Jharkhand is one of India’s richest mineral zones. It also offers incredible real estate investment opportunities as a state known for producing uranium, coking coal, and pyrite. From residential properties to commercial, there is no shortage of properties to purchase here. However, before investing in a property, you must know the stamp duty and registration fee attached.

Stamp duty is the tax charged on legal documents, generally when transferring property or assets. With these taxes, the government confirms a buyer’s ownership of the property or asset and funds their activities.

To know about the latest stamp duty and registration rates in Jharkhand, scroll down to read more.

Table of contents

- Jharkhand Stamp Duty on Property and Registration Charges

- Stamp Duty Rates in Jharkhand for Different Instruments

- Gift Deed Stamp Duty in Jharkhand

- Significance of Jharkhand Land/Plot Registration Charges

- Documents Required for Property Registration in Jharkhand

- Stamp Duty Calculator to Calculate Stamp Duty Charge in Jharkhand

- How to Pay Stamp Duty in Jharkhand?

- How to Obtain an E-Stamp Online?

- How to Check Slots Availability for Deed Registration Appointment?

- How to Register a Deed?

- FAQ’s about Stamp Duty in Jharkhand

Jharkhand Stamp Duty on Property and Registration Charges

Buying a property in Jharkhand requires paying 7% of the deal value as stamp duty and registration charges. For instance, if the value of the property is 50 lakhs, you (the buyer) will be required to pay 3.50 lakhs as stamp duty and registration fees.

For further clarity on Jharkhand stamp duty value of property, take a look at the table below.

| Property Registered in the Name of | Stamp Duty | Registration Charges |

| Men | 4% | 3% |

| Women | 4% | 3% |

| Joint | 4% | 3% |

| Joint (Male + Female) | 4% | 3% |

| Joint (Male + Male) | 4% | 3% |

| Joint (Female + Female) | 4% | 3% |

NOTE: The government rolled back the waiver offered to women on Jharkhand stamp duty value of property. Previously, women were to pay only ₹1 as a token amount to register properties worth up to 50 lakhs. This waiver, however, led to the government facing heavy losses. Due to this, the government decided to roll back the scheme in 2020.

Stamp Duty Rates in Jharkhand for Different Instruments

The stamp duty is set by the state government. It is the percentage of the transaction value for every registered sale. The table below displays the registration fees and stamp duty in Jharkhand for different instruments.

| Instrument Description | Stamp Duty Charge | Registration Fee |

| Adoption Deed | ₹42 | ₹1000 |

| Agreement | ₹3.50 | ₹1000 |

Bond

|

|

3% of the bond’s value |

| Conveyance (Sale Deed) | 4% of the document’s value | 3% of the document’s value |

| Mortgage | 4.2% of the deed’s value. | 2% of the deed’s value. |

| Partition | The same duty as a bond. | 3% of the deed’s value. |

| Partnership Deed | ₹42 | ₹1,000 |

| Trust(Declaration of) | ₹47.25 | ₹1,000 |

| Power of Attorney. | ₹31.50. | ₹1,000 |

| Will | N.A | ₹1,200 |

NOTE: Along with home or flat registration charges in Jharkhand, ₹30 as service provider fees is charged on each page of the document.

Gift Deed Stamp Duty in Jharkhand

According to Section 122 of the Transfer of Property Act, 1882, gifting is the act of voluntarily transferring existing property or assets (whether movable or immovable) by the donor (gift giver) to the donee (recipient) without any considerations.

The stamp duty charge for a gift deed in Jharkhand is calculated based on the gift value. There are three circumstances:

- If the value of the gift does not exceed ₹1000, the stamp duty is ₹31.50.

- When the value of the gift exceeds ₹1000 but is not more than ₹10,000, the stamp duty to be paid is ₹31.50 for the first ₹1,000. Additionally, ₹21 for every ₹500 or part thereof by which the value exceeds ₹1,000.

- When the value of the gift exceeds ₹10,000, the stamp duty to be paid is ₹31.50 for every ₹500.

Significance of Jharkhand Land/Plot Registration Charges

Paying stamp duty or property registration charges in Jharkhand is vital. Here’s why it’s important:

- Provides documents to validate the ownership of the property

- Helps to prevent fraud and conserve evidence

- Helps in keeping public records related to property registration up to date

- Provides security of title deeds and acts as proof in case the original documents are lost or damaged.

