Hyderabad’s housing market in India has demonstrated a continuous growth trend in value appreciation. One of the most populated metropolises in the country, Hyderabad’s property prices are as varied as its demography. Such a highly-populated city would organically see accelerating rates of property purchase. However, an important aspect to remember before finalising is that it involves stamp duty and registration rates in Hyderabad besides the property cost.

These charges will considerably increase the budget you’ve set for purchasing your house and can also differ from state to state. Stamp Duty and Property Registration are mandated under the Indian Stamp Act, 1899 to essentially confirm the property transaction and keep a record of the acquisition.

Table of contents

- What is Stamp Duty?

- Stamp Duty and Registration Charges in Hyderabad

- Registration Rates and Stamp Duty Value of Property in Hyderabad

- How Do You Calculate Stamp Duty Charges?

- How do I Pay Hyderabad’s Stamp Duty on Property Purchase?

- Gift Deed Stamp Duty in Hyderabad

- What Documents Do You Need for Property Registration Charges in Hyderabad?

- Aspects that Determine Stamp Duty Charges

- FAQ’s about Stamp Duty in Hyderabad

What is Stamp Duty?

Governments impose a charge known as stamp duty on legal papers, typically when assets or property are transferred. Documents required to legally record specific sorts of transactions are subject to stamp charges, usually referred to as stamp taxes, by governments. Legal records of weddings, military commissions, and the sale or transfer of property are included in this category. Similar to income tax, stamp duty is also collected by the government. A stamp duty is a paid document or instrument considered legal and can be admitted as evidence in courts. Documents that have not been properly stamped are not admissible as evidence by the court. Stamp Duty under Section 3 of the Indian Stamp Act, 1899 is payable and must be paid in full and on time. A penalty is levied if there’s a delay in the payment of stamp duty.

Stamp Duty and Registration Charges in Hyderabad

While purchasing a property, a salient factor to consider is the registration and stamp duty charges. The combination of Stamp Duty and Registration Charges increases your budget considerably, and they differ in different states. They are mandated primarily to validate the sale of the property and maintain a record of the purchase.

The stamp duty in Hyderabad and registration charges are mentioned in the table below:

| Type of Fee | Amount |

| Registration Fees | 0.5 percent of the property value |

| Stamp duty | 4 percent of the property value |

| Transfer duty | 1.5 percent on property value |

| Transfer and Stamp duty due on | Consideration or MV, whichever would be higher |

Registration Rates and Stamp Duty Value of Property in Hyderabad

It is a must for buyers to be aware of the stamp duty and registration rates in Hyderabad before proceeding to purchase a particular property since the amount can add significantly to the final price. Stamp duty remains the same throughout the state. Individuals need to pay a stamp duty worth 4% of the property value on all kinds of property purchases in Hyderabad. Besides, individuals also need to pay property registration charges in Hyderabad, applicable at 0.5% of the property value.

How Do You Calculate Stamp Duty Charges?

A person needs to calculate the stamp duty and registration rates in Hyderabad to calculate the final property price. Here is a simple example demonstrating the calculation process.

If a person plans to buy an apartment or a house worth Rs. 40 lakh, they would need to pay the stamp duty at 4%.

On top of that, the buyer also needs to pay 0.5% of the house registration charges in Hyderabad. Hence, the buyer must pay the stamp duty of 4% of Rs.40 lakh, which will be Rs.1.6 lakh.

Additionally, they will need to pay the plot registration charges, which will be 0.5% of Rs.40 lakh, which amounts to Rs.20,000. Hence, the person will incur an additional Rs. 1,80,000 as stamp duty and registration rates in Hyderabad on top of the original property price.

| Document | Registration Fees | Stamp Duty | Chargeable Value |

| Sale Deed (in Gram Panchayath) | 2.00 percent | 5.50 percent | Market Value (Or) Consideration Which Ever Is More |

| Sale Deed (in areas other than Gram Panchayat) | 0.50 percent | 5.50 percent | Market Value (Or) Consideration Which Ever Is More |

| Sale Agreement with Possession | 0.5 percent (Minimum Rs.1,000/-and Maximum 20,000/-) | 5.50 percent | Market Value (Or) Consideration Which Ever Is More |

| (5.50 percent Adjustable) | |||

| Sale Agreement Without Possession | 0.50 percent (Minimum Rs.1,000/-and Maximum 20,000/-) | 0.50 percent (not adjustable) | Market Value (Or) Consideration Which Ever Is More |

