Stamp Duty in Karnataka is a special tax that one must pay when buying a property or land. This tax is a percentage of the property’s value, set by the government, and it’s equal to paying for the government’s official approval of your property purchase. Paying stamp duty is crucial because it legally confirms you as the property’s owner in the government’s records. You need to pay this tax to avoid legal issues. The rate of this stamp duty varies across different areas in Karnataka, making it an essential part of the property buying process.

The stamp duty rates in Karnataka ensure the government recognises and validates your property transaction. Additionally, registration rates in Karnataka involve another key step in formally recording your ownership, further validating the property transaction. The Karnataka stamp duty and property registration charges ensure the government legally recognises and fully documents your ownership.

In this article, we will discuss various aspects related to Stamp Duty in Karnataka.

Let’s begin!

Factors Affecting Stamp Duty in Karnataka in 2024

It is mandatory for each and every individual to make payment for stamp duty. It is done to settle one’s ownership.

Factors that affect Karnataka stamp duty rates 2024 are as follows:

- The market value of the property when purchased

- Type of your property

- Property’s size

- Location and area

- The owner’s gender

- The owner’s age

- Purpose of the property (which could either be commercial or residential)

Stamp Duty and Registration Charges in Karnataka

Planning a new house comes with a lot of paperwork and charges. Thus, it is important for a purchaser to know the correct stamp duty charges that need to be incurred on the property. If you are someone who is looking for a property in Karnataka, this is the right article for you to read.

| Category | Stamp Duty in Karnataka | Registration Chsrges in Karnataka |

| Male | 5% on assets worth more than Rs. 45 lakh | 1% of the property value |

| 3% on assets between Rs. 21 to 45 lakh | ||

| 2% on assets worth less than Rs. 20 lakh | ||

| Female | 5% on assets worth more than Rs. 45 lakh | 1% on assets worth |

| 3% on assets between Rs. 21 to 45 lakh | ||

| 2% on assets worth less than Rs. 20 lakh | ||

| Male + Female | 5% on assets worth more than Rs. 45 lakh | 1% of the assets worth |

| 3% on assets between Rs. 21 to 45 lakh | ||

| 2% on assets worth less than Rs. 20 lakh | ||

| Female + Female | 5% on assets worth more than Rs. 45 lakh | 1% of the assets worth |

| 3% on assets worth between Rs. 21 to 45 lakh |

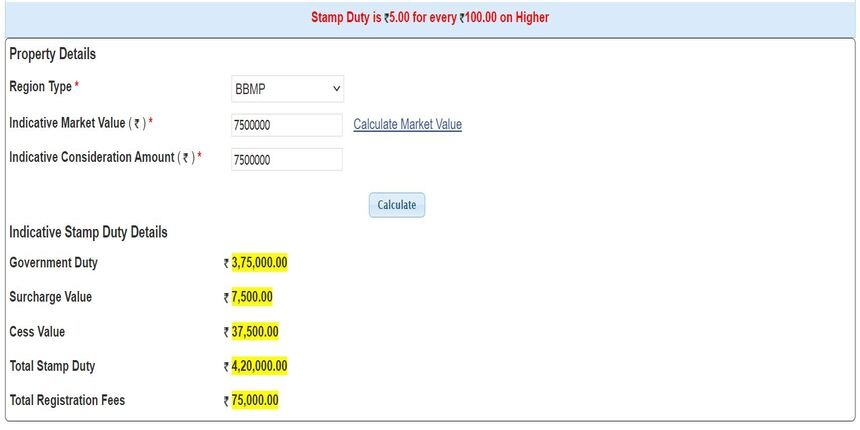

In Karnataka, in addition to the stamp duty, which is the tax charged for officially recording a property purchase, additional charges are required. The government adds a 10% extra charge (cess) and a 2% extra fee (surcharge) to the stamp duty. So, if you’re buying a property that costs more than 45 lakh rupees, you must pay 5.6% of the property’s price as stamp duty. In rural areas, the stamp duty goes up to 5.65% because the surcharge is 3%.