Documents Required for Property Registration in Jharkhand

To register a property, you have to pay property registration charges in Jharkhand, fill out an application, and attach a set of documents. The documents necessary for the property registration in Jharkhand are as follows:

- Proof of identity – documents like the Aadhaar Card, PAN Card, driving license or passport of the parties

- The Assessment Slip comprises the market value along with stamp duty and registration charges

- PAN Card or a duly filled and signed form 60 with ID and address proof of the parties

- Passport-size photos of the parties (whose names the property is registered under)

- Particulars on stamp duty and registration charges

Stamp Duty Calculator to Calculate Stamp Duty Charge in Jharkhand

Stamp duty and House registration charges in Jharkhand are paid on the overall value of the property. This value cannot be less than the government-authorized rates revised periodically. Stamp duty is calculated on whichever amount is the higher of the two:

- The purchase value of the property,

- The average value as per the government-set price

Let’s understand this with an example. If you buy a 1,500-sq ft plot for ₹1000 per square foot, you won’t be able to register it for less than ₹15 lakhs. Even if the seller is ready to sell it for ₹13 or 14 lakhs, its sale value won’t be registered below ₹15 lakhs. But if the seller keeps the selling price of the same property at ₹20 lakhs, you’ll have to get it registered at that value.

You can calculate stamp duty by using a stamp duty calculator Jharkhand as well.

In any event, you will have to pay 7% of the total amount as stamp duty and registration fee in Jharkhand. For more details, you can visit regd[dot]jharkhand[dot]gov[dot]in/jars/website.

How to Pay Stamp Duty in Jharkhand?

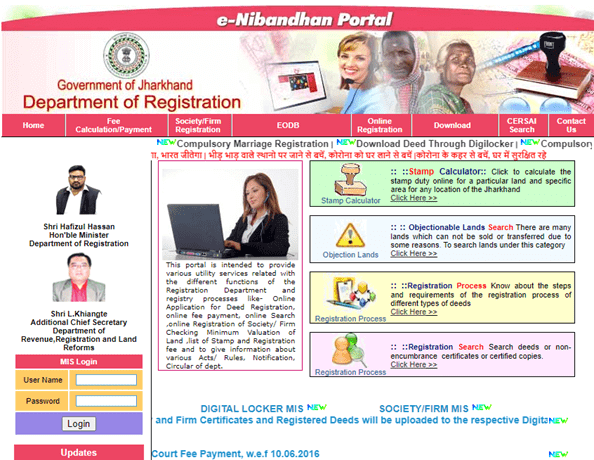

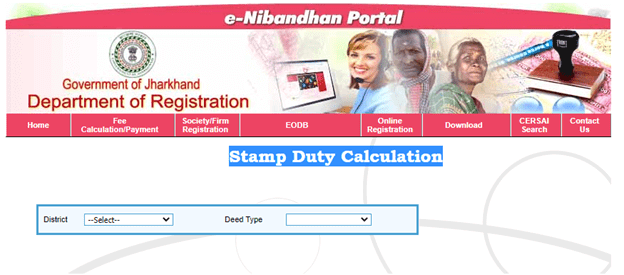

To calculate stamp duty in Jharkhand, you can use the official e-Nibhandhan website. Follow these simple steps:

Step 1: Go to http://regd[dot]jharkhand[dot]gov[dot]in/jars/website/ and click on the Stamp Duty Calculator from the home page.

Step 2: A new page will open. Here, you have to choose your district and deed type.

Step 3: Type in all the details related to the deed and click on the ‘Add’ option to calculate your stamp duty charge successfully.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Goa | Stamp Duty in Goa |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Delhi | Stamp Duty in Delhi |

| Noida | Stamp Duty in Noida |

| Andhra Pradesh | Stamp Duty in Andhra Pradesh |

| Mumbai | Stamp Duty in Mumbai |

| Bangalore | Stamp Duty in Bangalore |

| Assam | Stamp Duty in Assam |

| Pune | Stamp Duty in Pune |

How to Obtain an E-Stamp Online?

After calculating stamp duty and plot registration charges in Jharkhand, you need to obtain an e-stamp online. A lot of people either forget or get confused about this step. Our goal is to prevent that from happening to you, so please follow the guidelines below:

Step 1: Visit the official Stock Holding Corporation of India website: www[dot]shcilestamp[dot]com

Step 2: Fill up the registration form and login

Step 3: Choose your state and then select your nearest SHCIL Branch

Step 4: Fill out the other essential fields

Step 5: Once done, you will receive a reference receipt number

Step 6: Use this number to print a copy of your e-stamp certificate from a SHCIL branch near you.

