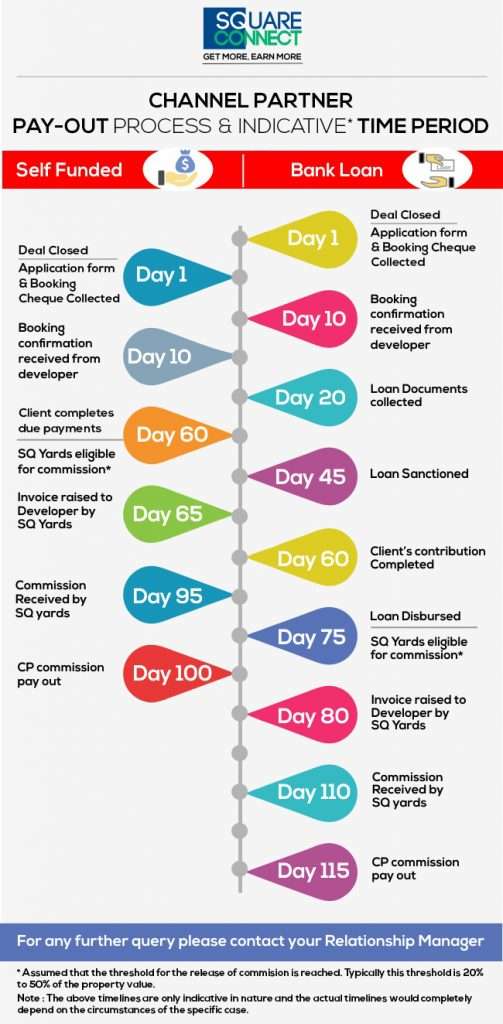

India’s first productivity booster mobile app for real estate brokers, Square Connect has a well-defined process for payouts in a time bound manner. Mentioned below are the steps which define the process clearly. Most of the transactions fall into two categories, self-funded and bank loans.

For self – funded transactions, first the deal is closed with a completed application form and a booking cheque. This is followed up by a confirmation from the developer within 10 days approx. Square Connect becomes eligible for payment within 60 days of booking when the complete amount is paid. Within 5 days post this, an invoice is raised to the developer. After 90 days of the booking, Square Yards receives the commission and is able to pay the CP within the next 5 days.

The bank loan transactions are more layered because of some additional steps involved in getting the loan sanctioned. It involves certain more steps like the collection of loan documents within 20 days of booking and sanction of the loan within 45 days. This pushes the usual timeline by 15 days as the loan is then disbursed by the 75th day of booking and makes it eligible for commission. Within 115 days of the booking, the CP commission is paid out.