Union Bank of India Net Banking is a digital payment system that allows individuals to retrieve their activities, exchange funds, deposit money, maintain trading platforms, and more. The bank encourages accessible banking 24*7 from any location. Net banking services can be available to all customers. Let’s learn more about the Union net banking e-commerce platform.

Table of contents

Types of UBI Net Banking

There are two types of Union Bank of India net banking:-

Retail Banking: Retail Banking service provided by UBI is for the general public or individual. Customers are the focus of retail banking products; they work with them directly. Collecting consumer deposit benefits allows banks to provide mortgages to their customers.

Corporate Banking: Corporate banking by UBI is a commercial banking facility which only deals with small or large companies and corporate bodies. The services are focused on the needs of businesses. Commercial banks extend credit that allows firms to expand and hire new employees, which contributes to the economic growth of a country.

How to do Union Bank of India Net Banking Registration?

To perform the Union Bank net banking registration, the following channels are:-

- Holder of debit card: Using the ‘Self User Creation’ option on Union Bank of India’s official net-banking portal. Generate your credentials like User ID and password.

- Non-holder of a debit card: The ‘Self User’ technology allows you to generate a User-ID and password by visiting the bank. In this instance, you should click on the option to ‘Register without an ATM card.’ However, you will be unable to conduct any transactions through net banking. Users would only be able to examine banking information and other non-financial operations, such as viewing account details and transactions of cash deposits.

- For commercial customers: For these accounts, holders have to go to their local Union Bank branch to complete the Net-banking Registration Form and wait for their account to be activated.

What is the Process to Activate the UBI Net Banking Services?

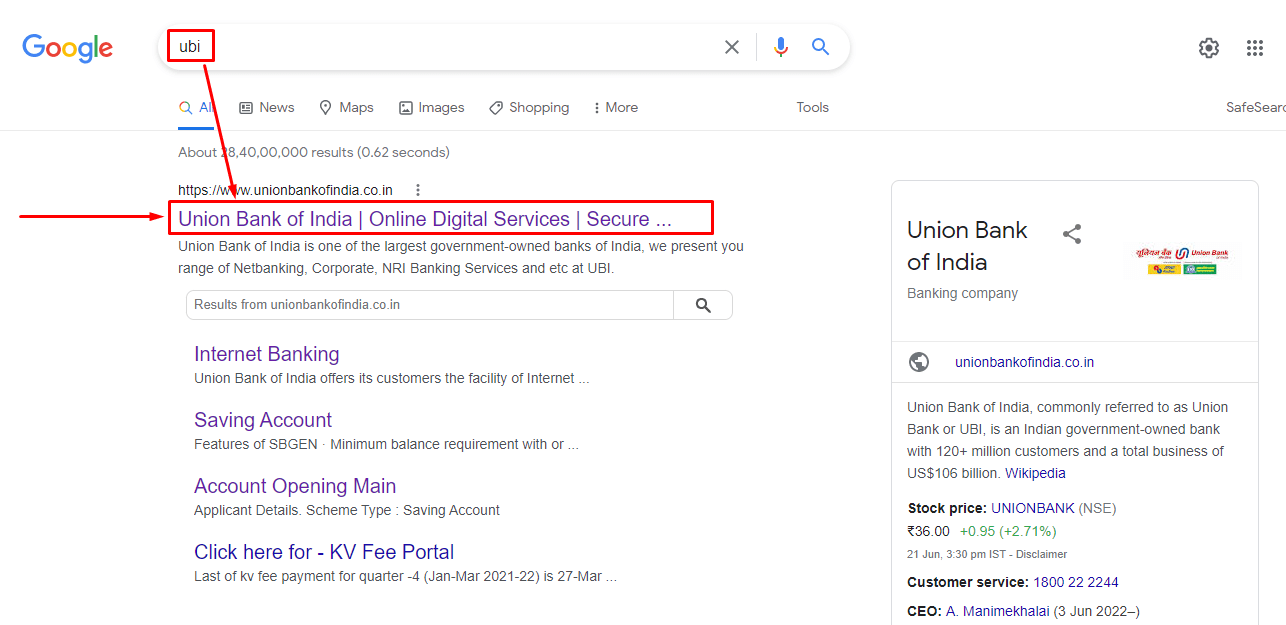

Step:1 Go to the official website.