| Sale Contract with Power of Attorney General | 0.5 percent (Subject to a minimum Rs.5,000/- and maximum Rs.1 lakh/-) | 6.50 percent | Market Value (Or) Consideration Which Ever Is More |

| (5.50 percent Adjustable) | |||

| Conveyance | 0.50 percent | 5.00 percent | Market Value (Or) Consideration Which Ever Is More |

| Sale Certificate | 0.50 percent | 5.00 percent | Value Identical To The Amount Paid for It |

| Construction/Development Agreement plus GPA | 0.50 percent (subject to a minimum of Rs.5000/- and maximum of Rs.1 lakh/-) | 1.00 percent (not adjustable) | Whichever is More, the land value or the estimated cost of the proposed construction or development of the property |

| Agreement for Development and Construction | 0.5 percent (subject to a minimum of Rs.1000/- and maximum of Rs.20,000) | 0.50 percent (not adjustable) | Whichever is More, the expected cost or the land value of the proposed construction or development of the property. |

How do I Pay Hyderabad’s Stamp Duty on Property Purchase?

For the purpose of registering property, buyers of real estate can pay stamp duty and registration fees online. Here is a step-by-step tutorial on how to pay without fuss.

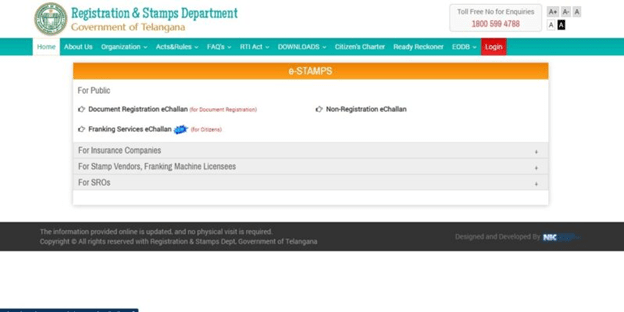

Step 1: Go to the Telangana Registration and Stamps department portal and look under the “Online Services” section for “E-payments.”

Step 2: A new page, registration[dot]telangana[dot]gov[dot]in/estamps.htm, will be opened for you to access. when three choices are presented to you are presented to you as:

- E-challan for document registration

- E-challan for non-registration

- Services e-challan for franking

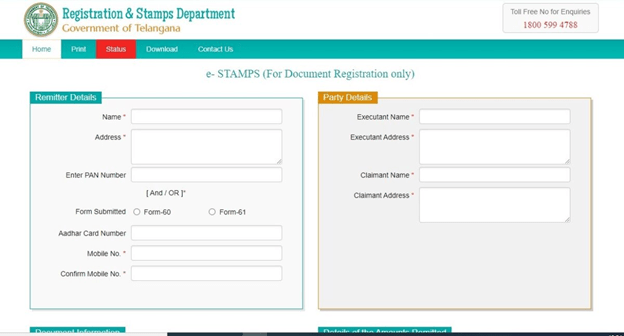

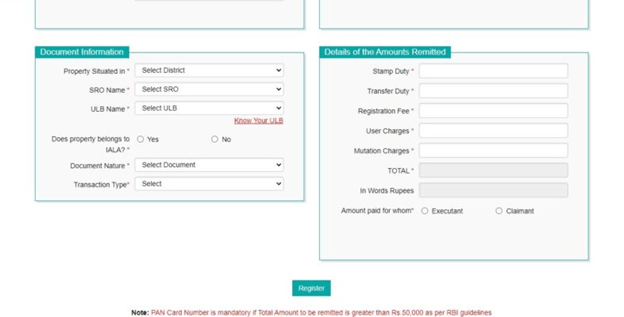

To register documents for property, select the first choice, enter the necessary information (including the remitter’s information, the party’s information, the document’s information, and the amount remitted), and then click the “register” button.

Step 3: Register your profile. You’ll receive an SMS with a 12-digit challan number and a five-digit passcode when you do this. Save this information for a future use.

Step 4: After signing up, go to the payment choice form to print the details of the challan number and passcode.

Step 5: After visiting the disclaimer page and accepting it, you will be led to SBI ePay, where you may choose to make your payment either online or offline.

Step 6: To make an online payment, choose NEFT, Net Banking, or a debit or credit card.

Step 7: The user receives a “successful” status message after inputting the payment credentials and providing the required information. The system will then generate a duplicate challan with the SBIePay confirmation reference number. During the property registration, the User must print the challan and deliver the SRO copy to the sub-registrar along with the required paperwork.

