1. What is the meaning of a succession certificate?

A succession certificate is a document handed to the heirs of a deceased individual who died without leaving a will. The Indian Succession Act defines a succession certificate as a certificate that authorises the person who acquires it to act in the place of the deceased for acquiring debts & securities owned by him or payable in his name.

The certificate holder has the authority to settle the deceased person's debts & to transfer the deceased person's assets. As a result, the succession certificate meaning also translates to that it protects all those who owe debts or are responsible for securities related to the owner of the certificate from financial loss. For example, if the deceased has borrowed money from a bank, evidence may be needed before the matter is handed on to the legal heir, in which case the succession certificate serves as proof.

Also known as a succession deed or succession letter, it includes a list of assets, debts & securities, and information on the legal heirs and the petitioner's relationship to the deceased individual. The District Judge of the relevant district issues a succession certificate to the deceased person's heirs, granting them such rights. If the authorities cannot locate such a location, jurisdiction is moved to where they might discover the deceased person's assets.

The succession certificate cost is three percent of the total property value. You can also get your succession certificate in Hindi apart from a variety of other regional languages.

2 .Why is the succession certificate important?

As indicated below, a succession certificate is advantageous in a variety of situations. If the deceased lent money to a business or an individual, the borrower might request verification from the heirs. In this instance, the heirs will need a court certificate stating that they are entitled to the deceased's inheritance. They can then recover the amount from the lender and offer a receipt proving that the money was returned to the correct person once they have the succession certificate.

3.What is the intent of a succession certificate?

The major goal of the succession certificate is to safeguard all parties who are paying debts in good faith. The certificate holder also has the authority to collect any interest or dividends on the securities and bargain or transfer the securities as stated in the certificate. As a result, all payments made on behalf of the deceased individual to and by the certificate holder will be legally lawful. This, however, does not always imply that the certificate holder is the legal successor or the owner of the securities. A different legal procedure is used to ascertain the legal heir(s).

4.How can I acquire a succession certificate online?

To get a certificate of succession, you must gather documents that suggest the deceased's asset or debt. You also need the deceased's death certificate, identity card, legal heirs' ration cards, and relevant documents specified by the lawyer. After this, follow these steps:

- Prepare a petition that includes information such as the deceased's date of death, address and property details of the deceased at the moment of death, along with details of family or other close relatives.

- You will then submit the form to the court, the petition will be filed in a court of competent jurisdiction, & the lawyer will notify you of the date of the visit.

- The Judge will decide whether the petitioner has the right to be awarded a succession certificate after considering all parties.

5. Do bank demands succession certificate

A succession certificate is required to claim assets such as bank accounts, fixed deposits, stocks, & mutual fund investments of a deceased person. Even to encash & claim the money of the deceased, a succession certificate is required.

6.Is a succession certificate mandatory?

A Succession Certificate is a court order that directs the division of assets among deceased's beneficiaries following the applicable Succession Act. The relevant court will issue a Succession Certificate if the Testator owns the property as well as financial assets or if the Testator died intestate. A Succession Certificate is required, especially when transferring property title from the deceased person's name to the beneficiaries' name. The legal heir is granted the ability to retrieve the debt or property through a Succession Certificate.

The Act's purpose is to appoint someone to offer legal discharge to creditors to the estate for unpaid debts. This certificate's main objective is to protect all parties who are repaying debts in good faith. The certificate holder also has the authority to receive any interest or dividends on the securities and negotiate or trade the securities specified in the certificate.

7. Who is eligible to apply for a succession certificate?

An adult of sound mind and who has a financial stake in the deceased's estate is eligible to apply. The interest could be in the shape of a deceased relative, a person with a beneficial stake in the security's debt, or something else entirely. The applicant must not be under the age of 18. The succession certificate, on the other hand, can be given to a minor by a guardian. For individuals claiming to be legal heirs, establishing a relationship can be challenging and time-consuming.

A succession certificate might be provided in such instances to establish a relationship. Well before the legal heir to the deceased's property is determined, the grantee's rights to debts/investments remain in effect. The objective of granting a succession certificate is not to provide litigants with a chance to settle disputed property title problems. The Act's two main goals are to make it easier for heirs of the deceased to collect debts & to provide debtors with a legitimate discharge.

8.What is the procedure for obtaining a succession certificate?

A petition should be filed by legal heirs who seek to claim ownership of the deceased person's assets. This must be done in the proper format and filed after being verified in a civil court with jurisdiction over the matter.

The details listed below should be properly stated in the petition when carrying out the succession certificate procedure:

- The deceased person's time, date, and place of death.

- All the details of other legal heirs.

