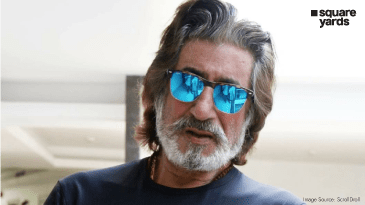

At YourStory’s annual flagship event, TechSparks 2020, Tanuj Shori, the Co-Founder and Square Yards CEO, talked of how the GDP (gross domestic product) will not return to 9% with the continuing struggles seen in the Indian realty sector. Shori was in conversation with Policy Bazaar CEO Sarbvir Singh at India’s largest and most important technology, innovation, and entrepreneurship summit, discussing the increase in demand for insurance products, overall trends in demand for insurance products, and the insights witnessed by Policy Bazaar health insurance while also adding his own inputs about the impact on the real estate sector.

Impact of coronavirus on real estate & property- What the experts feel

Shori has rightly stated that the demand-supply roadblock for real estate continues with multiple projects still stuck owing to the lockdown. The real estate sector has been one of the hardest-hit industries owing to the COVID-19 pandemic and Shori has called it a soul-crushing experience over the last 6 months. Even while the Government is anticipating a recovery of GDP to 8.8% next year, it is not possible when the realty sector is still grappling with multiple issues. He added that the Government should focus more on the sector while taking strategic measures for enhancing overall demand, lowering stamp duty charges, and a lot more. However, there is a slight ray of hope going by the slight revival seen in the residential real estate space.

Real estate news- How the future is shaping up

Both residential & commercial real estate will be on the path towards recovery according to Shori who also highlighted the recent turnaround of the residential segment. The last 2-3 months have thrown up a few improvements according to him, which is something that seemed impossible earlier. New projects were sold out within just two weeks and this used to take place in the pre-COVID phase. The impact of the coronavirus pandemic has been bigger on commercial realty and it should initially deteriorate in the short term. He talked of how corporates that were scaling up, are now renegotiating their expenditure on real estate and the gap remains between supply and demand, becoming wider than before. This makes smaller players bleed a lot more in the commercial segment. The only positive according to Shori is the fact that Indian has slowly been moving towards becoming an investment market for realty, something that was not there earlier. Buyers will try and cash in on the lower prices owing to the pandemic and residential realty may return to pre-COVID levels by the next quarter according to Shori.

For a detailed report on this read the articles we were featured in:

YourStory – https://lnkd.in/ermrKFC

Published Date: 29 October 2020