Property Registration Charges in Karnataka

Any individual that purchases land in any part of the country is required to pay a set amount to the government of India, this amount paid is known to be the tax levied on that particular land. And the same can be seen in Karnataka, recently there has been a reduction in the stamp duty rates from 5 % to 3 %. And to make the payment process easy, they have now started to collect the same amount through an online portal. One can simply log in to the ‘Kaveri Online Services’ and make the necessary payment.

| Price List of Property | Stamp Duty Charges |

| Rate Above INR 45 lakhs | 5% |

| Rate between INR 21 lakhs to INR 45 lakhs | 3% |

| Rate less than INR 20 lakhs | 2% |

Land Registration Charges in Karnataka for Agriculture

Land registration charges in Karnataka for agriculture are dependent on various factors, out of which the most important factor that is considered is the type of property that one owns. The purchaser is required to pay the stamp duty and registration charges in Karnataka according to the concerned department. But the procedure of this payment starts with the verification process of these documents.

The Documents Required for the Verification are as Follows:

- Property Card

- PAN Card

- Identity Proof for both the parties

- Power of Attorney

- Aadhar Card

- Original Identification

- Address Proof

- User Charges

- Registration Charges

- Encumbrance Certificate

- Document that holds significance for the parties involved.

- Demand Draft that proofs your payment of Stamp Duty

- Challan

- Receipts for payment of tax.

If all the documents mentioned above, get verified successfully. The transferring process of ownership gets completed.

Flat Registration Charges in Karnataka

Flat Registration Charges in Karnataka are inclusive of the surcharges. The stamp duty and registration charges in Karnataka is the sum total of the stamp duty charge, cess and the surcharge.

House Registration Charges in Karnataka

| Types of Charge | Stamp Duty Charge |

| Registration Charge | 1% (on the value of the property) |

| BMRDA & Surcharges | 3% |

| BBMP & Corporation Surcharges | 2% |

| BMRDA, BBMP & Village Area that added cess | 10% |

Stamp Duty and Registration Charges in Other States

| Maharashtra | Stamp Duty in Maharashtra |

| Gujarat | Stamp Duty in Gujarat |

| Uttar Pradesh | Stamp Duty in Uttar Pradesh |

| West Bengal | Stamp Duty in West Bengal |

| Delhi | Stamp Duty in Delhi |

| Haryana | Stamp Duty in Haryana |

| Rajasthan | Stamp Duty in Rajasthan |

| Bangalore | Stamp Duty in Bangalore |

| Gurgaon | Stamp Duty in Gurgaon |

| Pune | Stamp Duty in Pune |

| Punjab | Stamp Duty in Punjab |

| Odisha | Stamp Duty in Odisha |

Plot Registration Charges in Karnataka

A classification of a property is dependent on the purpose of why the property has been acquired. It could either be for residential or commercial purposes, or even for agriculture. Once an owner has decided on the purpose of the plot the next thing that needs to be taken into consideration is the area that is required for your use. The plot registration charges in Karnataka are calculated by multiplying the area of the plot with the list price of the plot.

| S.No | Type of Document | Stamp Duty Charges in Bangalore | Registration Charges in Bangalore |

| 1 | Adoption Deed | INR 500 | INR 200 |

| 2 | Affidavit | INR 20 | NIL |

| 3 | Immovable Property Sale | NIL | NIL |

| (i) with ownership | 5% of the property value | 1% | |

| (ii) without ownership | 0.1% of the property value Minimum 500, Maximum 20,000 | INR 200 | |

| (iii) Joint Development Agreement | 1% Maximum 15 Lakhs | 1% Maximum 1,50,000 | |

| 4 | Deposit of Title Deeds | 0.1% Minimum 500, Minimum 500, | 0.1% Minimum 500, Minimum 500 |

| 5 | Cancellation of Deed | Minimum 500 | Rs.100 or 1% of the property value if the cancellation has been made on the deed |

| a) Cancellation of previous deed where the stamp duty has already been paid. | Provided that if the original instrument is a conveyance on sale, then the stamp duty is as per article 20(1) | Rs.100 or 1% of the property value if the cancellation has been made on the deed | |

| b) All for Government. or any Local Authorities | INR.100 | INR.100 | |

| c) Others | INR.100 | INR.100 | |

| 6 | A conveyance that includes apartments | 5% of the property value with Surcharge & additional duty charge | 1% |