- Information about the deceased's possessions at the time of death

- Rights of petitioner

- ID proof such as Ration Cards or Passports.

- A list of the debts or investments for which the certificate has been requested.

- Certificates of no objection from other legal heirs

- In addition to the petition for succession certificate, you should also include a copy of the death certificate.

- The Court Fees Act of 1870 mandates the court to charge a certain proportion of the estate's value. The petitioner must pay this amount in judicial stamps.

- The court will now examine the petition before it is published in a major publication. Anyone with required papers to support their claim has 45 days from the date of the notice to lodge objections to the petition.

- If no one claims ownership of the deceased person's assets or raises objections within 45 days, the court issues the petitioner the succession certificate if the claim's legitimacy is confirmed.

- The petitioner must offer some security to the court; therefore, the last step is to sign the Indemnity bond.

9.What is the format of a succession certificate?

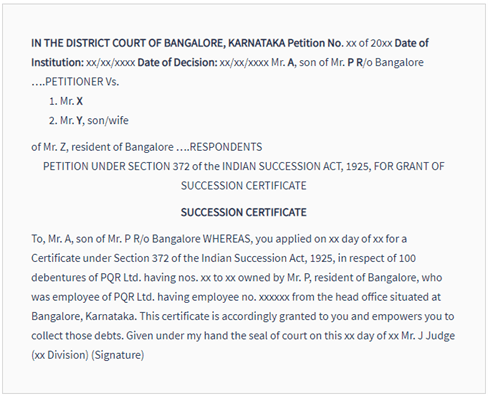

The following is an example of a succession certificate format:

10.What are the documents required to obtain a succession certificate?

The documents required for succession certificate are as follows:

- The deceased person's time of death.

- The deceased person's address

- The deceased person's property details

- The deceased person's complete family details

- The deceased person's complete legal heirs’ details

- A No Objection Certificate (NOC) from other legal heirs.

- Rights of the person requesting the succession certificate.

- The deceased person's assets list, debts & securities.

11.What is the fee for obtaining a succession certificate?

When a petition is submitted, a particular amount in the form of judicial stamps must be paid, according to The Court Fees Act of 1870. The court imposes a set proportion of the property's value as the charge for a succession certificate. Throughout the country, this percentage varies from state to state. It usually amounts to about 2% to 3% of the estate's worth.

12.How long does a court take to issue a succession certificate?

After the petition is filed, the issuance of the succession letter normally takes 45 days. The petition is published in a national newspaper by the court, and 45 days are given to oppose. If the petitioner's validity is proven after that time period, the judge can give the succession certificate.

13.What is the validity of a succession certificate?

The succession certificate is recognised throughout India. However, if a certificate has been issued in a foreign nation by an Indian official (as designated by the government) registered to that country, to have the similar effect as a certificate granted in India, the certificate must be correctly stamped in compliance with the Court Fees Act, 1870.

14.A Step-By-Step guide to apply for a succession certificate

To receive a certificate of succession, a person must file a petition with the District Judge of the appropriate jurisdiction.

Step 1: File a petition

The person requesting the succession certificate must file a petition with the appropriate official in their area. A petition should be filed by legal heirs who seek to claim ownership of the deceased person's assets. This must be done in the proper format and filed after it has been verified in a civil court with jurisdiction over the matter.

The details listed below should be properly stated in the petition.

- The deceased person's time, date, and place of death.

- All the details of other legal heirs.

- Information about the deceased's possessions at the time of death

- Rights of petitioner

- ID proof such as Ration Cards or Passports.

- A list of the debts or investments for which the certificate has been requested.

- Certificates of no objection from other legal heirs

- In addition to the petition, you should also include a copy of the death certificate.

Step 2: An affidavit for the Certificate of Succession must be submitted

The deceased's legitimate heirs must file an affidavit with the District or High Court of sufficient jurisdiction to obtain the certificate, stating their claim to the property. The petitioner must also give copies of their passports and ration cards, according to the document.

Furthermore, the applicant must include the following information in the affidavit as well:

- Petitioner's name;

- Petitioner's address;

- Petitioner's occupation.

If a legal heir decides to abandon his claim to the inheritance, this must also be included in the affidavit. The petitioners must file an affidavit with the court, and the court must notify all of the deceased's next-of-kin of the application. The facts should be made public via a notice in a national newspaper. In most cases, a ruling on a succession certificate takes roughly four months.

Stage 3: Indemnification Bond

After the court has awarded the petitioner the succession certificate, the next step is to sign a bond to indemnify those entitled to the deceased's debts & assets. The bond will also call for a surety with assets equivalent to or more than the deceased's estate. In most cases, the surety is used to protect the legal heir.

