When it comes to buying a home, it’s not just about the design and appearance. The location plays a significant role, as it contributes to your overall sense of well-being once you’ve moved in. The demand for property in seaside communities is always increasing. In India, Goa is quickly gaining popularity as a real estate investment location. The major questions which encircle the whole process of buying a property in Goa are mainly about the stamp duty value of property in Goa, plot registration charges and the whole process followed by these initial steps. A lot of customers have similar concerns.

We all know the fact that Goa’s scenic beauty and stunning beaches make it a great vacation destination. This state is also an excellent spot to buy a home for investment or to live in. However, purchasing a home can be challenging. It entails a significant amount of paperwork and taxation. It is important to register your property under the Registration Act of 1908 once you have purchased it. To finish the process, you must also pay stamp duty registration charges in Goa, a state-imposed levy that ensures the legality of the property deed. This article examines the stamp duty rates, land, house and flat registration charges in Goa, as well as the stamp duty payment options and registration process.

Table of contents

What is Stamp Duty?

The tax imposed by the state government on the sale of a property is what we call the stamp duty. It is due under Section 3 of the 1899 Indian Stamp Act.

The worth of one’s property while registering determines the stamp duty rates in total. It varies depending on different property rates of the particular state or region where the property is located and whether the residence is new or ancient.

Stamp duty on property is an additional fee you will incur when acquiring immovable property, therefore it is essential to comprehend the influence of the nature and location on the property you wish to purchase.

The State government determines the circle rate, used to calculate stamp duty. However, fees may vary depending on several circumstances, including the property’s location, the owner’s age and gender, and the type of property. Several states have reduced stamp duties for females to encourage female property ownership.

Goa Stamp Duty Registration Rates

In Panjim, Goa, the current stamp duty rate is 5% if the property worth exceeds Rs one crore. The stamp duty rate is 4.5 per cent if the property’s worth is between Rs 75 lakh and Rs one crore. Similarly, the applicable rate for houses priced between Rs 50 and Rs 75 lakh is 4%.

The stamp duty tax rate for assets under Rs 50 lakh is 3.5 per cent.

The state government has hiked land registration charges by 0.5-1 per cent for houses priced between Rs 50 and Rs 75 lakh. This means that buyers who purchase a home for less than Rs 75 lakh will pay an additional 1% in registration fees.

In contrast to other states, registration fees and stamp duty are based on the property’s value. People in places like Punjab and Uttar Pradesh pay the same stamp duty regardless of the property value. In addition, from Rs 50 lakh to Rs 75 lakh, the state government increased stamp duty by 0.5 per cent to 1% in 2021.

The Following are the Stamp Duty and Registration Fees for Goa in 2022:

| Property’s Market Value | Stamp duty in Goa | Land Registration charges in Goa |

| Up to Rs 50 Lakhs | 3.5% | 3% |

| Above Rs 50 Lakhs up to Rs 75 Lakhs | 4% | 3% |

| Above Rs 75 Lakhs up to Rs 1 Crore | 4.5% | 3.5% |

| Above Rs 1 Crore | 5% | 3.5% |

| Agreement for Sale | 2.9% | 3% |

| Deed of Rectification | Rs 500 | Rs 500 |

| Deed of Conveyance in Favour of Housing Co. Op. Societies | 3% | 1.5% |

Goa Stamp Duty Calculator

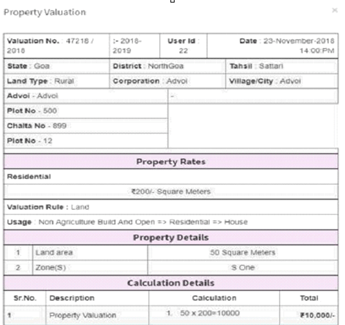

In Goa, the stamp duty value of the property is calculated based on the property’s market value, determined using the area’s circle rate or ready reckoner rate. Let’s use an example to show how stamp duty on property and registration fees are computed.

How do You Calculate the Ready Reckoner Rate?

Mr Dhruv plans to purchase a property in Goa, with a circle cost ranging from Rs. 7,438 to Rs. 13,527 per square foot. He purchased a home for Rs 80 lakh and now must pay the following fees to have it registered:

For the Rs 75 lakh to Rs 1 crore slab, stamp duty is 4%, while registration fees are 3%.

| Charges Applied | Amount |

| Stamp duty 4% of Rs 80 lakh | Rs 3,20,000 |

| House Registration charges 3% of Rs 80 lakh | Rs 2,40,000 |

| Total amount to be paid | Rs 5,60,000 |

How to Pay Stamp Duty Charges in Goa?

Stamp duty payment is required to complete the registration process, and it can be made in one of the following ways:

Purchasing Stamp Paper: The most common and convenient method of paying stamp duty in Goa is to purchase stamp paper. A stamp document with all the facts about the property transaction can be purchased from an authorised individual. You must submit the stamp paper to the state’s registration department’s sub-registrar within four months after the date of issuance. Both parties, the seller and the buyer, must sign a stamp paper.

Using Franking: A property agreement is printed on plain paper and signed by the parties. The agreement is subsequently presented to the authorised bank, which documents it further using a franking machine. The bank receives the stamp duty payments. In addition, banks incur franking fees. Franking fees are typically 0.1 per cent of the property value.

