In Telangana, as in other regions of India, stamp duty and property registration fees are important considerations when buying real estate. These legal requirements are necessary to validate the sale in government records and guarantee the formal transfer of property title. The state government levies stamp duty, a tax on the property's transaction value, and registration fees, which are related to the expenses of recording the transaction in official records.

The valuation, location, kind (commercial or residential), and other pertinent aspects of the property are considered while calculating Telangana's stamp duty and registration fees. The state government's policy goals and current market conditions are considered while adjusting the rates regularly. In addition to being required by law, paying these fees is a crucial first step towards establishing one's ownership rights over the property.

The sale deed must be drafted and signed, the appropriate stamp duty and registration fees must be paid, and the required paperwork must be turned in to the local registrar's office. Once the deed is registered, the buyer is acknowledged as the new legal owner

Property Registration Documentation Requirement

The Telangana Government has implemented an entire online property registration system. Before going to the Registrar's office, the applicant must use the Public Data Entry system to upload the transaction's data as well as the relevant documents. After submitting the documents, the user can pay using the online portal and schedule a time to complete the property registration requirements in the Registrar's office. Lastly, the applicant must appear at the concerned office on the scheduled date and time to finish the property registration procedure.

Given below are some of the documents to be submitted:

- Property records in their original form, signed by all parties

- Property Card

- The buyer, seller, and witnesses must all provide verification of their identities and addresses (Aadhaar Card and Pan Card)

- Encumbrance Certificate

- Power of Attorney

- Two reliable witnesses who will verify the parties, as well as identity cards with their images

- Pictures of the Buyer and Seller

- A pattadar passbook is crucial in the context of agricultural land

- Photocopy of Section 32A

- An outside shot of the property

- GPA /SPA, if any in original and its Photostat copy

- Link documents copies

- Webland copy in context of agricultural land

- Payment receipt for stamp duty and registration charges

Within 24 hours, the sale deed, lease deed, agreement, and other documents should be registered with the sub-registrar’s office. The parties will get back these documents when they have been scanned and certified. The junior or senior assistant will issue the encumbrance certificate within one hour. You may also seek market value to learn about property rates in a certain area. Again, within an hour, the market value data will be delivered.

Property Registration Charges in Telangana

Registration determines the registration costs and stamp duty in Telangana. The stamp duty charges are determined based on the property's market value. As a result, it changes depending on the property's location.It is also important for the users to note that the

Other expenses include Encumbrance Certificate fees and expenses for document preparation.

If you wish to purchase a property in, let’s say, Hyderabad, the Telangana government will charge you stamp duty and registration charges. So, before applying for a home loan, it's a good idea to learn about the present stamp duty charges and property registration fees. In Hyderabad, stamp duty is now imposed at a rate of 4%.

Flat Registration Charges in Telangana

| Documents | Stamp Duty in Telangana | Flat Registration Charge in Telangana | Transfer Charges |

| Sale agreement with possession | 4% | 0.5 % of the property's total worth (minimum INR 5,000, maximum INR 20,000) | NIL |

| Sale agreement without possession | 0.5% | 0.5 % of the property's total worth (minimum INR 5,000, maximum INR 20,000) | NIL |

| Sale agreement and GPA | 5% | INR 2,000 | NIL |

| Will | NIL | INR 1,000 | NIL |

| Sale of semi furnished flat | 4% | 0.5% | 1.5% |

For instance, a property in Hyderabad costs 4,000 INR per square foot in a certain neighbourhood.

Let's assume Mr. Anand paid Rs. 4,000 per square foot for a 1000 square foot property in Hyderabad.

The property's estimated worth is Rs.40,00,000 (Rs.4,000 times 1000).

The property's stamp duty is Rs.1,60,000 (4 percent of the market value Rs.40,00,000)

The property's registration fee is Rs.20,000 (0.5 percent of the saleable value of Rs.40,00,000).

Rs.1,80,000 (Rs.1,60,000 + Rs.20,000) is the total registration and stamp fee.

As a result, Mr. Anand would have to spend a total of Rs.41,80,000 to own the property (Rs.40,00,000 + Rs.1,80,000).