How to Check Slots Availability for Deed Registration Appointment?

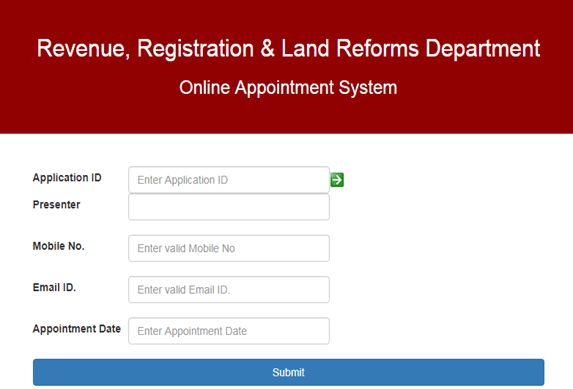

You need to book an online appointment after registering your property in Jharkhand. The procedure for that is as follows:

Step 1: Visit the e-Nibandhan portal to check slot availability.

Step 2: Open the online appointment system page. Enter details like – application ID, mobile number, email address, and presenter. Then type an appointment date that suits your schedule.

Step 3: Lastly, click on the ‘Submit’ button to confirm your appointment.

How to Register a Deed?

To register a property in Jharkhand, you need to register yourself at the ‘e-Nibandhan’ portal first.

User Registration Process

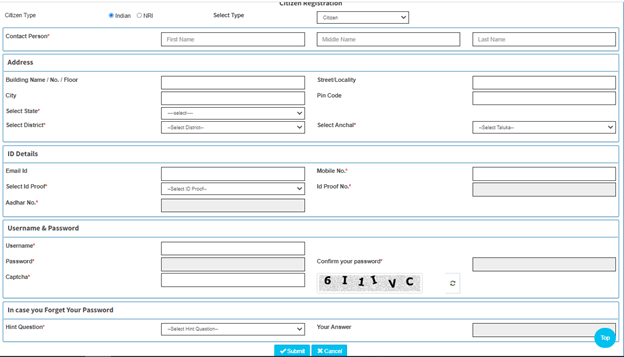

Step 1: Visit the e-Nibandhan portal, and click on the ‘Online Registration’ option from the top menu.

Step 2: From the drop-down menu, choose the ‘Pre-Registration’ option and wait for a new page to open.

Step 3: The National Generic Document Registration System website will open. Here, click on the ‘Register’ button right below the ‘Citizen’ section.

Step 4: A registration form will open on your screen.

Step 5: Enter all the essential fields in the field and click on ‘Submit.’

Online Application

Step 6: After successful submission, you must choose ‘Application Type’ and click on the ‘Proceed for the Online Application’ option.

Step 7: As soon as the new page opens, choose ‘SRO’ and click on the ‘Next’ button.

Jharkhand-Property-Registration-Application-Type

Documents

Step 8: Enter all the required document details, including the deed type and party category.

Step 9: Now, enter the property’s stamp value.

Step 10: Cross-check all the details and click on the ‘Next’ button.

Details of the Parties

Step 11: A new page asking for party details will be displayed on your screen. Here, you will have to enter the party’s details like name, address, occupation, PAN/Form 60, etc.

Step 12: Make sure you provide all the correct details. Then click on the ‘Next’ button.

Wrapping Up

Payment of stamp duty and plot registration charges in Jharkhand is a crucial step for completing property registration in Jharkhand. Overlooking these payments may result in incomplete property registration or legal disputes in the future.

You can pay Jharkhand land/plot registration charges and stamp duty in two ways – online or offline. The offline procedure will require you to visit the registration counter, while the online method requires you to follow simple instructions. In the event of more questions or concerns, we suggest you look at the FAQ section below.

FAQ’s about Stamp Duty in Jharkhand

Q1. What are the house registration charges in Jharkhand?

The property house registration charges in Jharkhand are 3% of the property’s value.

Q2. What is the stamp duty for gift deed in Jharkhand?

The stamp duty for a gift deed in Jharkhand depends on the gift value. For example, the stamp duty charge is ₹31.50 if the gift’s value does not exceed ₹1,000.

Q3. How can I get stamp paper in Jharkhand?

To get a stamp paper in Jharkhand, you need to visit your nearest stamp vendor or Court.