One must pay stamp duty and property registration charges in Uttar Pradesh when buying or selling a property. Paying the stamp duty is important because it makes the sale or purchase officially recorded and legal. If there’s ever a problem or disagreement about the property, the documents can be used in court to prove what was agreed upon. These documents won’t be accepted in court if you don’t pay the right stamp duty. The registration rates in Uttar Pradesh and the Uttar Pradesh stamp duty on property ensure that your ownership is legally recognised and secure.

Under the Uttar Pradesh Registration Act of 1908, fees must be paid for property deals over Rs. 100. This payment ensures the new owner’s name is officially on the property. The cost, stamp duty, and registration charges differ in Uttar Pradesh. Usually, stamp duty is about 5-7% of the property’s value, and registration is 1%.

Stamp Duty Registration Charge in Uttar Pradesh

In 2024, the Uttar Pradesh government launched an exciting plan to boost the economy and attract investments from big companies worldwide. They cut the stamp duty by half, so companies from the Fortune 500 list that want to invest in Noida and Ghaziabad will pay 50% less. In addition, these companies won’t have to pay any registration rates in Uttar Pradesh. This makes Noida and Ghaziabad attractive places for these companies to invest.

The government led by Yogi Adityanath in Uttar Pradesh has also made a helpful change by lowering the cost of transferring property among family members. This decision was made in a cabinet meeting on August 4, 2023, to make it less expensive for people to handle property matters within the family. Now, for Rs. 5,000, people can officially transfer properties through gifts, divide property fairly, or make family agreements on how to share assets among themselves.

Following the end of a similar rule last December 2023, which saved people from paying up to 7% of a property’s value in stamp duty in Uttar Pradesh, the government decided to bring back these savings. In a recent cabinet meeting, they agreed to keep this benefit going longer, but with a few changes. The department in charge will make an official announcement about this exemption for property transfers. The low stamp duty will likely reduce arguments over family property and help create more jobs. The stamp duty in Uttar Pradesh varies depending on the property’s value. Moreover, property registration charges in Uttar Pradesh are additional costs for officially recording transactions.

Legal and Non-Legal Stamp Duty

Stamp duties are classified under legal and non-legal duties. While legal stamp duties also known as court fee, are the charges that are imposed on appellant in courts, the stamp duty on property agreement comes under the non-legal charges, considering it to be a one-time payment. For most of the states, the volume of stamp duty comes from the tax on transfer or sale deeds.

Stamp Duty and Registration Fees in Uttar Pradesh

In Uttar Pradesh, the fee to register a property is based on set minimum prices called circle rates, which the government decides. In some regions, these are also known as “Ready Reckoner Rates.” They represent the lowest prices at which a property must be registered within a particular area. The government requires that a property’s registration value cannot exceed this minimum value. These circle rates determine the fees for registering a property and the stamp duty.

| Gender | Stamp Duty in UP | Registration Charges in UP |

| Male | 7% | 1% |

| Female | 6% | 1% |

| Joint (Male + Female) | 6.5% | 1% |

| Joint (Female + Male) | 6% | 1% |

| Joint (Male + Male) | 7% | 1% |

Note – The stamp duty exemption of 1% for women in Uttar Pradesh is limited to the first Rs. 10 lakhs of the total property transaction value.

Stamp Duty Charge for Women in Uttar Pradesh

A reduction in Uttar Pradesh Stamp Duty rate is enjoyed by women on property registration as many other states do. In Uttar Pradesh women exercise a discount on these charges, but only under a definite price bracket. Women being an owner only pays 6% stamp duty and registration charges in Uttar Pradesh whereas, a male owner tends to pay 7%. However, both men and women are bound to pay the same stamp duty in Uttar Pradesh if the cost of the property is more than 10lakhs.

You Might Also Like to Read: IGRSUP

Laws of Stamp Duty Value of Property in Uttar Pradesh

The law of Stamp Duty in Uttar Pradesh suggests the purchaser needs to register their sale attainment under the sub-registrar’s office if the transaction worth or cost exceeds INR 100, this is considered mandatory to acquire legal validity in the face of law under section 17 of the Uttar Pradesh Registration Act, 1908.

In short, the buyer needs to keep in mind these three key pointers

- Stamp Duty charges differ from state to state.

- Generally, purchasers must pay 1% of the deal value in the name of registration charges. While some states also impose a flat rate, as per the worth of the property.

- Stamp Duty is basically, the tax imposed by the government when there is a proceeding of a property, which means when a property is handed over from the seller to the buyer. It is simply calculated as per the percentage of the transaction value.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

Appeal to Reduce Uttar Pradesh Stamp Duty Rates by Government

The impact that Coronavirus had in all our lives has led people to face an economic set back as the pandemic ended. For the same reason Uttar Pradesh RERA wrote a letter asking a reduction in the stamp duty and registration charges in Uttar Pradesh to the state government to encourage the sentiment value of the consumer. A similar action was taken by other state RERA in reducing their stamp duty charge after the drop the property sales had to face post pandemic these states included Madhya Pradesh, Karnataka, and Maharashtra. But the Uttar Pradesh government still needs to take action on the same request.

Reduction in the stamp duty charge in Maharashtra has helped restrain command over the income and reasonable division in Mumbai market, not only this but has also given rise in the change of various extensive-ticket transactions in the urban city.