Stamp Duty and Registration Charges in Telangana

| Document | Stamp duty in Telangana | Transfer duty | Registration charges |

| Immovable Property Sale(Consisting of corporations, special grade administration & selection grade) | 4% | 1.5% | 0.5% |

| Immovable Property Sale(Covering all other areas) | 4% | 1.5% | 0.5% |

| Semi-Furnished Flats & Apartments | 4% | 1.5% | 0.5% |

| Sale agreement along with GPA | 5% (where 4% is adjustable & 1% non- adjustable) | 0% | INR 2,000 |

| Sale agreement along with possession | 4% | 0% | 0.5% (based on minimum amount of INR 1,000 & maximum limit of INR 20,000) |

| Sale agreement eliminating possession | 0.5% (non-adjustable) | 0% | 0.5% (based on minimum amount of INR 1,000 & maximum limit of INR 20,000) |

Stamp Duty Charges for Settlement, Property Partition & Gift Deed Charges in Telangana

| Document | Stamp Duty Charges in Telangana | Transfer Charges | Registration Charges |

| Partition amongst the family members | 0.5% on the VSS, based on a maximum limit of INR 20,000 | 0% | INR 1,000 |

| Partition amongst the co-owners (non-family members) | 1% on the VSS | 0% | INR 1,000 |

| Settlement amongst the family members | 1% | 0% | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of INR 10,000) |

| Settlement amongst (non-family members) | 2% | 0% | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of INR 10,000) |

| Charitable Settlement | 1% | 0% | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of INR 10,000)) |

| Gifts for Relatives | 1% | 0.50% | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of INR 10,000) |

| Gifts for other purposes | 4% | 1.50% | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of INR 10,000) |

Stamp Duty and Registration Charges in Other States

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Bihar | Stamp Duty in Bihar |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

| Punjab | Stamp Duty in Punjab |

| Odisha | Stamp Duty in Odisha |

| Karnataka | Stamp Duty in Karnataka |

Stamp Duty Charges in Telangana for Power of Attorney & Will

| Document | Stamp duty Charges in Telangana | Transfer charges | Registration Charges |

| General power of attorney- That authorises the family members to transfer, develop immovable property & sell | INR 1,000 | 0 | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of Rs 20,000) |

| General power of attorney- That authorises an agent or any other individual to sell, transfer & develop the immovable property | 1% | 0 | 0.5% (based on the minimum amount of INR 1,000 & maximum limit of Rs 20,000) |

| General power of attorney- for another purpose apart from authorising an agent or any other individual to sell, to transfer & develop the immovable property | INR 50 | 0 | INR 1,000 |

| Special power of attorney | INR 20 | 0 | INR 1,000 for the purpose of attestation |

| Will | 0 | 0 | INR 1,000 |

House Registration Charges in Telangana

Telangana’s house registration charges have been fixed by the government as follows:

Stamp Charge in Telangana : 4% (according the property’s market value)

In case there is a new home buyer then they will be required to pay 0.5% charge as a part of its registration charge & 1.5% as the transfer duty.

Calculation of Stamp Duty and Registration Charges in Telangana

Using the procedures listed below, property purchasers may simply determine stamp duty and registration charges in Telangana:

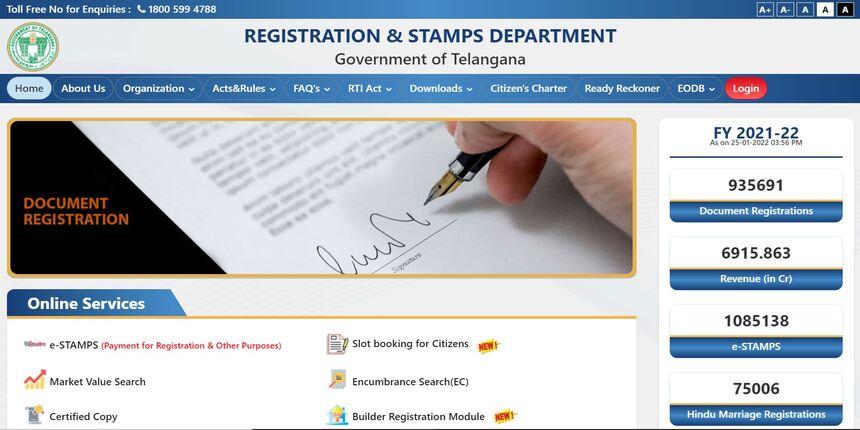

Step 1: Visit Telangana's Registration and Stamp Department's website.

