Under section 3 of the Indian Stamp Act 1899, the state government mandates the collection of West Bengal stamp duty on property transactions. This stamp duty is a tax the buyer of the property must pay. As of 2021, West Bengal does not offer any concessions on stamp duty and registration charges for female property buyers. The rates are the same for both men and women. The stamp duty must be paid promptly and in full to avoid penalties. In cases of delay or default in payment, the penalty for non-payment of stamp duty in West Bengal can range from 2% to 200% of the outstanding stamp duty amount.

The stamp duty in West Bengal applies to all legal documents for transferring immovable property but does not apply to property transfers executed through a will. In addition to online payment, several methods are available to pay stamp duty and cover property registration rates in West Bengal, including cash, demand draft, cheque, RTGS, or pay order. These regulations ensure that the property transaction is legally recognised, with the registration rates in West Bengal and the stamp duty on property being crucial components of this process.

Stamp Duty Rates in West Bengal

| Area of the property | Property value less than Rs. 25 lakh | Property value more than Rs. 40 lakh | Stamp duty for women | Registration Rates |

| Howrah | 4% | 5% | Same | 1% |

| Kolkata | 4% | 5% | Same | 1% |

| Siliguri | 4% | 5% | Same | 1% |

| Durgapur | 4% | 5% | Same | 1% |

| Kharagpur | 4% | 5% | Same | 1% |

Stamp Duty and Registration Charges in West Bengal

| Property Area | Property less than INR 25 lakhs | Property above INR 40 lakhs | Stamp duty Rate for females | Registration Rates |

| Corporation area | 4% | 5% | Same | 1% |

| Notified area or Municipality or Municipal Corporation | 4% | 5% | Same | 1% |

| Areas not included | 3% | 4% | Same | 1% |

There is no special discount or cut down for West Bengal Stamp Duty Rates for female home purchasers or buyers.

Stamp Duty on Property in West Bengal

| Documents | Stamp duty Rate | Registration Charge |

| Power of attorney- market value not exceeding INR 30 lakhs | INR 5,000 | Nil |

| Power of attorney - market value between INR 30 lakhs to INR 60 lakhs | INR 7,000 | Nil |

| Power of attorney - market value between INR 60 lakhs to INR 1 crore | INR 10,000 | Nil |

| Power of attorney - market value between INR 1 crore to INR 1.5 crores | INR 20,000 | Nil |

| Power of attorney - market value between INR 1.5 crores to INR 3 crores | INR 40,000 | Nil |

| Power of attorney - market value exceeds INR 3 crores | INR 75,000 | Nil |

| Partnership deed - up to INR 500 | INR 20 | INR 7 |

| Partnership deed - up to INR 10,000 | INR 50 | INR 7 |

| Partnership deed - up to INR 50,000 | INR 100 | INR 7 |

| Partnership deed - exceeding INR 50,000 | INR 150 | INR 7 |

| Transfer of lease - Government land in favour of family members | 0.5% market value of the property | Same as the market value |

| Transfer cost of lease in all other cases | Same as the market value | Same as the market value |

| Gift deed to the family members | 0.5% | Same as the market value |

| Gift deed apart from family members | Same as the market value | Same as the market value |

| Sale agreement - market value does not exceed INR 30 lakhs | INR 5,000 | INR 7 |

| Sale agreement - market value between INR 30 lakhs and INR 60 lakhs | INR 7,000 | INR 7 |

| Sale agreement market between INR 60 lakhs to INR 1 crore | INR 10,000 | INR 7 |

| Sale agreement market value between INR 1 crore to INR 1.5 crores | INR 20,000 | INR 7 |

| Sale agreement -market value between INR 1.5 crores to INR 3 crores | INR 40,000 | INR 7 |

| Sale agreement - market value exceeds INR 3 crores | INR 75,000 | INR 7 |

How to Calculate Stamp Duty Registration Charges in West Bengal?

These are the step-by-step methods to use the stamp duty calculator to calculate the transactions in West Bengal.

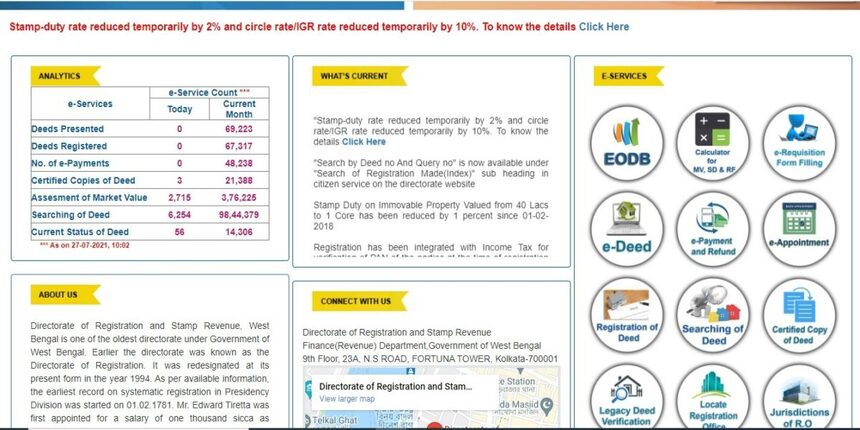

Step1: Visit the official homepage of West Bengal Registration Portal.

