The property purchasers need to pay the stamp duty and registration charges in Odisha to the revenue department for all possessions associated with the agreement. The registration charges and stamp duty vary from one state to another. Additionally, the plot registration charges in Odisha are also different from house registration charges and flat registration charges in Odisha. As per the latest reports, the Government of Odisha charges 7 percent stamp duty.

Factors Affecting Stamp Duty in Odisha 2021

It is compulsory for every individual to make payment for stamp duty. It is done for settling one’s property ownership.

Factors that affect stamp duty charges in Odisha in 2021 are as follows:

- The market value of the property when purchased

- Type of property

- Size of the property

- Location and area where the property is located.

- The owner’s gender

- The owner’s age

- Commercial or residential status

Stamp Duty and Registration Charges in Odisha

“The direct tax charged by the government when there is a property transaction is known as ‘stamp duty. It is charged on both residential and commercial property agreements, along with leasehold or freehold properties. As stamp duty is charged as per state, therefore the rate also varies all over the country. The stamp duty on property registration for men is 5% with 1% a registration charge on the market value of the property, whereas the stamp duty on property registration for women is 4% with 1% registration charge on the market value of the property.”

Property Registration Charges in Odisha

In Odisha, property buyers must register the sale of a property with the Stamp Duty Registration Department. This means the presence of both the parties at the sub-registrar’s office is mandatory to pay the stamp duty and registration charges in Odisha. The Odisha Registration Department is responsible for a variety of government services, such as property registration, Odisha land registration charges, Odisha stamp duty rates, marriage registration, partnership deed registration, gift deed registration charges, and many more.

Documents Required for Property Registration Charges in Odisha

Below are the documents required for property registration charges in Odisha –

- Property records in their original form, signed by all parties

- Property Card

- The buyer, seller, and witnesses must all provide verification of their identities and addresses (Aadhaar Card and PAN Card)

- Encumbrance Certificate

- Power of Attorney

- Two reliable witnesses who will verify the parties as well as identity cards with their images

- Pictures of the buyer and seller

- A pattadar passbook is crucial in the context of agricultural land

- Photocopy of Section 32A

- An outside shot of the property

- GPA /SPA, if any in original and its Photostat copy

- Link documents copies

- Web land copy in context of agricultural land

- Payment receipt for stamp duty and registration charges

You Might Also Like to Read: IGR Odisha

How to Calculate Stamp Duty Registration Charges in Odisha?

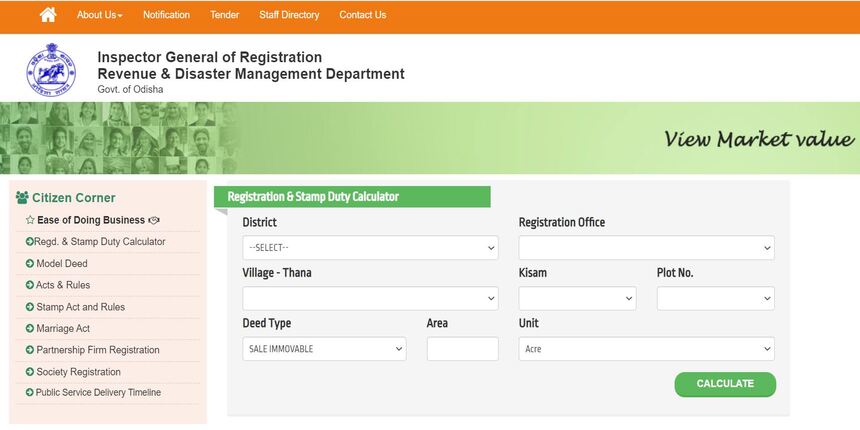

These are the step-by-step methods to use the stamp duty calculator to compute the transactions in Odisha.

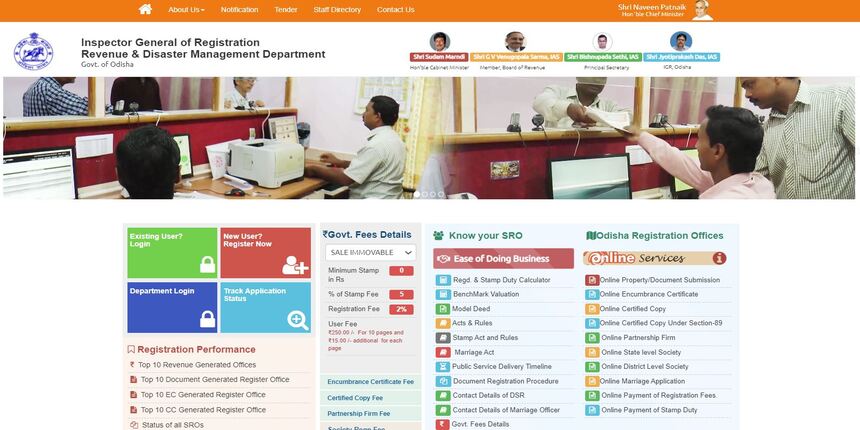

Step 1: Visit the official homepage of the Odisha Revenue Department Portal.