Step 2: In the drop-down box, select the transaction type and input the consideration value.

Step 3: Enter Y/N depending on whether the property has been identified or not. Input the measurements and boundary length if the property has been identified.

Step 4: After clicking ‘Calculate,' you will view the results.

How to Pay Stamp Duty Charges in Telangana on Property Purchase?

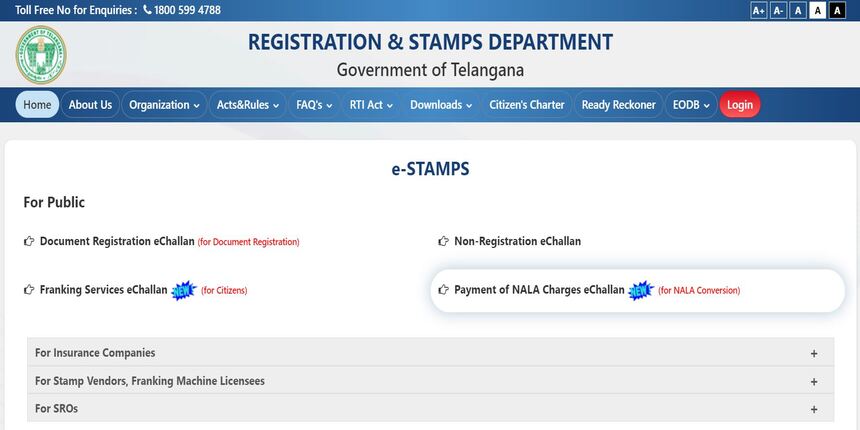

For the purpose of property registration, homebuyers can pay stamp duty and registration charges in Telangana even through online portals.

Here's a step-by-step process to make the payment quickly and easily.

Step 1: Visit the Telangana Registration and Stamps Department's website and look under the "Online Services" column for "E-payments."

Step2: You will be sent to a new page where you will have three choices:

Document registration e-challan

Non-registration e-challan

Franking services e-challan

Step 3: Complete your profile, and you will get an SMS with a 12-digit challan number and a five-digit passcode. Save this information for later use.

Step 4: After completing the registration process, go to the payment option form to print the challan number and passcode information.

Step 5: You will then be led to a disclaimer page; after you agree to it, you will be taken to SBI e-Pay, where you may pay your costs online or offline.

Step 6: Select Debit/Credit card, Net Banking, or NEFT for online payments.

Step 7: The user receives a ‘successful' status message after inputting the payment credentials and providing the required information. The system will then produce a duplicate challan with the SBI e-Pay confirmation reference number on it. During property registration, the user must print the challan and give the SRO copy of it, together with the papers, to the sub-registrar.

Sale Deed in Telangana Checklist

The owner of the property should have a legal draughtsman prepare the sale deed on non-judicial stamp paper of the required value. The parties shall utilise five non-judicial stamp papers, with the remaining sum payable through challan or any other method specified by the state government. The following terms should be included in the sale deed:

Name of the Deed: The type of deed should be explicitly stated in the document. The parties might settle on what sort of deed will be created for the property transfer document based on mutual agreement.

Parties to the sale Deed: The names, ages, and addresses of the parties engaged in the transaction should be included in the sale document. All parties involved in the transaction should sign the deed.

Property description in context: The property description in context should be explicitly specified in the sale document. It should provide a complete description of the property, such as the identification number, plot area, and location, among other things.

Sale consideration clause: A sale deed must include all relevant information about the sale price agreed upon by the seller and the buyer. It should state explicitly how much was paid to transfer property rights from one party to another.

Mode of Payment and Advance payment: A sale document should specify how a buyer will pay the selling price and, if an advance payment is made, the amount of the token.

Possession status and date: The deed must also state when the seller will receive possession of the immovable property. The precise date of ownership should be mentioned.

Indemnification clause: The sale agreement should include an indemnity clause, which states that the seller is responsible for any statutory charges, such as property tax, energy charges, water bills, and other charges related to the property, prior to the sale deed being completed.

Gift Deed Charges in Telangana

While gifting a property, the gift deed charges in Telangana are as follows:

- 4% Stamp duty charged

- 1.5% transfer duty

- 0.5% Gift deed registration

The consideration value of property or the one specified in the agreement is charged; whichever is higher.

The amount ranges from INR 1,000 to INR 10,000.