Please be aware that the Registration & Stamps Department does not license any intermediaries to conduct transactions relating to registration and stamp duty. The only person to whom you must directly pay the duties and fees related to the property is the SRO.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Mumbai | Stamp Duty in Mumbai |

| Goa | Stamp Duty in Goa |

| Kerala | Stamp Duty in Kerala |

| Punjab | Stamp Duty in Punjab |

| Jammu & Kashmir | Stamp Duty in Jammu & Kashmir |

| Noida | Stamp Duty in Noida |

| Rajasthan | Stamp Duty in Rajasthan |

| Chhattisgarh | Stamp Duty in Chhattisgarh |

| Bangalore | Stamp Duty in Bangalore |

| Gujarat | Stamp Duty in Gujarat |

| Jharkhand | Stamp Duty in Jharkhand |

Gift Deed Stamp Duty in Hyderabad

To gift a property, it must first be approved by the Income Tax Act or the government. The stamp duty charges for such cases are 1%, the transfer duty will be 0.5%, and the gift deed registration charges in Hyderabad are 0.5% (minimum is Rs 1000 and maximum is Rs 10,000) of the higher market value or consideration of the property.

In case of any other gift, Hyderabad’s stamp duty rate is 4%, the transfer duty is 1.5%, and the gift deed registration charges are 0.5% (minimum is Rs 1000 and max is Rs 10000) of the higher market value or consideration of the property.

What Documents Do You Need for Property Registration Charges in Hyderabad?

The list mentioned below is of documents that one needs to be present at the sub-registrar’s office to register their Hyderabad property. However, please note that the list is only indicative and not exhaustive. The sub-registrar may or may not demand a few more documents.

- Authentic property documents.

- Encumbrance Certificate.

- Stamp duty payments can be made by bank challan or demand draught.

- Executors and witnesses in photo form under Section 32A.

- Proof of the buyer, seller, and two witnesses’ names and addresses.

- Power of attorney.

Aspects that Determine Stamp Duty Charges

Age of the Property

The age of the property in question is a major factor in determining the stamp duty costs because it is determined by the overall value of the property or residence. The cost of new homes is typically higher than the cost of older homes. Because of this, newer homes will pay more in stamp duty than older ones.

Age of the Owner of the Property

Senior citizens occasionally receive a stamp duty discount, although this only happens under certain circumstances. Some states reduce the stamp fee they levy to seniors. This is precisely the reason why a property owner’s age plays a crucial role in determining the amount of stamp duty that must be paid.

The Property Owner’s Gender

Men typically pay a larger stamp duty value of property fee than women do in most states. Women receive reduced stamp duty rates, and men frequently pay rates that are around 2% more than those paid by women.

Description of the Property

Residential homes often incur lower stamp duty fees than commercial assets, according to widespread observation. Commercial properties have much more amenity needs than residential ones, hence their stamp duty costs are higher. Charges for flat and plot registration, for instance, will differ from those for commercial property.

Where the Property Is Located

Different locations are subject to various stamp duty rates. For example, a property located in an urban location will be subject to a higher stamp duty rate than a property located in a rural or suburban area.

Amenities

The numerous amenities that are offered in a home or property have an impact on how much stamp duty a person must pay. A property would incur a smaller stamp duty fee if it had fewer amenities, and a larger one if it had more amenities. A higher stamp duty fee will be charged for amenities including gyms, elevators, sports fields, swimming pools, and libraries, among others.

Summing Up

Payment of stamp duty and registration rates in Jharkhand is an important part of the conclusion for purchasing a property in Hyderabad or any other city in India. Leniency in making these payments may make your property registration incomplete and offer no protection against legal disputes in the future.

FAQ’s about Stamp Duty in Hyderabad

Q1. What are the stamp duty and registration rates in Hyderabad?

Buyers have to pay a stamp duty of 4%and registration charges of 0.5% of the property value as per registration rates in Hyderabad.

Q2. Are stamp duty charges refundable?

No, unfortunately, stamp duty charges aren’t refundable.

Q3. Can I claim stamp duty as a tax deduction?

That is indeed possible. Under Section 80C of the Income Tax Act, up to Rs. 1,50,000, stamp duty may be claimed as tax-deductible.

Q4. Is GST included in stamp duty?

Stamp Duty and GST are separate taxes levied on the sale of properties and are not related to each other in any shape or form.