The Private Equity (PE) funds are increasingly becoming a popular funding instrument in the Indian realty market. In the recent past, which has been associated with subdued investment sentiments and slowdown in terms of debt based financing instruments, PE is emerging as an alternative route to finance real estate projects.

In Q1 2015, the total PE investment in Indian realty has been in tune of over INR 50,000 (USD 784) million, a massive 85%, Year on Year (Y-o-Y) increase, according to the data revealed by Cushman and Wakefield.

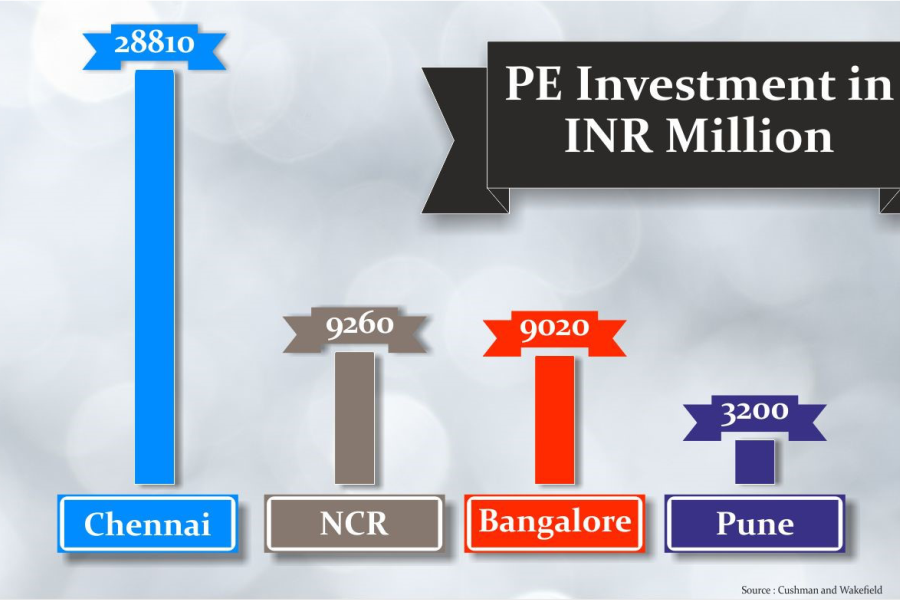

In terms of asset classes, residential real estate and commercial office space have been two major receptors comprising of over 90% of the investment volume. The total investment in the residential market has been INR 27,520 (USD 433) million. Likewise, the total investment in the commercial office space has been in tune of INR 24,100 (USD 378.5) million. In terms of cities Chennai has led the pack followed by NCR, Bangalore and Pune as captured below.

The surge in the investment activities could be attributed to the general positivity in the investment scenario of the country post the government change previous year. Likewise, the recent emphasis by the government on urban development and housing plans is further invigorating the investor interest towards Indian realty market. The surge in PE in the Indian realty has also been driven by rise in global economic outputs. Global economy is on the path of recovery with global GDP is increasing by 2.3% in 2014.

The total PE investment in India has been in tune of INR 970,000 million out of which realty sector constitutes of 5.2%. In the coming time on the backdrop of surge in economic activities coupled with rising status of India internationally, further increase in PE investment in Indian real estate is expected. The presence of more Grade-A builders involved in high ticket size projects will further act as a stimulant in enticing PE investment. Increasingly Indian real estate industry is being dominated by Grade-A builders with the size of small scale builders continuously shrinking. This will further positively influence PE investors to look into Indian realty sector.

Likewise, in terms of asset class, commercial office space including IT and Commercial SEZs will witness more interest, pertaining to low risk involved with such asset class. The commercial asset is touted as one of the safest investment in India. The commercial real estate market in India is presently driven by rise positive sentiments and surge in economic outputs. In 2014, the total amount of transaction in the commercial real estate has been in tune of 36 million Sq. Ft. In the near future on the backdrop of rise in economic activities, it is expected to further surge by 25% – resulting into further rise in investor interest.