E-stamping: Stamp duty payments can be made online at the Document Registration website in Goa. The stamp duty registration charges can be calculated on the website and paid with a net banking account, debit card, or credit card.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| Andhra Pradesh | Stamp Duty in Andhra Pradesh |

| Delhi | Stamp Duty in Delhi |

| Noida | Stamp Duty in Noida |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Bangalore | Stamp Duty in Bangalore |

| Pune | Stamp Duty in Pune |

Online Property Registration in Goa

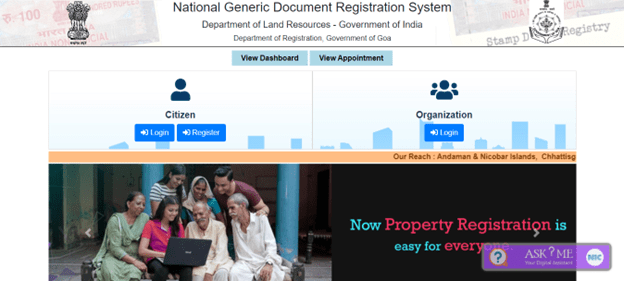

Now you can also register your property from the online portal provided by the Government of Goa. Go through the following steps for a better understanding:

- Visit the “Department of Registration, Government of Goa” portal

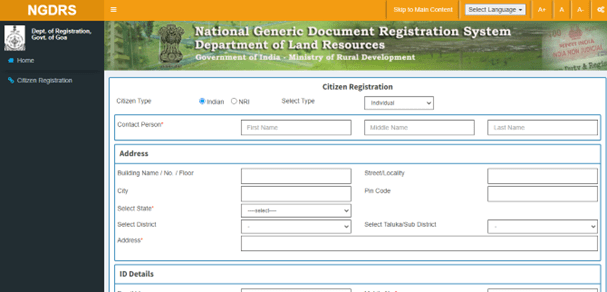

- Now, fill out the registration form to become a citizen. Fill in your address and ID information, as well as your username and password. Then press the Submit button.

- Return to the home page and select Login to become a citizen. Click Login after entering your username, passport, OTP, and captcha. To submit the document’s details, click Document Entry and then New Document Entry once the welcome screen has loaded. During the Goa property registration process, provide all essential documentation.

- After you’ve uploaded all of your documents and information, you’ll need to provide all of the property information. Fill in information about the district, land type, city region, location type, local governing body, property usage, and the seller and purchaser. Property value will be performed after you have filled in all of the facts, and the valuation report will be presented on the screen.

- After the valuation report, the Party Entry screen displays. Select the party type, purchaser party type, and party category, then click Preserve to save the information. On the next screen, fill in all of the witness information and click Save.

- The stamp duty screen will now open; fill in the consideration amount, and the stamp duty and registration fees will be calculated.

- A payment E-Challan will be generated, and you can pay it right away by clicking Pay. Net banking, debit, or credit cards can all be used to make such payments.

- A list of uploaded papers will appear; if any supporting documents are missing, you can upload them now. Upload the payment receipt as well. After that, click Submit to provide the data you’ve saved.

- Finally, select the appointment date, office shift, and hour on the appointment screen. On the specified day, you must physically bring the documents to the Sub-Office. Registrar’s The property is registered in Goa once the documentation is submitted.

Documents for Stamp Duty Registration in Goa

After completing the property registration application form, you must provide the following documents:

- ‘Dalil,’ or deed registration document.

- Land records of interest.

- Certificate of No Objection (NOC)

- Photograph or digital layout of the property.

- Proof of ownership: Utility bills, lease deed.

- Aadhar card, PAN card, driving licence, voter ID card, and passport are all acceptable forms of identification.

- Proofs of stamp duty payment.

- Two legal witnesses provide proof of their identities.

- The property’s map.

- Power of Attorney (if required).

Conclusion

To summarise, the Indian Stamp Duty Act 1899 mandates the payment of stamp duty and registration fees in Goa. In Goa, stamp duty is between 3% and 5%, and registration fees are between 3% and 3.5 per cent. When computing these fees, a direct relationship rule is used: a higher property worth attracts more stamp duty and registration fees, and vice versa. In Goa, you can pay your stamp duty either offline or online. To prevent any penalties, pay all due charges on time.

FAQ’s about Stamp Duty in Goa

Q1. How much is stamp duty on gift deeds in Goa?

As per the Indian Stamp (Goa Amendment) Act which has come into force on Thursday, September 30, 2021, a stamp duty of Rs 5,000 shall be paid irrespective of the market worth of the property whenever a gift deed is signed by the family members or transferred between blood relatives such as in favour of the father, mother, brother, sister, wife, husband, daughter, son, grandson or granddaughter.

Q2. Which Stamp Act is applicable in Goa?

The Indian Stamp (Goa, Daman and Diu Amendment) Act, 1968 applies throughout Goa and to the whole of the Union Territory of Daman and Diu.

Q3. How can I register my property in Goa?

You can now register your property online in Goa by visiting the “Department of Registration, Government of Goa” portal.