Today, all are aware of our choices in life. And take strategic steps especially when it comes to managing the finances. Therefore, most of us try to save some amount of money after cutting all day-to-day expenditures. And this amount is deposited in the types of savings amount.

But there are many types of savings accounts to choose from that can create confusion. Thus, it is wise to select from types of savings accounts that can cater to your needs as per your requirements and offer easy access anytime and anywhere.

To clear the confusion we have explained all types of saving accounts in India along with the facilities they offer. The perks may vary from bank to bank.

Let’s start here,

Table of contents

- How many types of savings accounts?

- Characteristics of Savings Account

- Privileges of Savings Account

- Documents Requirement to Open a Savings Account

- Winding Up

- Frequently Asked Questions (FAQ’s)

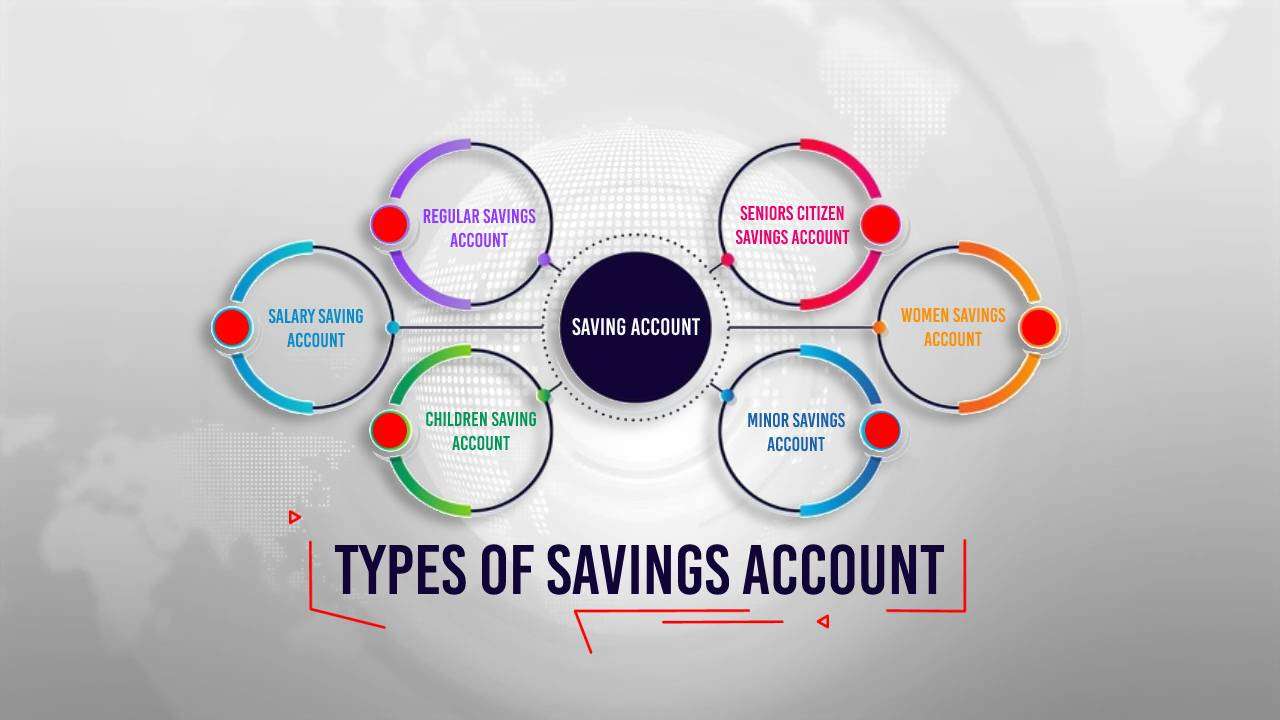

How many types of savings accounts?

All the banks in the country offered few specialized saving accounts that help people as per their individual needs and requirements. The main types of saving accounts are as follows:

- Regular Savings Account

- Salary Saving Account

- Seniors Citizen Savings Account

- Women Savings Account

- Children or Minor Savings Account

Regular Savings Account

It is a one of the regular or traditional types of savings accounts that many customers use to save some percentage of their hard-earned money. These savings accounts help customers in earning some extra cash on the amount deposited in their account.

As an owner of a regular savings account, you have to maintain a minimum balance in your account, as per your bank policies. And, if you fail to do so, then you have to pay the penalty.

Also, the withdrawal amount comes with a limit. You can only withdraw cash a few times, and after that, your bank is liable to charge you a fee for exceeding the monthly limits. These withdrawal limits don’t include ATM or withdrawals from a branch.

