Are you on a property shopping trip in Gurgaon? Then you should check out the stamp duty and registration charges in Gurgaon to gauge the cost and delude any financial stress in future.

When you purchase a property, it is important that you get it registered in your name at the Registrar’s office. As a result of registration, you get the legal ownership of your property confirmed and hence, the scope of any fraudulent event is narrowed. The eminent aspect here is the payment and documentation which maintains the process of registration of property you purchase.

When it comes to stamp duty and registration fees in Gurgaon, you must know that the process is carried out at the office of the Sub-Registrar. Once the sale deed is executed, the registration should be performed duly compiled along with the required set of documents within a period of four months. Upon the dissection of the documents which is done by the Sub-Registrar, the registration certificate is issued.

The stamp duty is a type of tax that is levied on the legal recognition of the documents for the property while the registration fee is the charge which the government levies in order to record the details related to the property. What you should note here is that these stamp duty and registration charges are determined on the basis of the type of ownership and the value of the property.

Stamp Duty Charges in Gurgaon

Here are the stamp duty charges with respect to different slabs occurring under Stamp Duty in Gurgaon-

| Jurisdiction | Female | Male | Joint |

| Within the confines of municipal | 5% | 7% | 6% |

| Outside the confines of municipal | 3% | 5% | 4% |

Stamp Duty Registration Charges in Gurgaon

You must keep in your mind the stamp duty registration charges for property in Gurgaon to help yourself determine the additional cost incurred by the purchase. Take a look at this table to know the property registration charges in Gurgaon under different property value slabs.

| Property Registration Charges | Registration Charge |

| Up to Rs 50,000 | Rs 100 |

| Between Rs 50,001 to Rs 5 lakhs | Rs 1,000 |

| Between Rs 5 lakhs to Rs 10 lakhs | Rs 5,000 |

| Between Rs 10 lakhs to Rs 20 lakhs | Rs 10,000 |

| Between 20 lakhs to Rs 25 lakhs | Rs 12,500 |

| Above Rs 25 lakhs | Rs 15,000 |

How to Calculate Stamp Duty Value of Property in Gurgaon?

You need to follow the steps mentioned below in order to calculate the stamp duty value of property in Gurgaon and the commensurate stamp duty payable-

Step 1- First of all, you need to have an estimate of the built-up area of the property. In case of a plotted development, you have to check up on the size of the plot.

Step 2- Then you have to choose the property type in the listed properties. Here, you must select whether the property is a builder floor or an apartment or a house or a shop or a plot.

Step 3- Now you need to select the area where the property is located.

Step 4- In the following step, you have to calculate the minimum inculcated value on the basis of the current circle rate.

Here is How You Need to do that in Accordance with different Types of Property-

|

Type of the Property |

Valuation of Stamp Duty on Property |

|

Residential Apartment, Builder Floors |

Built-up area x circle rate per square feet |

|

House Built on a Plot |

Plot area in square yards x circle rate per square yard + built-up area per square feet x minimum construction value per square feet |

|

Plot |

Area of the plot in square yards x circle rate as per square yards |

After the stamp duty on property is calculated, you have to multiply it by the stamp duty corresponding for which you can refer to the Gurgaon stamp duty rates mentioned in the section. Besides that, you should keep an apprehension of the municipal limits. The stamp duty payable will change in case the property falls outside the jurisdiction of the municipal. You should keep these rates and calculations in mind and go through them thoroughly in order to gauge cost. Acting with due diligence on this errand will enable you to do friendly financial planning.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Pune | Stamp Duty in Pune |

Stamp Duty Registration Charges on Various Properties in Gurgaon?

You can here learn how to calculate the price exactly for different kinds of properties in Gurgaon.

Flat Registration Charges in Gurgaon:

The flat registration charges in Gurgaon vary according to the area and circle rate per square yard in that area. The flat registration charges final value depending on the final amount quoted by the seller.