Step 2: Tap on the citizen corner for the option of Stamp Duty and Registration Calculator.

Step 3: Fill in the mandatory information such as the district or village and the registration office from the given dropdown.

Step 4: Next, you need to provide the plot number allotted to you.

Step 5: Tap on the ‘Search Button’.

Step 6: You will now be able to see the stamp duty charge for your particular property on your screen.

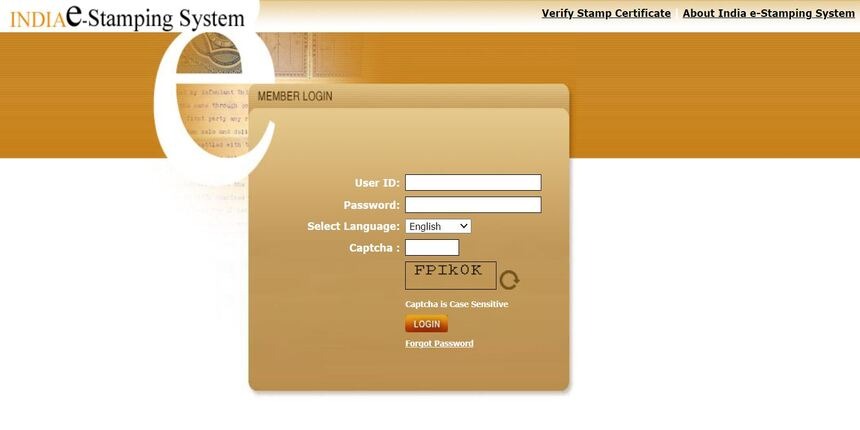

Another method that can be used for payment of your stamp duty and registration charge is through the SHCIL portal i.e. the agency allotted by the government for your e-stamping.

Stamp Duty Rates in Odisha

| Category | Stamp Duty Charges in Odisha |

| Male | 5% |

| Female | 4 % |

| Others | 5 % |

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

What is E-Stamping?

A buyer for each transaction is supposed to pay the stamp duty. This is done to complete the settlement. Earlier, it was made necessary for the purchaser to be present in the registrar’s office to complete their property registration. But now they have a facility to complete the same through an online portal. The process of completing the transaction through the online portal is called e-stamping or in other words online stamping.

Stamp Duty Online Payment for E-Stamping

“These are the step-by-step methods that can easily help you in paying your stamp duty for e-stamping:

Step 1: In case you are new to the SHCIL portal, simply tap on the ‘Register Now’ tab and proceed further.

Step 2: Fill up all the necessary information.

Step 3: Select your user ID and password along with filing the security questions asked, next fill up your bank details, and move forward.

Step 4: Once you are done selecting your user ID and password, you can now log in using the same.

Step 5: Choose the state from the given drop down for which you require to pay the stamp duty.

E.g.: If it’s for Uttar Pradesh, you will select the same from the drop-down and then further choose the ‘Nearest SHCIL Branch’ after which you are required to fill in some details such as:

⮚ First Party Name

⮚ Second Party Name

⮚ Article Number

⮚ The name of the person who paid the stamp duty.

⮚ The amount of the stamp duty

All the above details need to be filed accurately in order to generate your ‘Online Reference Acknowledgement Number’.”

This is done to pay any kind of amount through modes of Net Banking, RTGS, Debit Card, EFT, and NEFT.

Step 6: A citizen is then required to print this ‘Online Reference Acknowledgment Number’ and pay a visit to his/her most accessible SHCIL Branch to get its final copy of the e-stamp certificate.

Flat Registration Charges in Odisha

“Flat Registration Charges in Odisha for a property are dependent on various factors, one of the most important factors out of which is the type of property that one is purchasing. The purchaser is then required to pay the stamp duty and registration charges in Odisha to the concerned department. The flat registration charge in Odisha on the property for men is 5% and for women is 4%.”

Services Provided on Odisha Portal

There are various services that the IGR Odisha has come up with to make the job of homeowners easy:

⮚ Land Records of the Owners Property

⮚ Sale deed structure for Odisha property registration.

⮚ Provides with e-stamping certification.

⮚ Stamp Duty Charge Calculator

Gift Deed Stamp Duty in Odisha

| S. No | Type of the Deed | Deed- Subtypes | E-Registration Service Charge |

| 1 | Sale of immovable property | Sale | 200 |

| Cancellation of Sale by Executants | 200 | ||

| Cancellation of Sale by both Parties | 200 | ||

| Rectification for one error | 100 | ||

| Rectification for more than an error | 200 | ||

| 2 | Sale of Movable property | Sale | 200 |

| Cancellation of Sale by Executants | 200 | ||

| Cancellation of Sale both Parties | 200 | ||

| Rectification for one error | 100 | ||

| Rectification for more than an error | 200 | ||

| 3 | Conveyance | Conveyance by the government | 200 |

| Cancellation of Conveyance through the government by the Executants | 200 | ||

| Cancellation of Conveyance through the government by both the parties | 200 | ||