Table to compare the latest interest rates on regular savings accounts

| Banks | Interest Rates | Minimum Balance |

| DBS Bank Digi Account | 4.00% | Rs. 5000 (from 1st October 2020) |

| Yes Bank Savings Value Account | 4.00% – 5.25% | NA |

| Kotak Bank Nova Savings Account | 4.00% | Rs. 5000 |

| HDFC Bank Regular Savings Account | 3.00% – 3.50% | Rs.10,000 in metro cities Rs. 5,000 in semi-urban Rs. 2,500 in rural bank |

| ICICI Bank Regular Savings Account | 3.50% – 4.00% | Rs.10,000 in metro cities Rs. 5,000 in semi-urban Rs. 2,000 in rural bank |

| Axis Bank Basic Savings Account | 3.00% – 4.00% | NA |

| Bank of Baroda BOB Savings Account | 2.75% – 3.20% | QAB of Rs. 500 for rural branches QAB of Rs.1,000 for semi-urban & Rs. 2000 for urban |

| PNB Saving Deposit(General) Account | 3.00% – 3.50% | Between Rs.500 to Rs.1,000 for urban and rural branches |

| SBI Savings Plus Account | 2.70% | Rs.25,000 |

| IDFC Bank Savings Account | 4.00% | Rs.25,000 or Rs. 10,000 |

Regular savings account Pros and Cons

Pros:

- Easy access and available anytime and anywhere

- Protection from FDI

- It is a liquid asset

- Earn extra money in form of interest

- Minimal start-up requirement

- Automated bill payments directly from account therefore no hassle.

Cons:

- Need to maintain a minimum balance

- Lower interest rates

- Withdrawal limits

- Easy access and availability can make it tempting.

- Prices can change with time or new rules

Salary Savings Account

Initially, the salary savings account started by the company for which the customer is working. The customer will receive his monthly earnings into his salary account. Apart from zero minimum balance requirements, customers can enjoy several other perks.

Some of the facilities are – internet banking facilities, debit & credit cards, lower interest personal loans, lower NEFT charges, higher ATM withdrawals, etc.

But in case no salary is credited onto the account for three months, then the salary account will be transformed into a regular savings account along with pressure to maintain a minimum balance requirement.

Salary Saving Account Pros and Cons

Pros:

- No need to maintain a minimum balance as it’s a zero balance account Lower NEFT charges on transactions.

- Higher ATM withdrawals in a month.

- Good cibil will help you with easy loans like lower interest on personal loans, car loans etc.

Cons:

- If salary is not credited for a certain period then it will convert into a regular savings account.

- All the benefits will be gone.

Senior Citizens Savings Account

The senior citizen savings account offers special perquisites and high-interest rates (compared to other savings accounts) for depositors. These types of savings accounts in India give senior citizens a chance to use their money to fulfil their basic necessities. Depositors can also link their accounts to pension funds and manage them without any trouble.

Further, we have also suggested the names of banks that offer senior citizen savings accounts.

Table of different banks, name of senior citizen savings account and facilities they offer.

| Banks | Savings account name | Facilities |

| Canara Bank | Canara Jeevandhara (age 60 & above) |

|

| IDFC Bank | Senior Citizen Savings Account (age 60 & above) |

|

| IDBI Bank | Jubilee Plus (Senior Citizens) Account |

|

| Kotak Bank | Grand- The Savings Programme for the 55+ |

|

| Axis Bank | Senior Privilege Savings Account |

|

| ICICI Bank | Life Plus Senior Citizens Savings Account |

|

| HDFC Bank | Senior Citizens Account |

|

Seniors Citizen Savings Account Pros and Cons

Pros:

- Higher interest rate as compared to other savings account.

- Payout will be quarterly

- No risk in high investments.

- Tax exemption is available.

- Premature withdrawal is easily available.

- Direct credit of interest in the savings account is available.

Cons:

- If the interest is not claimed then no additional interest will be paid.

- Taxable interest

- 15 Lakh is the limit for maximum investment.

- No loan is available.

- Different age criteria

Women Savings Account

In India, women are popular for their money-saving skills. And, with time mostly ladies started to save money in their savings account to avail themselves of amazing benefits. Therefore, several Indian banks have come with the idea of starting specialized saving account services for women.

Every bank offers different facilities, offers, and rewards. And here we represent you the names of the schemes offered by different banks.

Table to display different savings account names from several banks

| Banks | Savings Account Name |

| HDFC Bank | Women’s Savings Account |

| ICICI Bank | Advantage Woman Savings Account |

| Axis Bank | Women’s Savings Account |

| Kotak Bank | Silk-Women’s Savings Account |

| PNB | PNB Power Savings |

| IDBI Bank | Super Shakti (Women’s) Account |

Women Savings Account Pros and Cons

Pros:

- Good interest rate

- Safe investment

- Minimum investment amount

Cons:

- Varying interest rate

- Easy access makes it tempting for customers.

- Need minimum balance to maintain in the account.

Children or Minor Savings Account

To encourage children (below 18) and help them understand the management of money on their own, it’s important for them to learn the experience of handling their own savings accounts under the guidance of adults. To promote such habits Indian banks launch several schemes for kid’s savings accounts.

