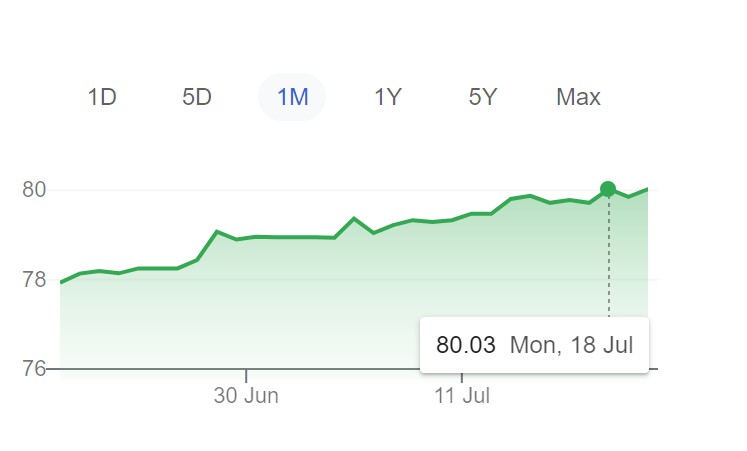

The Dollar to INR price today (July 19, 2022) of 79.94 – saw a reduction of 9 paise from the dollar rate of 80.03 on July 18, 2022. This value alone defines that Indian Rupee (INR) is facing the backlash of the crude oil prices and foreign investment outflows, among many other factors. There is just one question that invades the mind of the smart citizens of India-

What will be the impact of the Indian Rupee hitting 80 against the US dollar?

Before we jump onto a train to unravel the impact of the dollar rate in India, let us first gain a little insight into the monetary units – dollar and rupee.

Table of contents

History of Dollar

A dollar is a monetary unit capable of giving a person heartache by sheer fluctuations in its value. It is the name of the common monetary unit in the United States, Canada, Australia, New Zealand, and other nations. It was formerly a silver coin that was used in several European nations. The English-speaking populace referred to the Spanish peso, used in the Spanish and English colonies in America as a dollar. Because of the widespread use of this coin, the dollar became the recognised monetary unit of the United States in 1792. Canada adopted the dollar and the monetary decimal system in 1858, Australia in 1966, and New Zealand in 1967.

History of Rupee

The rupee is the present currency of India and Pakistan and was the currency of Muslim India in the 16th century. The word “silver” in Sanskrit is where the term comes from and is also the name of the currency in Nepal, Seychelles, and Mauritius. The silver rupee, divided into 16 annas, was first introduced by the Mughal Dynasty of Central and Northern India in the late 16th century. However, the value of the rupee fluctuated from region to region depending on the minter, and the rupee was not made consistent by legislation until 1835. Mohandas Gandhi, the pioneer of the 20th-century fight against British colonialism, is featured on the obverse of every Indian banknote and coin.

A Quick Run-through of Currency Rates

Before delving into the American Dollar price in India, let’s look at the current market scenario.

The Dollar to INR price today (July 19, 2022) for three nations is discussed below:

What is the US Dollar Price in India?

One American dollar price in India is 79.94 INR. The average US dollar rate in India is 76.5107 INR for the year 2022.

What is the Price of the Canadian Dollar?

One Canadian dollar price in India is 61.73 INR. The average Canadian dollar price in India stands at 60.0493 INR for the first five months of 2022.

What is the Australian Dollar Price in India?

One Australian dollar price in India is 54.78 INR. The average Australian dollar price in India stands at 54.7557 INR for the first five months of 2022.

What Has Influenced the Rise in the US Dollar Price in India?

Exchange rate refers to the relationship between the price of one country’s currency and that of another. Numerous elements influence the value of a currency resulting in a different dollar rate in India. The following factors cause a surge in the American dollar price in India:

The Russia-Ukraine War

The Russo-Ukrainian War eruption in January 2022 gravely impacted the Indian Currency. A sharp depreciation was noticed in INR against USD when the West imposed sanctions on Russia and US Fed increased the interest rates. The dollar rate in India, which earlier stood at INR 74.5 rose to INR 76 on the day Russia invaded Ukraine. The spiralling inflation soured the mood of Foreign Portfolio Investors (FPIs), resulting in an INR 1 lakh crore disappearance from the Indian markets in the first three months. Amidst the tension of the war, India’s annual inflation rose to 7.8% in April 2022, making the Indian currency a victim of monetary chaos.

Crude Oil Prices

Furthermore, the Russo-Ukrainian war influenced the crude oil prices, igniting the surge in the US dollar. India imports approximately 80% of the crude oil. As of July 19, 2022, one barrel of crude oil costs USD 102.58. It’s imperative to convert Indian Rupee into US Dollars per the exchange rates to procure a barrel of crude oil.