Step2: Click on the ‘E-services’ tab underlined in yellow.

Step3: Select ‘Calculator for MV, SD and RF’ out of all the options mentioned.

Step4: You will now be guided to another page, now choose your suitable option from the four-option listed.

Step5: Tap on ‘Stamp Duty and Registration Fee’ option.

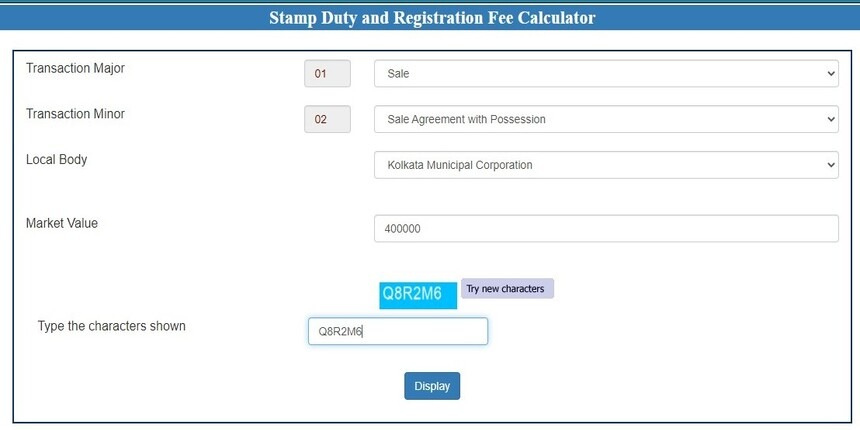

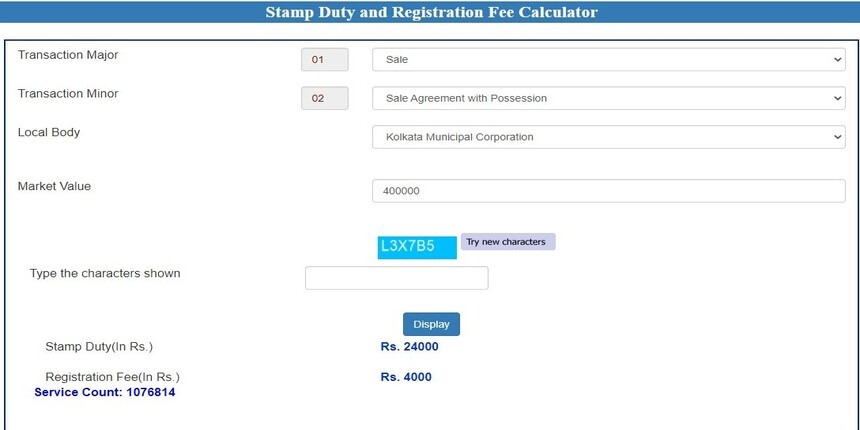

Step6: After selecting the Stamp Duty and Registration Fee Calculator option, which includes your transaction minor, major and local body which you will be able to choose from the drop-down.

Step7: After filing the necessary details now enter your market value- press enter and click on the ‘Display’ Button.

Step8: After clicking on the display button, you will now be able to see the stamp duty and registration charges in West Bengal calculated on your display.

How to Pay Stamp Duty and Registration Charges in West Bengal Online?

A candidate is set to pay stamp duty and registration fees only if the e-deeds have been approved. For which you will have to fill the e-assessment at the time of submitting your application. To pay your West Bengal stamp duty rates follow the following:

Step1: Visit the stamp duty West Bengal website and select ‘E-payment and Refund’ under the ‘E-services’ tab

Step2: After selecting the option it will now land you to another page where you can find an option ‘E-payment of Stamp Duty and Registration Charges’, tap on the same.

Step3: The page that you see now is for you to include your details such as Query Year, Number and then click on “Check Query Status’.

Step4: Furthermore, you need to enter details such as branch name, name of the Bank, Account number, Account holder’s name, contact number, Bank Account Type, IFSC Code and, MICR code. You are also entitled to your refunds also in the same account, now press ‘Proceed for e-payment’.

Step5: Now press ‘ok’ on the pop button to proceed further from where you will be redirected to West Bengal’s GRPS (Govt. Receipt Portal System) portal.

Step6: Tap on ‘Make Payment’

Step7: Go for ‘Directorate of Registration and Stamp Revenue’ under the ‘Select Department/ Directorate’ category from the menu and in the ‘Select Service’ box, tap on ‘Payment of Stamp Duty’, ‘Registration Fee’ and ‘Mutation Fees’ and select on proceed.