Industry interest groups have requested the state government of UP to reinstate the earlier system, where the Uttar Pradesh government charged only INR. 20,000 as a part of the registration charge, to uplift confidence and sentiments of the buyer’s post the Covid-19 circumstances. But the state government increased stamp duty in Uttar Pradesh to 1% of the asset value as the cost of stamp duty and registration charges in Uttar Pradesh.

In a statement Prashant Tiwari- president, CREDAI- Western UP said, “If the registration fee is reduced to the minimum, property will increase, and revenue will go up for the state. We have urged the government to reduce stamp duty for the next six to twelve months, to speed up the purchase and sale of properties after the Coronavirus pandemic”.

Similarly, Subodh Goya, secretary CREDAI- western UP agreed on the statement and added that “it is absolutely vital to register the accordance but paying a fee of 1% is a big affair for the buyers in the market as the average price of the property has increased to Rs. 40-50lakhs. Therefore, it’s a humble request to the state government to reduce the stamp duty and registration charges in Uttar Pradesh and charge a minimum fee for the agreements to sub-lease”.

Home sales in the National Capital Region, the most economical housing zone, like Noida, have faced a decline of 28% in the period of January to March in 2021. As the UP government is still not back with any response because of which Uttar Pradesh Stamp duty rates have remained unchanged, this is despite many request calls by the industry officials and the center.

Property Registration Charges in Uttar Pradesh

The Uttar Pradesh government imposed an increase in the new Stamp duty registration charges in Uttar Pradesh for the property that was restricted to a maximum charge of Rs.20,000 on transactions. But, after the imposition of new statement the fees are now calculated as 1% as per the sale consideration, which means if the deed for an asset is 70lacs, the purchaser will be charged Rs.60,000 as a part of the registration fee. Also, the flat registration charges in Uttar Pradesh vary in comparison to the plot registration charges in Uttar Pradesh.

Example for Calculation of Stamp Duty

For Instance, Raghu is purchasing a property of 900 sq ft carpet area in a location where the circle rate is Rs. 6,000 per sq ft. Therefore, the circle rate-based value of the property would be 900 X 6,000 = Rs. 54 lacs.

Considering that the property is being registered at the same amount, the purchaser will currently pay 7% of this amount as stamp duty. This amount will then come out to be Rs. 3.78 lacs.

As, the buyer is bound to pay the staple amount of 7% as per the circle rate therefore, even if the property has been registered in a lesser amount. But, if the purchaser property has been registered at 64 lacs, the purchaser needs to pay 7% of 64 lacs as stamp duty.

How to Pay Stamp Duty on Property Online in Uttar Pradesh?

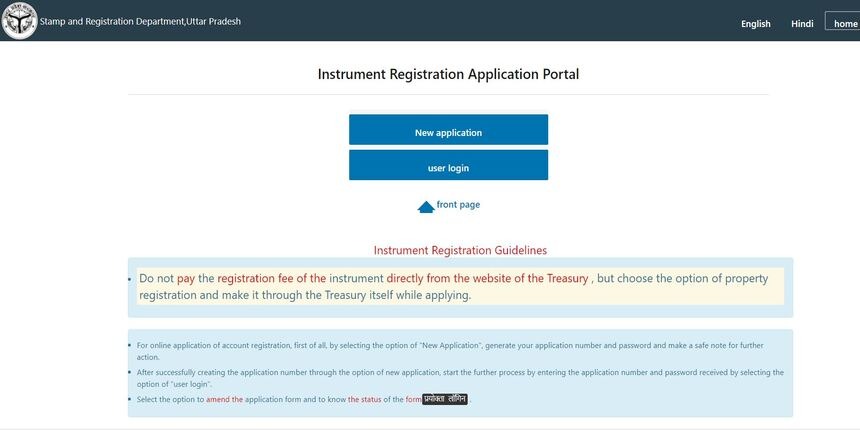

Firstly, login to the Uttar Pradesh Stamp and Registration Department Portal. Here the page will open in Hindi initially, but after selecting the option of changing language you can now change the Hindi language to English.

Once you have switched your language, now apply for registration and generate your own application number by selecting the ‘New Application’ choice.

After registering yourself by using your own credentials, you can easily login as a registered user. You now need to fill in the key information of your property, the seller, the purchaser, or the buyer along with information of the eyewitness. Once done with filling all the information , the system will now calculate the stamp duty and registration charges for your specific property. After the registration payment is done you will receive a receipt number that will be auto generated. It is suggested to save this number for further use while an appointment has been engaged for asset registration at the sub-registrar’s office.

FAQ’s About Stamp Duty in Uttar Pradesh

Q1. How is stamp duty calculated in Uttar pradesh?

The buyers in Uttar Pradesh need to pay seven percent of transaction cost as part of stamp duty.

Q2. What is the land registration fee in Uttar Pradesh?

Registration fee of land in Uttar Pradesh is 1% of the total value of your property, which is subject to a maximum amount of INR 30,000.

Q3. What is the stamp duty in Uttar Pradesh?

Stamp Duty in Uttar Pradesh is 7% of the sale cost.

Q4. How do I calculate my registry in Uttar Pradesh?

Registration fee of property is calculated at one percent of the sum total value of the transaction. For instance, the cost of the land has been registered at 1cr then the registration on the same will be levied at 1lakh.