Procedure for Registering a Property in Telangana

The following is a step-by-step guide to registering property in Telangana:

- Create a login ID for the Registration and Stamp Department by visiting the Telangana Property Registration website.

- After uploading all the documentation, you may pay the needed registration and Telangana stamp duty rates.

- Arrange a date to go to the sub-registrar's office and register the property.

- Make any necessary revisions to the uploaded documentation if needed and obtain the officer's checklist from the sub-registrar's office.

- An e-KYC (Know Your Customer) procedure is followed, which is then cross-checked against the Aadhaar database.

- Stamp duty and other taxes will be validated using a challan copy of the registration charges.

- The registration procedure will proceed after verification.

- During the registration process, a document number will be produced, and thumb imprints will be taken.

- The registrar will scan and update the application. This application will also be uploaded on the portal, which the user can download.

- If the verification fails, the applicant must resubmit the documents with the necessary adjustments.

- Until the land is sold to someone else; the registration is considered valid.

- To complete the process, it takes two days. One day to upload the documents online and another to go to the registrar's office and finish the rest of the procedure.

How to Look for Blacklisted Properties in Telangana?

Before signing or making any payment to the seller, property purchasers in Telangana should verify the list of prohibited properties. Follow these procedures to search the list on the Telangana Registration Department's website:

Step 1: Visit the Telangana Property Registration Department and choose Prohibited Property from the drop-down menu.

Step 2: To find a list, choose a district, mandal, village, and criteria. The following criteria might be used:

The ward/block number

Town survey number

Survey number

Revenue survey number

Survey number-wise details

Ward-wise details

Step 3: Submit your information. The list will appear on your computer screen.

Latest News on Land Registration Fees in Telangana

June 21, 2021

The Telangana administration, in a dramatic turn of events, has decided to restart the property registration procedure in the state beginning June 1, 2021. After the state cabinet agreed to prolong the lockdown duration by three hours till 1 p.m., the decision was made. The offices are now operating at a reduced capacity.

Six slots are generated by the sub-registrar's offices every hour, and the attendance of required persons such as buyers, sellers, and two witnesses is permitted. This implies that for the time being, each SRO is only permitted 24 slots in six hours. The number is larger in district registration offices, which can schedule up to 48 registration slots per day.

The Telangana administration had already stopped property registrations due to the state-wide lockdown, which was extended until May 31, 2021, due to an increase in Coronavirus infections across the state.

February 23, 2021

The Telangana government is paying a high price for halting property registrations to allow the Dharani portal's launching. Property registration revenue has dropped to Rs 3,189 crores, compared to a target of Rs 10,000 crores. Earnings from property registrations continue to be the most impacted of all sectors. Consequently, the state budget has been cut by at least 20% from the previous year, as the state's financial situation has been severely harmed by the COVID-19 outbreak and accompanying lockdown.

January 28, 2021

NRIs who do not have Aadhaar cards but own or want to buy property in Telangana can now use their passports to register their property ownership and acquire land. Telangana NRIs residing abroad may now acquire lands and have peace of mind about the security of their assets by registering with the Dharani site and utilising their passports for land registration. Rescheduling the registrations is also a possibility.

FAQ's about Stamp Duty in Telangana

Q1. How much is the stamp duty in Telangana?

The stamp duty in Telangana is set at 4% by the government based on the recent market value of the property. Other than that, the buyers are required to also pay the registration fee and transfer duty on the property value of 0.5% and 1.5% each.

Q2. What is the Relinquishment deed stamp duty in Telangana?

The relinquishment registration fee in Telangana is 0.5% minimum.

Q3. In Telangana, what is the stamp duty on property sales?

On the sale of property in Telangana, a stamp duty of 4% of the transaction value is levied.

Q4. What happens if you don't pay your stamp duty in a timely manner?

Stamp duty should be paid in whole and on schedule. A fine or even jail may be imposed as a penalty. Delay in paying property Stamp Duty will result in a penalty of 2% each month on the Stamp Duty deficit amount, with a maximum penalty of 200%.

Q5. In Telangana, how can I check the status of my property registration online?

Visit - www.registration[dot]telangana[dot]gov[dot]in to look for Telangana land records online. Then, choose 'Know your SRO jurisdiction' on the following page. You'll be asked to input your District, Mandal, and Village at this point. When you click submit, all of the information about your SRO will be shown.