| Conveyance through BDA | 5% of the consideration mentioned in the document with Surcharge & additional duty charge | 1% | |

| Conveyance on TDR | 5% of the consideration mentioned in the document with Surcharge & additional duty charge | 1% | |

| 7 | Exchange | 5% of the property’s value or consideration value depending on which one is higher with Surcharge & Additional duty | 1% |

| 8 | Gift | ||

| (i) Non-Family Member | 5 % of the property’s value with Surcharge & Additional duty | 1% | |

| (ii) Family Member | INR 1000 with surcharge & Additional duty | Fixed INR 500 | |

| 9 | Lease for immovable property or License | ||

| (i) Below or for 1 yr. of residential | 0.5% of the annual avg. rent with Advance & Premium with Fine. Maximum INR 500 | INR 100 | |

| (ii)Below or for 1yr of commercial & industrial | 0.5% of the annual avg. rent with Advance and Premium with Fine. | INR 5 for each INR.1000 for each or partMinimum INR 100 | |

| (iii) Less than 1year and more than 10 years | 1% of the annual avg. rent with Advance & Premium with Fine | INR 5 for each INR.1000 for each or part | |

| (iv) Less than 10years and more than 20 years | 2% of the annual avg. rent with Advance & Premium with Fine | INR 5 for each INR.1000 for each or part | |

| (v) Less than 20years and more than 30 years | 3% of the annual avg. rent with Advance & Premium with Fine | INR 5 for each INR.1000 for each or part | |

| Lease Only | |||

| (vi) Below 30 years/ perpetuity/not a definite term. | Of the property’s value or else the annual avg. rent paid with advance & premium with fine and deposit (whichever comes out to be higher) | 1% | |

| Immovable Properties between the family members | INR 1000 | INR 500 | |

| 10 | Mortgage | ||

| (i) When possession of the property is given. | 5 % of the property’s value with Surcharge | 1% | |

| (ii) When possession of the property is not given. | 0.5% with Surcharge | 0.5%Max. of INR 1000 | |

| 11 | Partition | ||

| (i) For Non-Agricultural Land for Property located in Municipal Corporation or any Urban Department Authorities else Municipal Councils or any Town in Panchayats area | INR 1000 for each share. | INR 500 for each share. | |

| ii) Others | INR 500 for each share. | INR 250 for each share. | |

| (b) Agricultural Land | INR 250 for each share. | INR 50 for each share. | |

| (c) Movable property | INR 250 for each share. | INR 100 for each share. | |

| (d)Both Movable and Immovable Properties | Maximum of above per share | Maximum of above per share | |

| 12 | Power of Attorney | ||

| For Registration of one or more than one documents | INR 100 | INR 100 | |

| Authorizing one or more than one individual to act for a single transaction | INR 100 | INR 100 | |

| Authorizing for not allowing more than 5 individual to act for a single transaction | INR 100 | INR 100 | |

| Authorizing for not allowing more than 5 but not beyond 10 individuals to act for a single transaction | INR 200 | INR 100 | |

| For consideration along with interest when selling off any kind of immovable property. | 5% of the property’s value or consideration value, whichever comes out to be higher | 1% | |

| For a promoter or a developer | 1% of the property’s value or consideration value, whichever comes out to be higherMaximum INR 15 lakhs | 1%Maximum INR 1.5 lakhs | |

| The authorization provided for immovable property Given to others that don’t include family members such as mother, wife, sister, father, brother, husband. All of this is located in Karnataka. | 5% of the property’s value | 1% | |

| In any other case | INR 200 | INR 100 | |

| 13 | Re-conveyance for the mortgaged property | INR 100 | INR 100 |

| 14 | Release | ||

| (i) Not for family members | 5% of the property’s value or consideration value, whichever comes out to be higher | 1% of the property’s value or consideration value, whichever comes out to be higher | |

| (ii) For family members | INR 1000 | INR 500 | |

| 15 | Settlement | ||

| (i) Disposition not for the family members | 5% of the property’s value with additional duty. | 1% of the property’s value | |

| (ii) Disposition for specified family members | INR 1,000 with Additional duty | INR 500 | |