Here is how you will calculate the flat registration charges. Let’s see an example:

For Apartments or Flats – Carpet area x circle rate square yard

For Instance: If the carpet area is 250 sq. ft. and the circle rate per square yard is Rs. 38,00. Then the final price will be Rs. 9,50,000.

Now, the flat registration charges in Gurgaon for the amount between Rs 5 lakhs and Rs 10 lakhs are Rs.5,000.

House Registration Charges in Gurgaon:

If you are planning to buy a home built on a plot then, the final price will be quoted by using the plot area in square yards, circle rate per square yard of that area, carpet area per square yards, minimal construction cost per square yard. And, that is how the final price will be quoted by the seller and that will decide how much you have to pay as house registration charges in Gurgaon.

The formula for calculating the exact amount is as follows along with an example:

For Homes built on plot – Carpet area per square yard x minimum construction cost per square yard + Plot area in square yard x circle rate per square yard.

For Instance: 135 x 5,00,000 + 200 x 5000

= 67500000 + 1000000

= 6,85,00,000

The final price will be 6,85,00,000 and the house registration charges in Gurgaon are Rs. 15,000.

Plot Registration Charges in Gurgaon:

For plot registration charges in Gurgaon, you have to multiply the plot area in square yards with the circle rate per square yard.

For Plot – Plot area in square yard x circle rate per square yard

In the case, of builder floor,

For Builder floor – Carpet area x circle rate per square yard

For Instance: 200 x 5000, for a plot.

The final plot registration charges will be Rs. 10,000

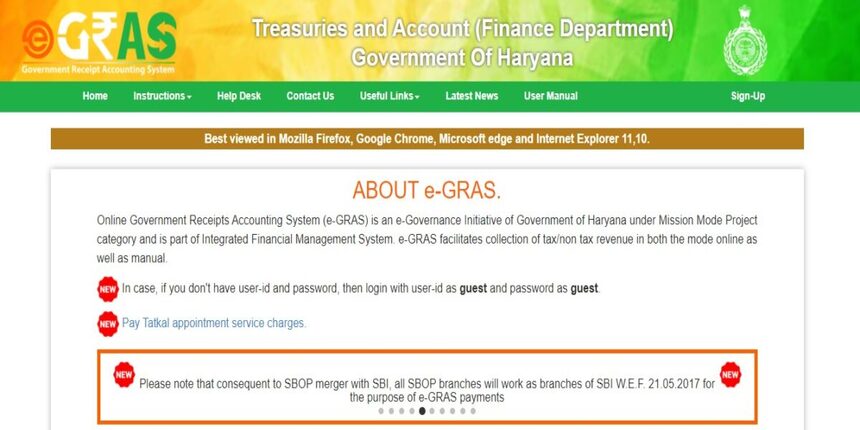

How to Pay Online Stamp Duty in Gurgaon?