Step8: The next page that you are landed on now, the beneficiary details including name, residential details, contact number, and e-mail ID. Choose your user type from the menu, and you will be able to see a box related to your query which includes number and year which needs to be filled, after which you need to choose your preferred payment mode and proceed.

Step9: After mentioning all the above details about the West Bengal stamp duty rate on the portal you will now be able to see your total amount. Tap on ‘Submit’ followed by a page wherein, you will be able to see all your details- now press confirm and proceed further to complete your online payment.

Step10: After the payment is completed you receive a payment confirmation message, download your challan receipt by selecting the ‘Click here to download Challan’ option.

Stamp Duty Charges in Other States

| State | Stamp Duty Charges |

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| Madhya Pradesh | Stamp Duty in Madhya Pradesh |

| Delhi | Stamp Duty in Delhi |

| Noida | Stamp Duty in Noida |

| Rajasthan | Stamp Duty in Rajasthan |

| Mumbai | Stamp Duty in Mumbai |

| Jharkhand | Stamp Duty in Jharkhand |

| Pune | Stamp Duty in Pune |

Want to Apply for Refund of Stamp Duty Charge in West Bengal?

In case your documents are not introduced under the sub-registrar for registration the purchaser or the buyer can claim a refund on the stamp duty flat registration charges paid online. The following steps will help you seek refund for your stamp duty and registration charges in West Bengal.

Step1: Visit the official website of Stamp Duty Charges and select ‘Application for Refund of e-payment’.

Step2: After the selection enter your query details such as year, number and GRN (Government reference number) and explore for payment details. If there would be any applicable refund on your query number, it automatically gets credited in your bank account that was noted while paying the stamp duty and registration charges.

Documents that need to be uploaded for your registration are:

- Copy of Query or valuation report.

- Both original and partly executed documents.

- Documents as a proof for the cancellation of the agreement.

- E-Challan of deposit

- Cancelled Cheque

The above steps need to be followed if you are claiming your refund online but in case you don’t want to go through the procedure online, you can easily apply for an offline method for the process.

Offline Method to Apply for a Refund

Step1: The primary step is to submit the application in the prescribed format to the registration office, selected in the e-Assessment form.

Step2: Make sure that you claim for your refund within the period of three months from the date of online payment you made of the stamp duty and registration charge.

Step3: Next, attach the following documents along with the form for the approval:

- Copy of Query or valuation report.

- Both original and partly executed documents.

- Documents as a proof for the cancellation of the agreement.

- E-Challan of deposit

- Cancelled Cheque

Check Market Value of Your Property in West Bengal

Now the property purchasers and sellers can easily check the market value of their properties in West Bengal online.

Step1: Go on the West Bengal Registration portal and tap on ‘Calculator for MV, SD and RF’ from the menu on the right.

Step2: You will be able to see a pop up for four options stating the market value of land, with its structure, apartment and stamp duty and registration charges.

Step3: Choose any three of the first options that you see followed by filling the required details for the space.

Step4: After all the steps mentioned above have been followed, your value of the property will be calculated now and displaced on your monitor.

Properties Eliminated from the Stamp Duty in West Bengal

Yet, the land that has been purchased by the departments of the government officials have been eliminated from the stamp and registration charge and is to be refrained by the governor of the state. Aside, there is no other kind of transaction that has been eliminated from the list of government taxes which includes your registration charges and stamp duty.

Can Cheque be Used as a Mode of Payment Method for Stamp Duty in West Bengal?

The following list of payment modes can be used by the property buyers for their stamp duty and registration charges:

- Cheque

- Demand Draft

- Cash

- Pay Order

- RTGS

- NEFT

- Account to Account Transfer

But it is best recommended by the buyers to contact their nearest e-stamping center, before commencing any type of fund transfer. Adding to which the purchaser or the buyer needs to undergo an additional cost of bank gateway charges.

What is Stamp Duty Value of Property?

The application value of the property is the amount you pay to the vendor of the property, in consideration of the property rights. In other words, any value that has been undertaken by one party to the other party can be learnt as a consideration. In case of the property registration charges, the consideration or application value should be equal to or should exceed the circle rate, If the sale has been registered based on this consideration value. Please note that the house registration charges are different from the plot registration charges.

FAQ's about Stamp Duty in West Bengal

Q1. How to calculate my registry charges in West Bengal?

Generally, the registry rates are equivalent to 1%, but can fluctuate according to the area of your property.

Q2. What is gift deed stamp duty in West Bengal?

According to the market value and receiver of the property the stamp duty charge is usually between 0.5% to 7%.

Q3. What is the stamp duty rate?

The stamp duty rate usually varies from 2% to 12% of the acquired price, but it depends totally upon the value of your property bought, with the date on which you purchased the property. It also depends on if you are a first-time buyer or multiple homeowners.