Capital Outflows

Continual outflows of foreign cash from India since the beginning of 2022 are approximated at INR 2,35,975 crores. Due to several factors, such as tightening monetary policy in advanced economies and rising currency and bond yields in the US, Foreign Portfolio Investors (FPIs) have been selling stocks in the Indian markets. The foreign investors seek refuge in the strong dollar, making them ditch the risk that Indian assets carry.

Various other factors contribute to the depreciation of the Indian rupee, like consumer price inflation, aggressive policy of the US Fed, and weak domestic growth, among others.

Impact of Dollar Rate in India Hitting 80

The Indian currency has recorded a depreciation exceeding 7% against the USD since the beginning of 2022. The impact of INR crossing 80 against USD is discussed below.

The Expensive Imports

The plunge in Indian currency turns the imports into an expensive purchase as the imports require a payment to be made in US dollars. Due to the high US dollar price in India, the pay-offs of imports will require more Indian currency for the same number of dollars. This will act as a constraint on the importer’s pocket and disrupt the functioning of the Indian economy.

The Cheap Exports

A weak rupee is beneficial for exporters. Exporters receive more money in exchange for a given amount of US dollars if the dollar price increases. Margin expansion results from this. The export-oriented industries like IT and Pharma benefit from the devaluation of the currency, whereas the import-oriented industries lose their market profit.

Rise in Inflation

Inflation can be understood as an increase in price over a time period. The impact of the rupee hitting 80 against the US dollar will severely affect inflation as the cost of imports will rise with a decline in currency value. As a result, the cost of raw materials will increase, raising the price of finished goods. As a result, consumers must pay more for the same commodities. This will increase the flow of the Indian rupee in the domestic market, which will sow the seeds of recession. The recession is a result of increased prices with limited income.

As retail inflation exceeds its upper tolerance limit of 6%, it is widely anticipated that the Reserve Bank of India (RBI) will raise its benchmark interest rate for a third time next month.

Increase in Deficit in Current Account

The difference between the money gained from selling goods to a foreign country and the money paid for purchasing things abroad is known as the Current Account Deficit (CAD). The decline in the rupee causes the “deficit” to increase since the country imports more items than it sells. India already faces CAD challenges. This fiscal year, it’s projected to reach USD 105 billion, or 3% of the GDP. For the fiscal year 2021-22, CAD was calculated to be 1.2% of the GDP, driven by the trade deficit.

Statistics about the Rupee Depreciation Impact

The figures heeding to the impacts can be summed in the following:

- A 172.72% increase in the estimated merchandise trade imbalance was witnessed in June 2022 from USD 9.60 billion to USD 26.18 billion.

- The nation’s imports increased by 57.55% to USD 66.31 billion in June compared to the same month last year.

- June 2022 recorded USD 21.3 billion, nearly double in crude oil imports.

- The amount of coal and coke imported during the month doubled from USD 1.88 billion in June 2021 to USD 6.76 billion in June 2022.

- India’s foreign exchange reserves have decreased by INR 1 trillion since February 2022.

The Solution

With little relief in sight, India’s central bank, the Reserve Bank of India (RBI), is battling numerous fronts to stop the Rupee from falling to new lows. The difficulties that shower the Indian currency and RBI with pressure are- drops in forwarding dollar premiums and increased open interest in futures. The RBI’s official position is that it intervenes to lessen currency volatility, not to direct it.

To stop the rupee devaluation, the RBI is implementing several initiatives. They are:

- Out of its foreign exchange reserves, it has been selling US Dollars on open markets. Due to an increase in supply, the value of USD on the markets is decreased. But it also causes the loss of foreign exchange reserves.

- Additionally, RBI has suggested a rupee settlement system. In contrast to the customary US dollars, this allows overseas enterprises to make international payments in rupees. This should lower the demand for US dollars in international trade and stabilise their value.

- To partially offset the impact of the spot sales on reserves and money market liquidity, the monetary authority is engaging in buy/sell swaps.

- The RBI’s decision to intervene in the futures markets is wise since they won’t lose money because the contracts are settled in rupees while still having a little impact on the spot markets.

A Parting Thought

The dollar rate in India hitting 80 INR can be compared to an economy’s doomsday. The appreciation in the US dollar has wreaked havoc on the Indian economy. Thankfully, it is surviving due to the powerful stance of RBI. If this appreciation is not controlled, the dominating currency will drive India into a state of inflation, causing recession and leading to unemployment, reducing the residents’ purchasing power and weakening the economy. The government plays its part, and as the proud citizens of India, we can do our bit by selling foreign exchange, procuring domestic currency, and reducing inflation by tuning the market competitive. Remember, Rome was not built in a day!