To avail the ownership of a property and get it registered in their name, the buyer has to pay stamp duty and registration charges in Haryana. These charges have to be paid to the Revenue Department for all possessions taking place. Section 23 of the Registration Act of 1908 states that except Wills, all the documents have to be presented to the government. These documents have to be made available within four months after the execution of the deal.

The entire process has been made easier by the government by shifting it online. So, the buyer can pay the charges and taxes linked to the property conveniently through the online mode as well. If the buyer delays paying the house registration charges, then a penalty of up to 10 times the registration charges can be levied. Hence, stamp duty registration is vital.

Have a look at the stamp duty registration charges in Haryana levied on the registration of property and other deeds.

Stamp duty Registration Charges in Haryana

Given below are the stamp duty on property based on the areas (rural and urban) in Haryana -

| DOCUMENT | RURAL AREAS | URBAN AREAS |

| Sale, conveyance deed or certificate of sale | 5% | 7% |

| Exchange deed | 6% of the greatest value of one share | 8% of the share of the greatest value |

| Special power of attorney | ₹100 | ₹100 |

| Loan agreement | ₹100 | ₹100 |

| Partnership deep | ₹22.50 | ₹22.50 |

| Gift deed, Mortgage deed with possession | 3% | 5% |

| General power of attorney | ₹300 | ₹300 |

| Mortgage deed without possession, settlement deed, partition deed | 1.5% | 1.5% |

| Exchange of Property | 5% | 7% |

| Affidavit | ₹10 | ₹10 |

| Security bond, Surrender of the lease, Property, Release of Ancestral | ₹15 | ₹15 |

| Trust Deed | ₹45 | ₹45 |

| Adoption Deed | ₹37.50 | ₹37.50 |

The charges for Equitable mortgage/deposit of title deed, pledge, or pawn is 0.2445% if that loan is repayable on demand or within more than three months. The charges are 0.12225% if that loan is repayable in not more than three months.

Mentioned below is the Breakdown of Stamp Duty Rates in Haryana Differentiated According to Gender.

| JURISDICTION | MALE | FEMALE | JOINT |

| Urban area | 7% | 5% | 6% |

| Rural area | 5% | 3% | 4% |

Stamp Duty Property Registration Charges in Haryana

Before 2018, the flat registration charges levied by the Haryana government were ₹15,000. But, after 2018 the government increased the registration fee to ₹50,000. The new increased flat registration charges are now applicable on gift deeds, sale deeds, sale certificates, mortgage deeds, exchange deeds, settlement deeds, lease deeds, collaboration agreements, and partition deeds.

Documents Required for Property Registration in Haryana

- Sale deed

- Seller’s and buyer’s ID proofs

- Seller’s and buyers address proofs

- No-objection certificate from the society

- The ID proofs of two witnesses

- Building map, plan, etc.

- Proof of ownership (Certified copy of the assessment of MC or Mutation, Original old sale deed)

- Proof of Identification (Ration Card/Driving License/Voter ID/PAN Card)

- Digital photograph of the property

Stamp Duty Land Registration Fees in Haryana

The property registration charges/house registration charges and plot registration charges in Haryana are variable and depend on the usage and the area where the land is situated. The buyer needs to register the purchase of land within a period of four months after the purchase has been made, as per the rules of the Registration Act. Contrary to the other States, the stamp duty and registration fees in Haryana is a flat price which depends on the worth of the property. In other states the buyers are required to pay a registration fee of 1% of the property value. Have a look at the detailed table below to understand the property registration charges in Haryana.

| Property value | Registration charge |

| Up to ₹ 50,000 | Rs 100 |

| ₹ 50,001 to ₹ 5 lakhs | Rs 1,000 |

| ₹ 5 lakhs to ₹ 10 lakhs | Rs 5,000 |

| ₹ 10 lakhs to ₹ 20 lakhs | Rs 10,000 |

| ₹ 20 lakhs to Rs 25 lakhs | Rs 12,500 |

| Over a sum of ₹ 25 lakhs | Rs 15,000 |

How to Calculate the Stamp Duty Value of Property in Haryana?

The presence of the Internet has made it easier for buyers to calculate the stamp duty charge online. Ideally, the buyers have to pay the stamp duty based on their agreed transaction and laid out an agreement. The stamp duty is calculated based on the circle rate of the locality where the property is located. Usually, the property is registered at the value of the circle rate or a rate higher than the circle rate. So, if the house bought is being registered at a price higher than the circle rate then the buyer would have to pay the stamp duty on the higher rate. And, if the property is being registered at a lower rate then the stamp duty would be calculated according to the circle rates.