15.What is the difference between a succession certificate and a legal heirship certificate?

| Succession Certificate | Legal Heir Certificate |

| A succession certificate is obtained to get authority to seize the deceased's debts and assets in the absence of a will. | Legal Heir Certificate is obtained to establish a claim as a legitimate heir to the deceased's estate. |

| A succession certificate is issued by a civil court & High Court. | A legal heir certificate is issued by the Tahsildar, Municipality, District Civil Court, or Panchayat. |

| A succession certificate aids in certifying an already existing legal heir to obtain the deceased's securities and other properties by filing a petition for it. | A legal heirship certificate is used to identify a person as the legal heir of a deceased individual. |

| If the legal heirship certificate from court is denied, the heirs must file an application for succession certificate. | Legal Heirship Certificates, on the other hand, can be used in place of a Succession Certificate. |

| It takes 7-8 months to receive a succession certificate. | It takes 15 to 30 days to process legal heir certificates. |

| The applicant's relationship to the deceased person, as well as the obligations and securities sought. | The contents include a list of the deceased's legal heirs. |

| The holder of the certificate may or may not be the final beneficiary of the deceased's estate. | The holder can inherit the estate. |

16.What is the significant difference between a succession certificate and a letter of administration?

| Succession certificate

|

| A letter of administration:

|

17.Why do you need a succession certificate for an immovable property?

The Indian Succession Act was enacted to create guidelines for the issuance of succession certificates in India. They're defined as a legally valid certificate that confirms an heir's legitimacy or genuineness after the person has passed away. It also allows the successor to inherit assets that belonged to the deceased. A succession certificate for immovable property is necessary for provident funds, bank accounts, shares, and loans. The applicant should present the letter of administration for an immovable item such as land or jewellery.

Read Also : What is legal heir certificate ?

FAQs

Where is the legal heir certificate issued in Chennai?

The applicant should apply in person at the tahsildar.

Applicant should take documents, such as Application form, Death certificate, Identity Card, Ration card, Proof of residence of the deceased person and so on, with them.

Visit the authorized office & file the completed application that you were given.

Tahsildar will direct the application's processing to the Village Administrative Officer (VAO) & Revenue Inspector (RI).

How to get a legal heir certificate?

Legal heir certificates can be requested from the district civil court, the area Tahsildar, and the municipality office of the specific area.

The applicant must go to the Tehsildar's office and ask for a Legal Heir Certificate from the Taluk.

Alternatively, the applicant could employ a lawyer to obtain the paperwork from the District Civil Court.

The applicant must obtain a request form from the Tehsildar official in charge, complete it with all pertinent information, and attach any required papers.

The applicant must use a Rs. 2 stamps to seal the application form.

The Village Administrative Officer & Revenue Inspector then reviews the application to verify that all the information and papers are correct.

The certificate, which will name all of the deceased's genuine heirs, will be issued by the proper government after all the verification stages have been completed.

In most circumstances, obtaining a Legal Heir Certificate takes 30 days. Regardless, you must notify the Revenue Division Officer (RDO) or the sub-collector if there is an excessive delay or the concerned authorities refuse to respond.

What happens if you die without a will in India?

Inheritance under the Indian Succession Act is exercised in the absence of a will. Without the deceased person's will, death often causes havoc, with family members battling over property and succession. When a person dies intestate, the succession act was enacted to prevent chaos from arising.

How long does it take to get a succession certificate?

It usually takes 7-8 months to receive a succession certificate.

What are the essential elements of a succession certificate?

The essential elements of a succession certificate are as follows:

The deceased person's time of death.

The deceased person's address

The deceased person's property details

The deceased person's complete family details

The deceased person's complete legal heirs’ details

Certificates of No Objection from other legal heirs.

Rights of the person requesting the succession certificate.

The deceased person's assets list, debts & securities.

Who can grant a succession certificate?

A succession certificate is issued by a civil court & High Court to the heir/successor of a deceased individual who has not made a will to demonstrate the successor's authenticity. The applicant must not be under the age of 18. The succession certificate, on the other hand, can be given to a minor by a guardian.

Who is the legal heir for the father's property?

The legal heir for the father’s property can be any of the below individuals:

A deceased person's spouse

A deceased person's son

A deceased person's daughter

A deceased person's Father

A deceased person's Mother

A deceased person's brother

A deceased person's sister

Is succession certificate and legal heir certificate the same?

The legal heir certificate and the succession certificate are not the same. Although both the legal heirship certificate & the succession certificate are used to identify & validate a person's status as the legal heir of a deceased person, the certificates are distinct and serve different purposes.