Check the table and learn about the best bank for Kid’s savings account.

| Banks | Savings account name | Privileges |

| SBI | Pehla Kadam and Pehli Udaan |

|

| Canara Bank | Canara Junior Saving Account |

|

| IDFC Bank | Minor Saving Account |

|

| Kotak Bank | Junior- The Savings Account for Kids |

|

| PNB | PNB Junior SF Account PNB Vidyarthi SF Account |

|

| ICICI Bank | Young Stars Savings Account Smart Star Savings Account |

|

| HDFC Bank | Kids Advantage Account |

|

| Axis Bank | Future Stars Savings Account |

|

Children or Minor Savings Account Pros and Cons

Pros:

- Increase financial management knowledge in minors.

- More operating and practical knowledge about how financial institutions work.

- Personalized debit card.

- No minimum balance requirement

- Mobile & internet banking

Cons:

- Minors are less mature, therefore, need monitoring from time to time.

- Limited transactions and withdrawals.

- Chances of fraud.

Characteristics of Savings Account

Here is why having a savings account is a good idea!

- Salaried individuals can save for their future investments using their net pay.

- Earn more interest on deposited amount without much ado.

- No time limit for holding a savings account (it won’t get deemed even after becoming inactive for some time.).

- Internet facilities, pay bills, check mini statements, transfer funds, etc.

- Buy or shop anything using your credit card, debit card, online, on different websites.

- No need to maintain a minimum balance in some of these savings accounts.

- Set small financial goals and achieve them easily.

- Enroll in the PF funds scheme using only your savings account.

- Unlimited deposits and withdrawals in a month (though they vary as per your bank policies, as you may get charged after a certain point.).

Privileges of Savings Account

Here are some common facilities provided by every bank on all types of savings accounts in India. Save money, earn interest, enjoy stress-free services.

- You can pay bills online – mobile bill, electricity bill, DTH top-up, water & gas bill, etc.

- Easily transfer of funds by means of using NEFT, RTGS, and IMPS.

- Use an ATM card to withdraw money anytime and anywhere across the country.

- Use bank branches for depositing money from anywhere in the country.

- Enjoy hassle-free online shopping, exciting offers, and cashback rewards.

- Get rewards on every transaction and redeem unlimited vouchers of top brands, traveling, movie tickets, etc.

- E-banking facilities. Say no to lines!

- Pay your EMIs on time, clear credit dues, etc.

- Avail of interesting loan offers with lower interest rates.

- Check your savings account mini statement just by sitting and chilling at home using the bank app.

Documents Requirement to Open a Savings Account

To open any types of savings account as discussed above, an individual has to fulfil the following document requirements. These are the common documents required while filling the application form at the bank.

- Identity Proof – Passport, Voter’s Id, Aadhaar card, or PAN card, etc.

- Address Proof – Driver’s License, PAN card, Aadhar Card, etc.

- PAN card (mandatory)

- 2 passport size photographs (latest)

Winding Up

These several types of savings accounts in India help millions of people in one way or the other. With these types of savings accounts many people save some percentage of their earnings and use it further in emergency situations. These savings accounts helped a lot of people in times of pandemic. And, apart from it several banks provide exciting offers for shopping and entertainment, cashback rewards, and other other benefits that attract people more for establishing a savings account.

We hope you have understood the concept, requirement, benefits, and other facilities of these types of saving accounts in India.

YOU MAY ALSO LIKE

| Savings Account Interest Rates | Savings Account |

| Post Office Savings Account | SBI Balance Enquiry |

| Zero Balance Saving Account |

Frequently Asked Questions (FAQ’s)

What Type of Savings Account Is Best?

High-yielding savings accounts are best for saving because they offer higher APY as compared to regular or other savings accounts. These types of accounts are available on online banks.

What Is an Advantage of a Regular Savings Account?

The three most regular advantages of a regular savings account are: earning from interest rate amount, easy access, and security with FDIC insurance.

What Is the Benefit of a Salary Account?

Salary accounts offer many perks such as – zero minimum balance, free passbook, cheque book, debit cards, and net banking, no transaction on withdrawal and deposition or any transaction, Demat account services, loan accessibility, offers for credit cards, etc.

Which Bank Is Best for Senior Citizens?

In the public sector, the best bank is the “Bank of Baroda.”

In the private sector, the best bank is “Yes Bank.”

Among small finance banks, the best bank is “North East Small Finance Bank.”

What Is the Best Type of Savings Account for A Child?

The best type of savings account for a child is – Kid’s saving account. These kinds of accounts can be handled singly or in joint with the guardian. It allows limited transactions, limited credit balances, zero minimum balance, and other features.

Which Bank Is Best for Women?

The best banks are – ICICI banks advantage woman savings account, Axis women savings accounts, Kotak silk savings accounts, HDFC women savings account, and IDBI bank SuperShakti account.