Revised Income Tax Returns

The below-mentioned key points below are the provisions for filing revised income tax returns:

- The revised income tax return can be filed only after the submission or verification of the previously filed return, which is the original one. By filing the revised income tax return under section 129(5), the original ITR filed under section 139(1) 04 139(4) shall be withdrawn or deemed.

- The acknowledgment number received by the individual after filing the original ITR should have to be assessed, which is written in the ITR V. Moreover, you can also obtain it from the online filing portal. The individual needs to log in and search for ‘View Returns’ and then the ITR details will be displayed on the screen.

- From the financial year 2017-18 and onwards, the belated returns which were filed by the assessee under section 139(4) for any year can be revised according to section 139(5).

- Even after receiving an income tax refund, an individual can still revise the ITR for an IT refund under Section 143(1) which is different from the above-mentioned assessment.

Eligibility Criteria and Time Limit for Return Revision

The eligibility for return revision is as follows:

- If the individual has filed the original return under section 123(1) of the Income Tax Act

- If the belated return was filed under section 139 (4), it can also be revised

- A revised ITR can be filed by an individual anytime before the end of the relevant year of assessment or before the completion of the assessment.

Explaining with Example: If an assessee files for the ITR for the financial year 2017-18 (A.Y. 2018-19) on July 8th, 2018 and later on. If there is an error, the individual may file a revised ITR up to March 31st, 2019 or before the assessment compilation.

To Sum Up

Income Tax Returns are filed in order to do a self-assessment tax return paid by the taxpayers. This whole process ensures that any extra tax paid by the taxpayer gets refunded. In the event that any excess amount of tax is present, the IT Department may process a refund to the taxpayer’s linked bank account. An individual can file a revised income tax return via the online mode only if the original tax return was also filed in the same manner. According to the IT Department, the revised income tax return must be filed via the same mode of income tax filing. There is no limit to filing a revised ITR before the deadline. However, INR 5,000 is the late filing penalty that will be levied on individuals who fail to file ITR before the deadline. A small taxpayer whose income does not exceed INR 5 lakh per annum can’t be penalised more than INR 1,000.

You May Also Like

Frequently Asked Questions (FAQ)

Can I file a revised income tax return?

Yes, you can file a revised ITR multiple times as there is no limit to filing the return. Only if the ITR assessment is completed by the assessing officer under section 143-(3) of the IT Act, then a revised income tax return cannot be filed.

What if the revised return has some error in it?

An individual can file another return if there is an error. However, filing multiple Income Tax Returns can land you in trouble, and if the individual files a belated ITR after the deadline, i.e., July 31, then he/she might be liable for a penalty of INR 5,000.

Who can file a revised return?

Any taxpayer can file a revised return if he/she has already filed an income tax return.

What is the penalty for filing a revised income tax return?

According to the law, INR 5,000 is the late filing penalty that will be levied on individuals who file belated income tax returns. However, for a small taxpayer, the total sum penalty will not exceed INR 1,000 if the total income is less than INR 5 lakh.

How long a revised income tax return takes?

The whole revised income tax return usually takes about one or one and a half months from the day of verification to the receipt of ITR-V by the Centralised Processing Centre.