| Rectification of Conveyance | 100 | ||

| 4 | Adoption | Adoption without any consent | 200 |

| Adoption with a consent | 200 | ||

| Cancellation of Adoption | 200 | ||

| Adoption with Property | 200 | ||

| 5 | Gift Immovable Property | Gift | 2()0 |

| Cancellation of gifts | 200 | ||

| Cancellation of gifts by both the parties | 200 | ||

| A gift to the government | Exempted | ||

| 6 | Gift Movable Property | Gift | 200 |

| Cancellation of gift by the Executants | *Rev | ||

| Cancellation of gifts by both the part les | 200 | ||

| Giving gifts to the government | Exempted. | ||

| 7 | Partition of Immovable Property | Partition on an equal share | 200 |

| Partition on an unequal share | 200 | ||

| 8 | Partition of Movable Property | Partition on an equal share | N/A |

| Partition on an unequal share | 200 | ||

| 9 | Rent Reserved on Lease | Lease period less than 1 year | 100 |

| Lease period between 1 to 5 years | 100 | ||

| Lease period between 5 to 10 years | 200 | ||

| Lease period between 10 to 20 years | 200 | ||

| Lease period between 20 to 3tyears | 200 | ||

| Lease period between 30 to 100 years. | 200 | ||

| Above 100 years | 200 | ||

| Indefinite period | 200 | ||

| 10 | Lease with advance Payment only | Only advance payment | 200 |

| In case the rent has been paid in advance | 200 | ||

| 11 | Lease in Advance along with the rent | Lease period of less than 1 year along with Rent and advance | 100 |

| Lease period of less than 1-5 years along with rent and advance | 100 | ||

| Lease period of less than 5 to 10 years along with rent and advance | 100 | ||

| Lease period of less than 10 to 20 years along with rent and advance | 200 | ||

| Lease period of less than 20 to 30 years along with rent and advance | 200 | ||

| Lease period of less than 30 to 100 years along with rent and advance | 200 | ||

| Above 100 years along with Rent and Advance | 200 | ||

| Indefinite period along with Rent and Advance | 200 | ||

| Surrender of the lease | 100 | ||

| Cancellation of the lease | 100 | ||

| 12 | Power of Attorney | General POA without the property | 200 |

| General POA with A property without any possession of fewer than 6 persons | 200 | ||

| General POA with A property without any possession of 6 or more individuals | 200 | ||

| Giving Power of Attorney to one or more people for a single dealing | 200 | ||

| POA with a possession | 200 | ||

| Cancellation of POA | 200 | ||

| Power of Attorney with an authentication | 100 | ||

| 13 | Partnership | If the partnership is less than INR 500 as capital | 50 |

| If the Partnership is more than INR 500 as capital | 200 | ||

| Dissolution of partnership | 100 | ||

| 14 | Trust | Declaration of the Trust | 200 |

| Trust with the property | 200 | ||

| Revocation of the Trust | 200 | ||

| 15 | Will | Will | 200 |

| Cancellation of the Will | 100 | ||

| Sealed Cover of the Will | 50 | ||

| Opening the Sealed Cover of the Will | 50 | ||

| 16 | Bond | Bond | 200 |

| Bond of Administrative | 200 | ||

| Bond of Administrative with the property | 200 | ||

| Bond Bottomry | 200 | ||

| Bond Bottomry with the property | 200 | ||

| Bond of Customs | 200 | ||

| Bond of Customs with the property | 200 | ||

| Bond of Indemnity | 50 | ||

| Bond of Indemnity with the property | 50 | ||

| Bond of Respondentia | 50 | ||

| Bond of Respondentia with the property | 51 | ||

| Bond of Security | 50 | ||

| Bond of Security with the Property | 50 | ||

| l7 | Agreement | Agreement without any property | 200 |

| Agreement with the property | 100 | ||

| Cancellation of the Agreement | 100 | ||

| Agreement of sale with a possession | 500 | ||

| Agreement of sale without any possession | 100 | ||

| 18 | Affidavit | Affidavit | 50 |

| 19 | Divorce | Divorce without any property | 200 |

| Divorce with a property | 200 | ||

| 20 | Exchange | Exchange of the property | 200 |

| 21 | Release | Release of the property till 1000 | 100 |

| Other Cases apart mentioned above | 200 | ||

| 22 | Settlement | Settlement | 200 |

| Revocation of the Settlement | 100 | ||

| Mortgage | 200 | ||

| 23 | Mortgage | Mortgage with a possession | 200 |

| Mortgage without any possession | 200 | ||

| Cancellation of the Mortgage | 100 | ||

| Mortgage to the Government | Exempted | ||

| Reconveyance of the Mortgage | 50 | ||

| 24 | Counterpart | Counterpart | 200 |

FAQ’s about Stamp Duty in Odisha

Q1. What is the stamp duty for power of attorney in Odisha?

The stamp duty for Power of Attorney in Odisha is 2% of the property’s value.

Q2. What is the stamp paper duty in Odisha?

The stamp paper duty in Odisha is 5% of the property’s value.

Q3. How do I pay stamp duty and registration fees in Odisha?

An individual can pay its stamp duty and registration fee Odisha through the official website or portal of Odisha or through e-stamping by using the SHCIL portal or even through Nationalised banks.