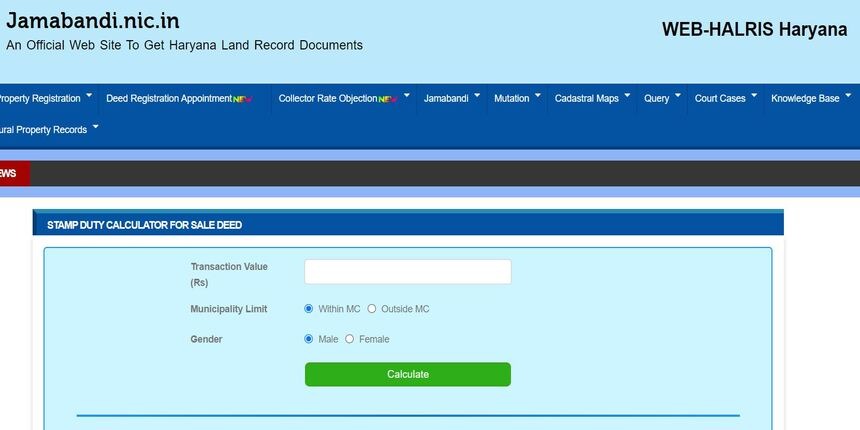

You can check and calculate the stamp duty charge on the Jamabandi Haryana website by following these simple steps.

Step 1: Open the stamp duty page of the Jamabandi web portal

Step 2: Enter the transaction value in the box in rupee

Step 3: You would then have to select your gender and municipality

Step 4: Click on calculate and your stamp duty & registration fee would show up.

After you have calculated the stamp fee, an e-stamp has to be obtained for the registration of the property.

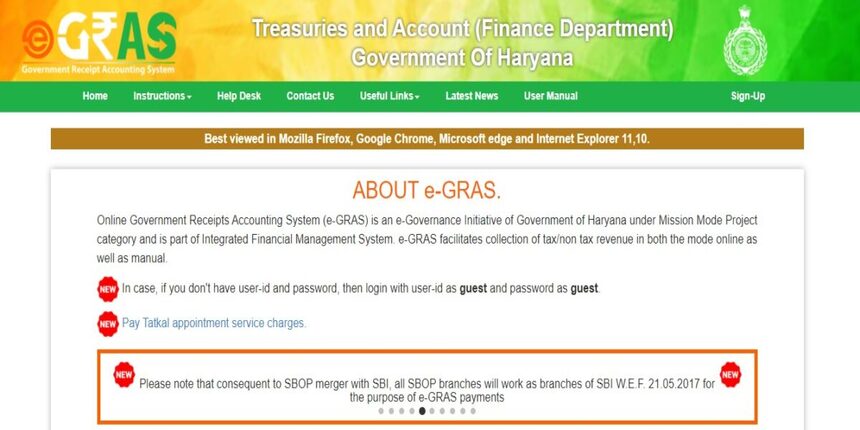

How to Procure e-stamp Online

The buyers have to buy an e-stamp for stamp duty registration. To avail of that e-stamp, visit the Online Government Receipts Accounting System (e-GRAS) platform. Through the e-GRAS platform, you will be able to facilitate the collection of non-tax/tax revenue in both the manual as well as online mode. Register yourself and you will be able to procure your e-stamp.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

How to Buy Stamps Offline

If you want to buy stamp papers offline, then you can purchase them at the treasury office. You can buy ₹10,000 worth or more of stamp papers. For that, you just need to deposit the amount in the State Bank of India (SBI) under the head, ‘0030-Stamp and Registration’.

