Stamp duty and registration charges in Bangalore are the two vital parts of the property transaction in the city of Bangalore. Like in any other metropolitan city in India, the property buyers in Bangalore are also required to pay stamp duty for getting their names registered under the government records.

Stamp duty in Bangalore is affixed to the most important document that provides legal standing to your property. The duty paid goes to the government as revenue. There is a method of calculating stamp duty which is charged on the saleable portion of a property. It is computed by multiplying the property’s dimension with the market value or guidance value. Other charges such as parking, floor rise, and preferential location charge are also incorporated into the calculation of total value.

Value of sale = Basic cost + Parking charge + Floor rise + Locational advantage charge

Registration charges = 1% of the saleable value.

Factors Affecting Stamp Duty in Bangalore during 2021

It is compulsory for every individual to make payment for stamp duty. It is done for settling one’s property ownership.

Factors that affect stamp duty charges in Bangalore during 2021 are as follows:

- The market value of the property when purchased

- Type of property

- Size of the property

- Location and Area where the property is located.

- The owner’s gender

- The owner’s age

- Commercial or residential status

Stamp Duty and Registration Charges in Bangalore

When an individual is planning to buy a new home for themselves, it is very important for them to know the stamp duty charges they’ll be paying for the property. If you are somebody who is looking for a new property in Bangalore, this article will help in making you aware of all the latest stamp duty and registration charges in Bangalore. The property registration charges in Bangalore are 1%.

Stamp Duty Rates in Bangalore

Stamp duty in Bangalore is paid at a prevalent rate of 5% for a unit priced over INR 35 lakhs along with 1% of the total value of the property as your registration charges.

The registration charges remain the same for all property categories and so does the stamp duty. There will be a 10% cess along with 2% surcharge on stamp duty as an additional cost. In urban areas, buyers will be paying 5.6% as stamp duty while areas under Village Panchayats will have a 3% surcharge and total stamp duty values of 5.65%.

Property Registration Charges in Bangalore

Purchasing land in any district of India involves an amount that needs to be paid to the government of that state, this amount is considered as the tax levied on that land. Similarly, the government of Karnataka has very recently made a reduction in their stamp duty charges to 3% from 5% in case you buy land worth INR45 lakhs. These changes were made for boosting the property market in the state. And to make the procedure of stamp duty in Bangalore easier, they have started collecting the charges through online portals. The user is simply supposed to log in to ‘Kaveri Online Services’ and make payment with just a click for the state.

| Price List of Property | Stamp Duty Charges |

| Rate Above INR 45 lakhs | 5% |

| Rate between INR21 to INR45 lakhs | 3% |

| Rate less than INR20 lakhs | 2% |

Land Registration Charges in Bangalore

Land Registration Charges in Bangalore are dependent on multiple factors, one of the most important factors being the type of transacted property. The purchaser is then required to pay the stamp duty and registration charges in Bangalore to the concerned department. However, the procedure of this payment starts with the document verification process. Land Registration charges in Bangalore are divided as 5% stamp duty and 1% registration fee on the transaction value.

The Documents Required for the Verification are as Follows:

- Property card

- PAN card

- Identity Proof for both the parties

- Power of Attorney

- Aadhar Card

- Original Identification

- Address Proof

- User Charges

- Registration Charges

- Encumbrance Certificate

- A document that holds significance for the parties involved.

- Demand Draft that proofs your payment of Stamp Duty

- Challan

- Receipts for payment of tax.

Flat Registration Charges in Bangalore

Flat Registration Charges in Bangalore are all-inclusive of surcharges & cess that have been computed by the government of Karnataka along with the Bruhat Bengaluru Mahanagara Palike.

Therefore, the stamp duty and registration charges in Bangalore come out to be the total of recent stamp duty charges, the cess & surcharge.

Stamp Duty and Registration Charges in Other States

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

| Punjab | Stamp Duty in Punjab |

| Goa | Stamp Duty in Goa |

House Registration Charges in Bangalore

| Types of Charge | Stamp Duty Charge |

| Registration Charge | 1% (on the value of the property) |

| BMRDA & Surcharges | 3% |

| BBMP & Corporation Surcharges | 2% |

| BMRDA, BBMP and Village areas that added cess | 10% |

Plot Registration Charges in Bangalore

The purpose of purchasing a land describes the classification of the same, whether it’s used for residential purposes or commercial purposes or is a simple plot used for agriculture. Further, the use of the plot decides the area you require your plot to have. Plot registration charges in Bangalore are then calculated by multiplying the listed price with the area that the plot covers.

