The State Bank of India (SBI) has linked itself to new technologies to allow its users to transact online banking online anywhere around the globe. Additionally, the bank provides online SBI mobile banking services, via which you can access a variety of services. For example, YONO, UPID Pay, and Buddy are some of the online mobile banking apps.

Customers are seeking revolutionary online banking services for their comfort in this period of e-banking. Banks have introduced services like online mobile banking to serve customers better.

Mobile banking makes a variety of transactions possible be it in the comfort of your home or office. The user can also review its account transactions statement, the status of fixed deposit, and the bill’s to be paid among a few benefits of the SBI Mobile Banking App.

Let’s learn how to register for SBI mobile banking and some of the attractive features of this service.

Table of contents

- Features of SBI Mobile Banking

- Benefits of SBI Mobile Banking

- How do I Register for SBI Mobile Banking Services?

- How do I Log In to SBI Mobile Banking Services?

- How to Reset SBI MPIN?

- How to Transfer Funds Using SBI Mobile Banking

- SBI Fund Transfer – Timings, Charges, and Limits

- SBI Customer Helpline Number

- Frequently Asked Questions (FAQ’s):-

Features of SBI Mobile Banking

A list of features of SBI Mobile Banking are mentioned below:-

- Request for cheque book

- Enquiry about Demat

- Enquiry about balance

- Mini statements request

- Funds transfer within and to other bank

- Services for Direct to Home (DTH) and mobile top-up

- Transactions for IMPS (Immediate Payment Services)

- Service for Merchant payments

- Facility for Postpaid bill transaction

- Service for ATM card or branch locator

- Premium for life insurance

- Ticket booking for railways using IMPS via IRCTC website

- Instantly open or close of Fixed Deposits

Benefits of SBI Mobile Banking

Some of the benefits of SBI Mobile Banking:-

- SBI bank provides the service of mobile banking, which helps customers make payments anytime and anywhere via their mobile phones.

- All the services of SBI Mobile Online Banking are free of charge, except the message facility.

- It provides a proper, safe, and secure process for transferring funds.

- If you are a customer of SBI bank, then for every service, you don’t have to register. It is connected all across the platform.

- Recently, SBI has been working on facilities like ticket booking for movies, flights, and trains via the State Bank FreedoM service.

How do I Register for SBI Mobile Banking Services?

The SBI mobile online banking registration can be performed by following the steps mentioned below:-

For New User Registration

- In the case of a new user, choose the “New User Registration” option for registration.

- Enter the password according to your choice and get started with services.

Once you are registered, you can avail of mobile banking services through the various methods mentioned below:-

Via SMS

- In order to receive your ID number and MPIN (default). Write a message and send it to the 9223440000/567676 number with the code “MBSREG”.

- The bank will provide your login details along with a direct download link for mobile banking.

- Once the download is complete then you can log in into App by using your credentials.

- After signing in, by choice you can reset the MPIN.

Via SBI ATM

- Go to the nearest SBI ATM to register for online banking.

- Click on the “Mobile Registration” option and fill in the phone number.

- After filling in the contact number, confirm it and submit it.

- After submitting, you will get a message for activation.

- Once you receive the confirmation through SMS, you are eligible to use online banking.

Via Branch

- Go to the nearest branch to register for online banking.

- After submitting the required details to the bank, your online mobile banking service will be activated.