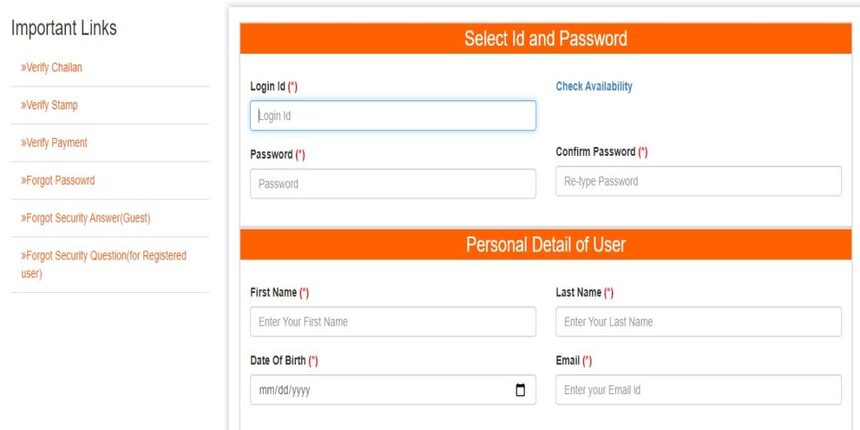

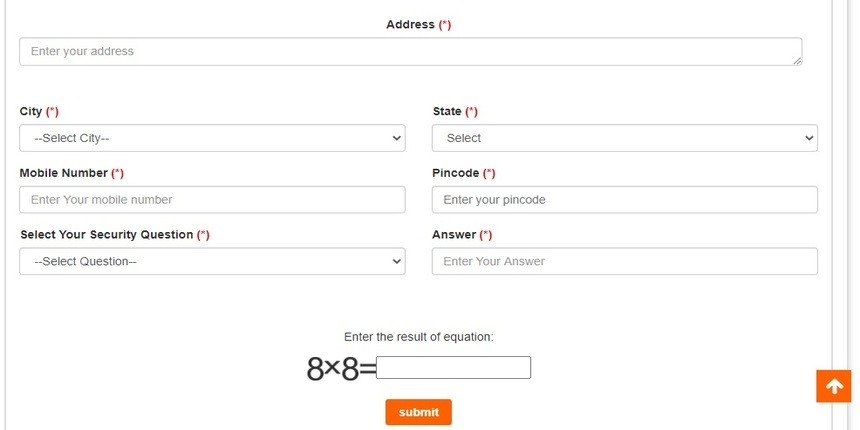

In order to make a stamp duty payment in Gurgaon, you need a little process to follow. Here are the steps which you must cross in order to pay stamp duty in Gurgaon-

Step 1- Navigate to the official website of GRAS.

Step 2- Now you need to create an account with a username and password.

Step 3- Move on to the following page and input the property details.

Step 4- You now have to go through the stamp duty and initiate the required payment via internet banking.

Step 5- After the payment is complete, the receipt for the same will be generated. Be sure to keep this receipt handy for future references.

Stamp Duty and Registration Charges Calculator

In India, the stamp duty is charged on every purchase of the property. The stamp duty charges vary between 3% and 7%. And, to make your stamp duty and registration calculator easy, SquareYards have implemented a stamp duty and registration calculator that vary in different states and Union Territories.

Gurgaon Stamp Duty and Registration Charges – Final Thoughts

The point is that it is peremptory to go through the additional cost that fall under stamp duty and registration charges. There may not be the pecuniary strain on your shoulder out of minor transactions, the finances can take on a significant move when it comes to the big property purchases. So your vigilance must not be bargained when mobilizing your tabs on the cost of the property. This is how you will succeed in making a sound call and avoid the burden you don’t deserve.

FAQ’s about Stamp Duty in Gurgaon

Q1. What are Stamp Duty Rates in Gurgaon?

Gurgaon stamp duty rates depend on the factor of whether your property is within the limits of municipal or not. For properties that fall within the municipal boundaries in Gurgaon, the stamp duty rates are 7% for men, 5% for women and 6% in case of a jointly owned property. On the other hand, the stamp duty rates for properties beyond the municipal limits are 5% for men, 3% for women and 4% for the jointly owned property.

Q2. What are Property Registration Rates in Gurgaon?

Registration charges in Gurgaon are determined based on the property value. The land registration charge payable by you will be decided as per the current market value of the purchased property.

For properties with a value up to Rs 50,000, the registration in Gurgaon costs Rs 100. It is Rs 1,000 for the properties with a value falling in the range of Rs 50,001 to Rs 5 lakhs and Rs 5,000 for the ones that have their value ranging from Rs 5 lakhs to Rs 10 lakhs.

In the case of property with a value falling between Rs 10 lakhs to Rs 20 lakhs, the registration charge is Rs 10,000 and for the one between 20 lakhs to Rs 25 lakhs, it is Rs 12,500. The properties that go beyond the value of Rs 25 lakhs costs Rs 15,000 for the registration charge.