The 2022-23 Union Budget has proposed that home buyers should deduct TDS (tax deducted at source) of 1% while purchasing any property. This should be deducted from the amount that is paid to the property seller or the stamp duty value, whichever is more. This will subsequently apply for all immovable and non-agricultural properties that have this stamp duty or selling value higher than Rs. 50 lakh.

Experts state that TDS came into the property sphere under Section 194IA for property transactions worth more than Rs. 50 lakh. Now, they opine, whenever buyers purchase any property worth more than this amount, they will have to deduct the TDS and deposit the same with the Central Government. Till date, as per Section 194IA, deduction of TDS took place on the sale consideration. At the same time, this move brings more parity between Sections 194IA, 50C and 43CA for computation of income under the head profits and gains from business or profession and capital gains.

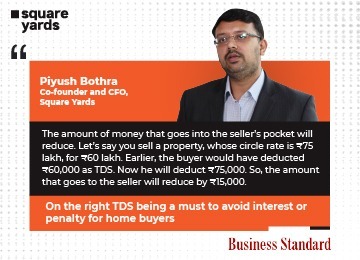

Home buyers will have to deposit their TDs with the I-T Department and this will help the authorities identify all transactions happening below the stamp duty value. They can deal better with issues pertaining to tax evasion, since amounts will be mentioned in Form 26AS of both the buyer and seller. Mismatches will lead to enquiries on the part of the income tax department. Co-Founder and Chief Financial Officer, Square Yards, Piyush Bothra, states that the money entering the pocket of the property seller will naturally come down. He provided an example of a property being sold for Rs. 60 lakh where the circle rates are Rs. 75 lakh. While Rs. 60,000 may have been deducted earlier as TDS by buyers, it will now be Rs. 75,000, meaning a reduction of Rs. 15,000 in the seller’s hands. However, on a Rs. 60 lakh consideration, it will still be a smaller amount according to him. Buyers will have to be careful about deducting the right TDS amount and depositing it with the I-T Department in a timely manner for avoiding any penalties or interest.

For a detailed report on this read the articles we were featured in:

Business Standard : https://bit.ly/3GtF9gH

Published Date: Feb 04, 2022