Via YONO Lite SBI App

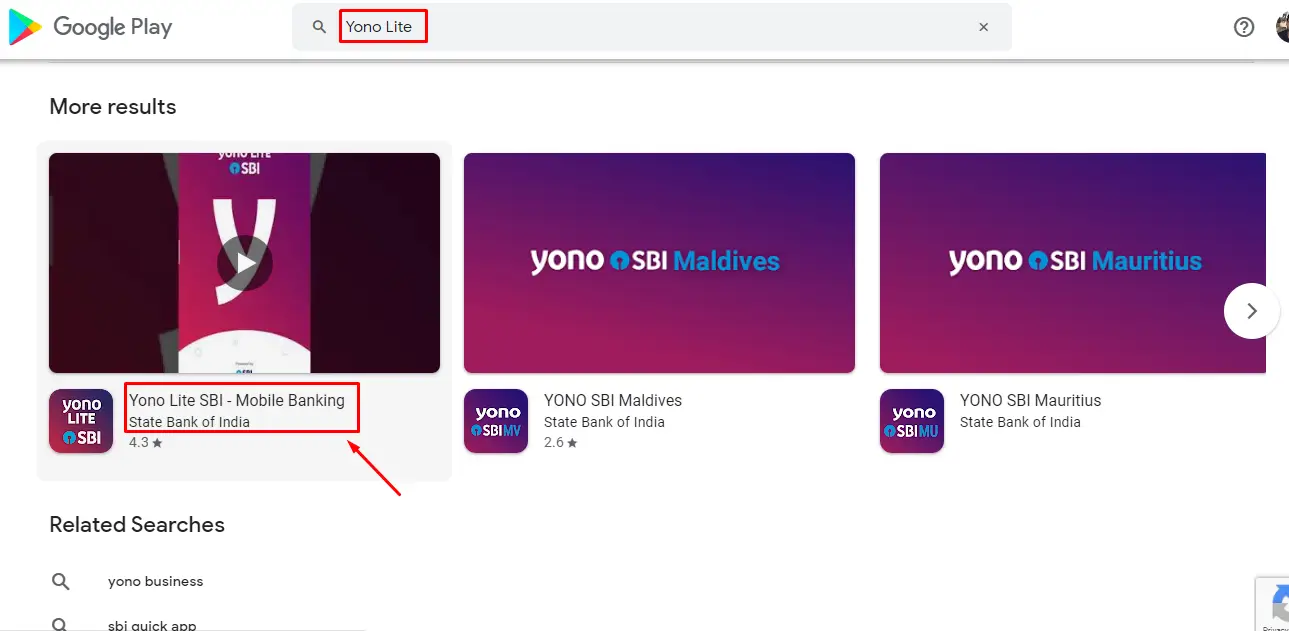

- From the google play store, download the YONO lite SBI mobile banking app.

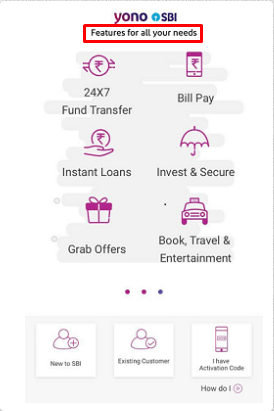

- After downloading the app, a login screen will appear and consist of several options such as fund transfer, bill pay, instant loans, and so on.

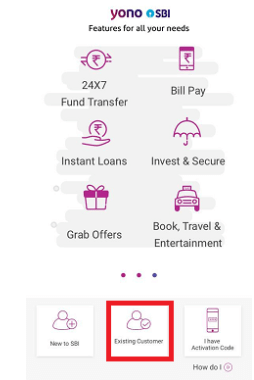

- Select the “Existing Customer” option, and it will appear at the bottom of the home page screen.

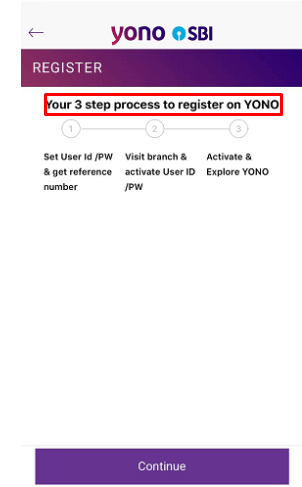

- On the next page, three steps will appear to complete the registration procedure and Select the “Continue” option.

Note: For your flexibility, you can also select another branch. Then, select the “Next” option for visiting the next stage.

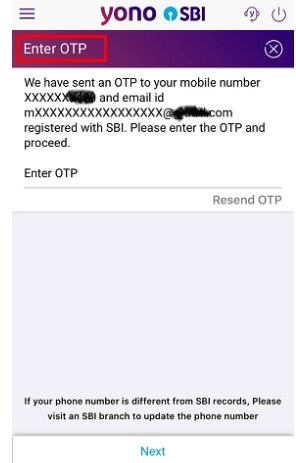

- An OTP will be sent your registered email ID and phone number and submit it.

A successful text will be displayed on the screen for your registration procedures.

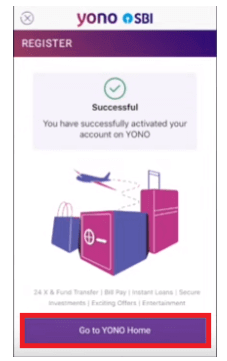

- Select the “Go to Yono Home” option.

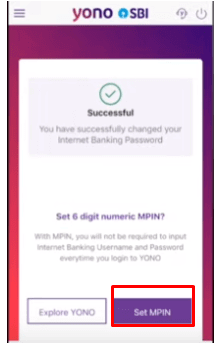

- For the first time log in, you need to change the password. Replace the old password with a new password.

- While changing the detail like the password, it will ask MPIN code. Select the “Set MPIN” option.

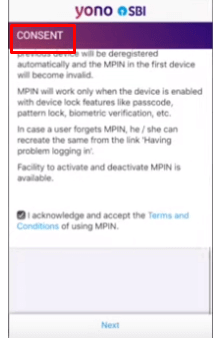

- The “Consent” option on the screen, enables you to select the “I acknowledge and accept the Terms and Conditions of using MPIN” statement. Once, you have selected the statement then choose the “Next” button.