| (iii) Revocation of the Settlement | INR 200 | INR 100 | |

| 16 | Surrendering Lease | INR 100 | INR 100 |

| 17 | Transferring of Lease | ||

| (a) Period Less than 30 yrs. | 5% of the consideration | 1% of the consideration | |

| (b) Period more than 30 yrs. | 5% of the property’s value | 1% of the property’s value | |

| 18 | Trust | ||

| (i) Declaration of the Trust deed that includes any money or any amount that has been conveyed through the author to trust as part of the collection. | INR 1000 | 1% | |

| (ii) Concerning any kind of immovable property that is possessed by the holder that has been conveyed to trust for which the holder is known to be the sole trustee | INR 1,000 | 1% | |

| (iii) Concerning any kind of immovable property that is possessed by the holder that has been conveyed to trust for which the holder is not the trustee or maybe one of the trustees | 5% according to article number 20(1) | 1% | |

| (iv) Cancellation of Trust | Maximum INR 200 | INR 100 | |

| 19 | Will deed | Not Applicable | INR 200 |

| Cancellation of the Will deed | INR 100 | Maximum INR 200 | |

| Deposit of the Sealed Cover that contains the will | Not Applicable | INR 1,000 | |

| a) Withdrawal of the Sealed Cover | Not Applicable | INR 200 | |

| b) Charge for opening the sealed cover | Not Applicable | INR 100 |

Steps to Calculate Stamp Duty in Karnataka

Below are the few steps that will help you in Calculating Stamp Duty in Karnataka:

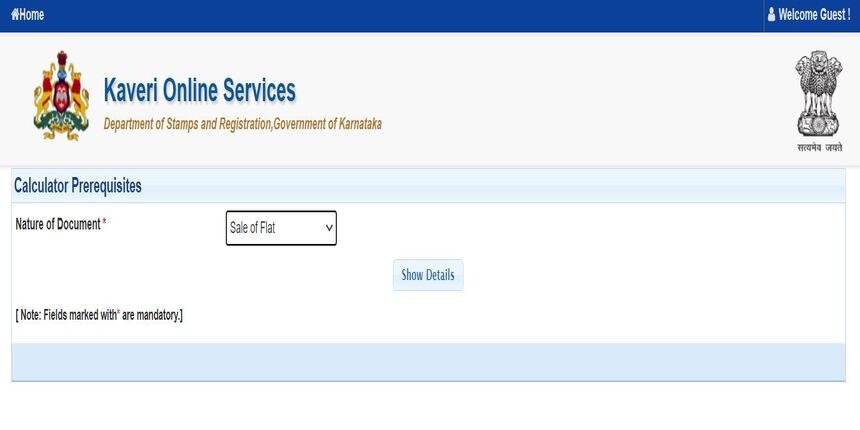

Step 1: Go on the official website of “Kaveri Online Services”.

Step 2: Next, fill in the information to let the calculator fetch the amount that is required to be charged, which also includes the nature of your document.

Step 3: As soon as you fill in the necessary information, you will be able to see a drop-down that reflects the types of the regions.

Some of these Regions include:

- Town Panchayat

- City Corporation

- Gram Panchayat

- Municipal Corporation

The above steps mentioned in the Karnataka Stamp Duty Calculator will calculate the amount that needs to be paid for stamp duty and registration charges for your new property.

FAQ’s about Stamp Duty in Karnataka

Q1. How much is the stamp duty in Karnataka?

The stamp duty in Karnataka is set as follows:

For properties costing INR 45 lakhs – 5%

For properties between INR 21 lakhs to 45 lakhs – 3%

For properties that are less than INR 20 lakhs – 2%

Q2. How much are stamp duty and registration charges in Karnataka for agricultural land?

The stamp duty and registration charges in Karnataka are INR 250 per share and INR 50 per share.

Q3. How is stamp duty calculated for rent in Karnataka?

The stamp calculated for rent in Karnataka is 1% out of the sum rent paid with the deposit that has been paid annually else INR 500, considering the lower amount.

Q4. What is the stamp duty for a trust deed in Karnataka?

The stamp duty rate for trust deeds in Karnataka is INR 45.