| S.No | Type of Document | Stamp Duty Charges in Bangalore | Registration Charges in Bangalore |

| 1 | Adoption Deed | INR 500 | INR 200 |

| 2 | Affidavit | INR 20 | NIL |

| 3 | Immovable Property Sale | NIL | NIL |

| (i) with ownership | 5% of the property value | 1% | |

| (ii) without ownership | 0.1% of the property value Minimum 500, Maximum 20,000 | INR 200 | |

| (iii) Joint Development Agreement | 1% Maximum 15 Lakhs | 1% Maximum 1,50,000 | |

| 4 | Deposit of Title Deeds | 0.1% Minimum 500, Minimum 500, | 0.1% Minimum 500, Minimum 500 |

| 5 | Cancellation of Deed | Minimum 500 | Rs.100 or 1% of the property value if the cancellation has been made on the deed |

| a) Cancellation of previous deed where the stamp duty has already been paid. | Provided that if the original instrument is a conveyance on sale, then the stamp duty is as per article 20(1) | Rs.100 or 1% of the property value if the cancellation has been made on the deed | |

| b) All for Government. or any Local Authorities | INR.100 | INR.100 | |

| c) Others | INR.100 | INR.100 | |

| 6 | A conveyance that includes apartments | 5% of the property value with Surcharge & additional duty charge | 1% |

| Conveyance through BDA | 5% of the consideration mentioned in the document with Surcharge & additional duty charge | 1% | |

| Conveyance on TDR | 5% of the consideration mentioned in the document with Surcharge & additional duty charge | 1% | |

| 7 | Exchange | 5% of the property’s value or consideration value depending on which one is higher with Surcharge & Additional duty | 1% |

| 8 | Gift | ||

| (i) Non-Family Member | 5 % of the property’s value with Surcharge & Additional duty | 1% | |

| (ii) Family Member | INR 1000 with surcharge & Additional duty | Fixed INR 500 | |

| 9 | Lease for immovable property or License | ||

| (i) Below or for 1 yr. of residential | 0.5% of the annual avg. rent with Advance & Premium with Fine. Maximum INR 500 | INR 100 | |

| (ii)Below or for 1yr of commercial & industrial | 0.5% of the annual avg. rent with Advance and Premium with Fine. | INR 5 for each INR.1000 for each or partMinimum INR 100 | |

| (iii) Less than 1year and more than 10 years | 1% of the annual avg. rent with Advance & Premium with Fine | INR 5 for each INR.1000 for each or part | |

| (iv) Less than 10years and more than 20 years | 2% of the annual avg. rent with Advance & Premium with Fine | INR 5 for each INR.1000 for each or part | |

| (v) Less than 20years and more than 30 years | 3% of the annual avg. rent with Advance & Premium with Fine | INR 5 for each INR.1000 for each or part | |

| Lease Only | |||

| (vi) Below 30 years/ perpetuity/not a definite term. | Of the property’s value or else the annual avg. rent paid with advance & premium with fine and deposit (whichever comes out to be higher) | 1% | |

| Immovable Properties between the family members | INR 1000 | INR 500 | |

| 10 | Mortgage | ||

| (i) When possession of the property is given. | 5 % of the property’s value with Surcharge | 1% | |

| (ii) When possession of the property is not given. | 0.5% with Surcharge | 0.5%Max. of INR 1000 | |

| 11 | Partition | ||

| (i) For Non-Agricultural Land for Property located in Municipal Corporation or any Urban Department Authorities else Municipal Councils or any Town in Panchayats area | INR 1000 for each share. | INR 500 for each share. | |

| ii) Others | INR 500 for each share. | INR 250 for each share. | |

| (b) Agricultural Land | INR 250 for each share. | INR 50 for each share. | |

| (c) Movable property | INR 250 for each share. | INR 100 for each share. | |

| (d)Both Movable and Immovable Properties | Maximum of above per share | Maximum of above per share | |

| 12 | Power of Attorney | ||

| For Registration of one or more than one documents | INR 100 | INR 100 | |

| Authorizing one or more than one individual to act for a single transaction | INR 100 | INR 100 | |

| Authorizing for not allowing more than 5 individual to act for a single transaction | INR 100 | INR 100 | |

| Authorizing for not allowing more than 5 but not beyond 10 individuals to act for a single transaction | INR 200 | INR 100 | |

| For consideration along with interest when selling off any kind of immovable property. | 5% of the property’s value or consideration value, whichever comes out to be higher | 1% | |

| For a promoter or a developer | 1% of the property’s value or consideration value, whichever comes out to be higherMaximum INR 15 lakhs | 1%Maximum INR 1.5 lakhs | |