- According to your choice, enter the six-digit permanent code for MPIN.

- You will receive an OTP on your registered phone number and email id. Fill the OTP and select the “Next” option.

- A successful text will be shown on your screen.

How do I Log In to SBI Mobile Banking Services?

To log in for SBI mobile banking registration, the following steps are:-

- Open the YONO Lite app.

- Fill in the six-digit MPIN to enter into your profile.

- Otherwise, enter your credentials such as username & password. Select the “login” option.

- A new page will appear on your screen, which shows your dashboard. The dashboard consists of various options for services that can perform directly from the app.

How to Reset SBI MPIN?

Once your ID and MPIN are created then log in. For safety purposes, it is vital to reset the MPIN. Some of the steps are mentioned below to reset SBI MPIN:

- Open the YONO lite SBI app and enter the credentials.

- Click on the “Settings” button.

- Select the “Change MPIN” option.

- Fill in the old MPIN password and then create the new MPIN password.

- Once you have filled in the password then confirm the new MPIN password.

- Select the “Change” option and submit it.

How to Transfer Funds Using SBI Mobile Banking

To transfer funds using SBI Mobile banking the following steps are:-

- Open the YONO lite App and Log in.

- Select the “YONO Pay” option and start the process of transferring the funds.

- Click on the “ Bank Account” button to transfer the funds, themselves or others.

- Enter the beneficiary details that are present application under the “Frequent Transfer” tab. You can also choose the “Other Accounts” option. Moreover, if you want to make a payment to a new account then click on the “Pay a New Beneficiary” option.

- After the confirmation, you will receive an OTP on your registered email id and contact number. Fill out the OTP code and submit it.

- To transfer money, choose your account and enter the amount to be paid. Moreover, when you will select an account the current balance will be shown on your screen, and click on the “Next” button. In case, you want to make a payment later then, select the “Pay later(Schedule)” option.

- Before making payment, revise the details for instance beneficiary account number, payment amount, applicable tax for doing the payment, and remark text. After checking, select the “Confirm” option.

- After making a payment, a “Successful” message will appear on the screen.

SBI Fund Transfer – Timings, Charges, and Limits

Through NEFT Charges:-

| Transaction Amount | Price(₹) |

| Up to ₹10,000 | ₹ 2.50 |

| Up to ₹ one lakh | ₹ 5 |

| Above ₹ one lakh to two lakhs | ₹ 15 |

| Above ₹ two lakhs | ₹ 25 |

Through RTGS and its Timings and Price:-

| Transaction Timing | Transaction Amount | Price |

| 9:00 a.m to 12:00 p.m | ₹ 2 lakhs to ₹ 5 lakhs | ₹ 25 |

| Above ₹ 5 lakhs | ₹ 51 | |

| 12:00 p.m to 3:30 p.m | ₹ 2 lakhs to ₹ 5 lakhs | ₹ 26 |

| Above ₹ 5 lakhs | ₹ 52 | |

| 3:30 p.m to 4:30 p.m only on Weekdays | ₹ 2 lakhs to ₹ 5 lakhs | ₹ 31 |

| Above ₹ 5 lakhs | ₹ 56 |

SBI Customer Helpline Number

In case any customer faces queries or wants to file a complaint, the below contact number is provided.

Toll-Free Numbers:–

You May Also Like

Frequently Asked Questions (FAQ’s):-

Q1. Can I apply for a home loan through the SBI YONO App?

Ans: SBI YONO App provides an instant Home Loan facility. It is made available for customers to perform hassle payments.

Q2. Can I send the SMS for registration from any mobile number?

Ans: No, you can’t SMS for registration from any mobile number due to SBI bank premises.

Q3. Are there any charges to use the SBI YONO App?

Ans: There are no charges to use the SBI YONO App.

Q4. Is there a limit on fund transfers using the SBI YONO App?

Ans: There is a transaction limit from ₹ 10,000 per to ₹ 25,000 on the daily basis via YONO lite SBI App. However, another merit is that users can instantly transfer funds using IMPS/NEFT/RTGS method.

Q5. Can I pay the bill for my credit card from a different bank using the YONO SBI App?

Ans: Yes, you can pay the bill for my credit card from a different bank using the YONO SBI App by following the steps:

- Go to the SBI YONO App and fill in the credentials by entering MPIN or username and password.

- Select the “My Relationships section”, by visiting the “My Credit Cards” option.

- Choose the category for SBI Credit Card & view its information.

At last, open the “Summary Page” of transactions and then select the “Pay” option and submit it.

Q6. What is Wireless Application Protocol in SBI Mobile Banking?

Ans: The bank has created WAP (wireless application protocol) that is based on mobile online banking services. It assists customers to access the bank’s portal by using their smartphone and can make transactions in a flexible manner.