How to Book a Slot for Property Registration in Haryana

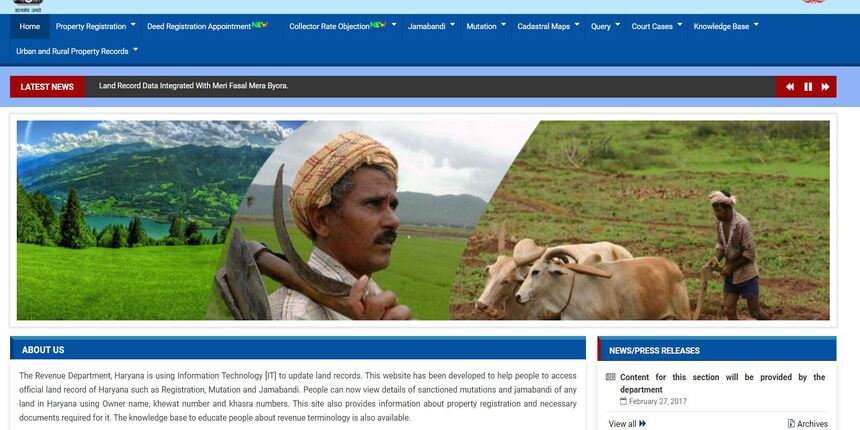

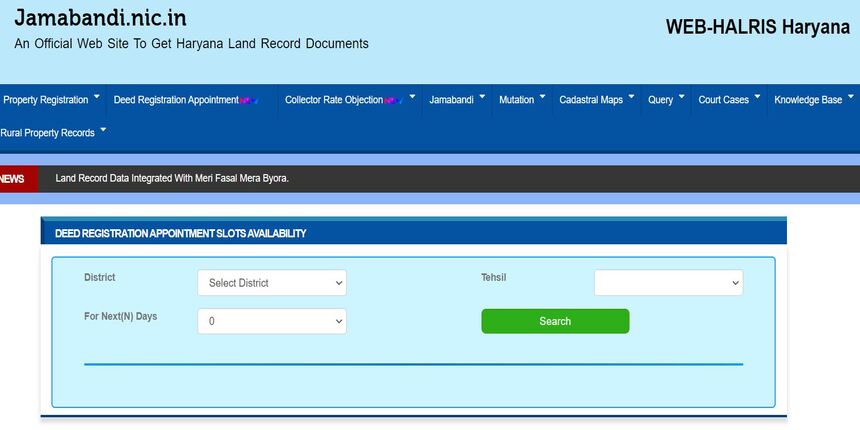

After the e-stamping, the buyer needs to book a slot for registering his property on the Jamabandi website. The appointment has to be booked at the Sub-Registrar’s office. Follow this easy procedure to book a slot:

Step 1: Head to the Jamabandi website and click on Property Registration. Select Check Deep Appointment Availability.

Step 2: Enter the details such as Tehsil, District, and For Next (N) Days. Now, click on search to check availability.

Step 3: You will now be able to make e-appointments for registration. You will need the E-Stamp details at the time of the online appointment. These details are to be filled in on the appointment slip.

Step 4: The seller, the buyer, and two witnesses need to go along to the Sub-Registrar office or the SRO office for the completion of the registration process on the day of the booked appointment.

Procedure for Registering a Deed

To register a deed in the state of Haryana, just follow these simple steps.

Step 1: Visit the Jamabandi website and download the desired deed.

Step 2: Fill in all the required details in the deed. (The deeds are available in both Word and PDF format)

Step 3: You will have to visit the Sub-Registrar office on the required date and time. The deeds will be forwarded to the Sub-Registrar.

Step 4: The deed will be marked by the Sub-Registrar. It will be filled into the HARIS and deed data. After this, the photograph of the buyer will be recorded by the system.

Step 5: While you are being registered in HARIS, the desk officer will update the details of the seller and buyer along with the E-Stamp number. The transaction fees will be updated. After your details are entered, the real-time photograph will be captured.

Step 6: After the deed is registered in HARIS, your biometric details would be obtained by the SRO Officer. He will regularize your deed.

Step 7: After the deed is regularized, the registry of the land will be printed with pictures of the buyer, seller, and witnesses, along with all the signatures.

Step 8: The copy of the registered deed would be provided to the parties. The same would also be uploaded to the Jamabandi web portal by the Tehsil Office.

You can also view the registered deed

Step 9: Visit the Jamabandi website to view your registered deed online.

Step 10: Head to the Jamabandi web portal. Select the option ‘view registered deed’ under the property registration menu.

Step 11: Enter your details like Tehsil, Registry Number, and more.

Step 12: Type in the captcha and press search. You will be able to see the details of your registered deed.

Recent Hike in Circle Rate in Haryana

Please note that there is planning by the Haryana government to introduce an additional 2% transfer charge on the properties related to resale for the year 2021. This hike in the circle rate would lead to an increase in the rate of the properties. The increase could be up to 80% in some areas of Gurgaon.

But, the announcement of this plan was not welcomed by the broker community and the developers of Haryana state. It would also be a setback for residential real estate. Additionally, it will also cause an interruption in the Ready-to-Move deals that are provided in Gurgaon.