| The authorization provided for immovable property Given to others that don’t include family members such as mother, wife, sister, father, brother, husband. All of this is located in Karnataka. | 5% of the property’s value | 1% | |

| In any other case | INR 200 | INR 100 | |

| 13 | Re-conveyance for the mortgaged property | INR 100 | INR 100 |

| 14 | Release | ||

| (i) Not for family members | 5% of the property’s value or consideration value, whichever comes out to be higher | 1% of the property’s value or consideration value, whichever comes out to be higher | |

| (ii) For family members | INR 1000 | INR 500 | |

| 15 | Settlement | ||

| (i) Disposition not for the family members | 5% of the property’s value with additional duty. | 1% of the property’s value | |

| (ii) Disposition for specified family members | INR 1,000 with Additional duty | INR 500 | |

| (iii) Revocation of the Settlement | INR 200 | INR 100 | |

| 16 | Surrendering Lease | INR 100 | INR 100 |

| 17 | Transferring of Lease | ||

| (a) Period Less than 30 yrs. | 5% of the consideration | 1% of the consideration | |

| (b) Period more than 30 yrs. | 5% of the property’s value | 1% of the property’s value | |

| 18 | Trust | ||

| (i) Declaration of the Trust deed that includes any money or any amount that has been conveyed through the author to trust as part of the collection. | INR 1000 | 1% | |

| (ii) Concerning any kind of immovable property that is possessed by the holder that has been conveyed to trust for which the holder is known to be the sole trustee | INR 1,000 | 1% | |

| (iii) Concerning any kind of immovable property that is possessed by the holder that has been conveyed to trust for which the holder is not the trustee or maybe one of the trustees | 5% according to article number 20(1) | 1% | |

| (iv) Cancellation of Trust | Maximum INR 200 | INR 100 | |

| 19 | Will deed | Not Applicable | INR 200 |

| Cancellation of the Will deed | INR 100 | Maximum INR 200 | |

| Deposit of the Sealed Cover that contains the will | Not Applicable | INR 1,000 | |

| a) Withdrawal of the Sealed Cover | Not Applicable | INR 200 | |

| b) Charge for opening the sealed cover | Not Applicable | INR 100 |

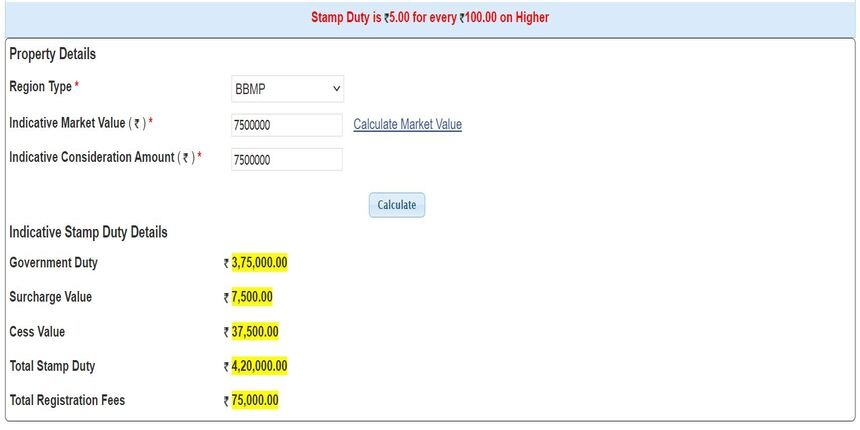

Calculating Stamp Duty in Bangalore

Below are the few steps that will help you in Calculating Stamp Duty in Bangalore

Step1: Visit the website of “Kaveri Online Services”.

Step2: Next, you are supposed to fill in some information to let the calculator fetch the charge amount for you. This includes the nature of your document.

Step3: Further, you will be able to see a drop-down that reflects the kinds of regions.

Some of these Regions include:

- Town Panchayat

- City Corporation

- Gram Panchayat

- Municipal Corporation

By following the above steps, the Bangalore Stamp Duty Calculator will help you compute your stamp duty and registration charge for that particular property.

FAQ’s about Stamp Duty in Bangalore

Q1. What is the stamp duty for first-time buyers in Bangalore?

Stamp duty in Bangalore while buying a property the first time is 5% of the transaction value.

Q2. What is the Stamp Act Amendment in Bangalore?

The Stamp Act 1957 states that reduction of stamp duty on properties ranging from INR 35 Lakhs to 45 lakhs will be done to 3% from 5% earlier. This act is only applicable on registering new properties.

Q3. What are land registration charges in Bangalore?

Land Registration charges in Bangalore include 5% stamp duty and 1% registration fee on the transaction value.