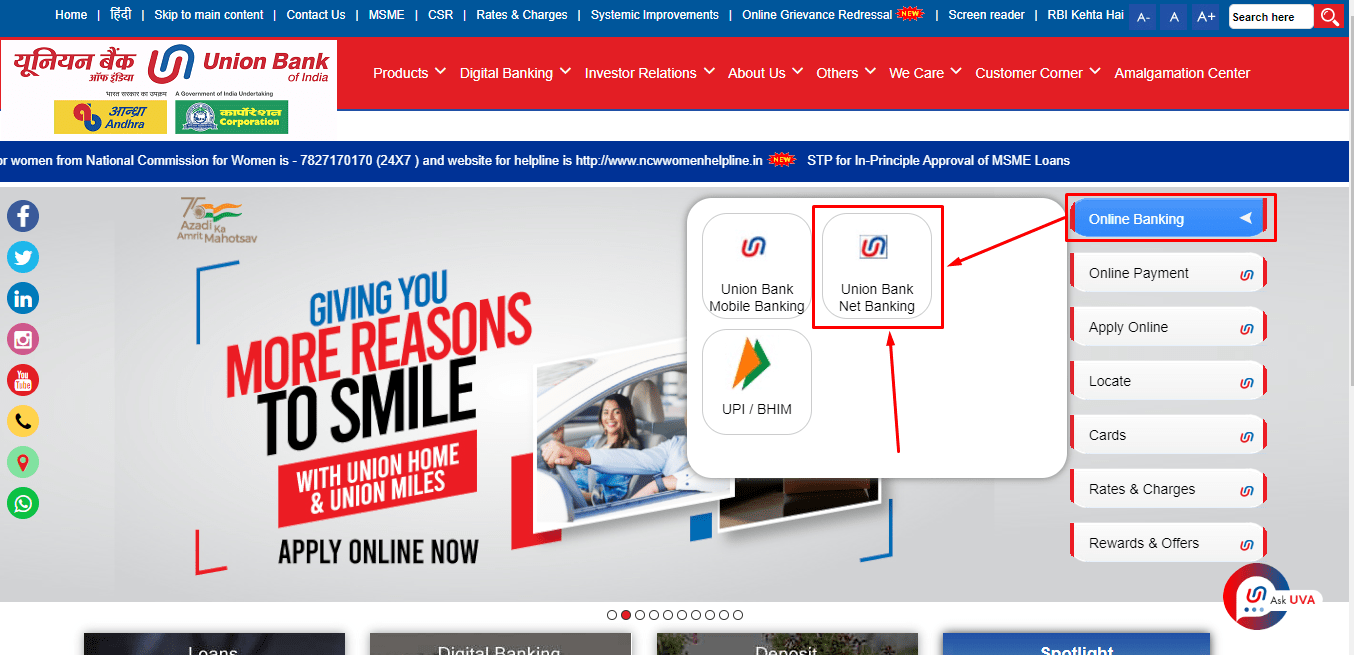

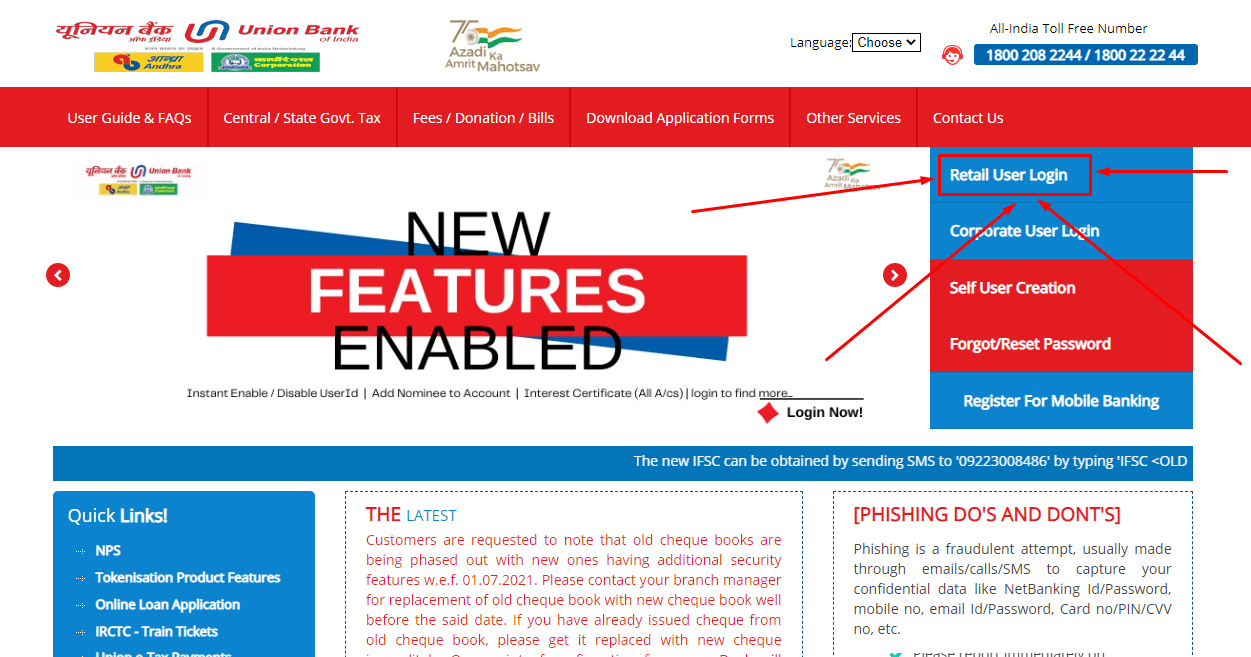

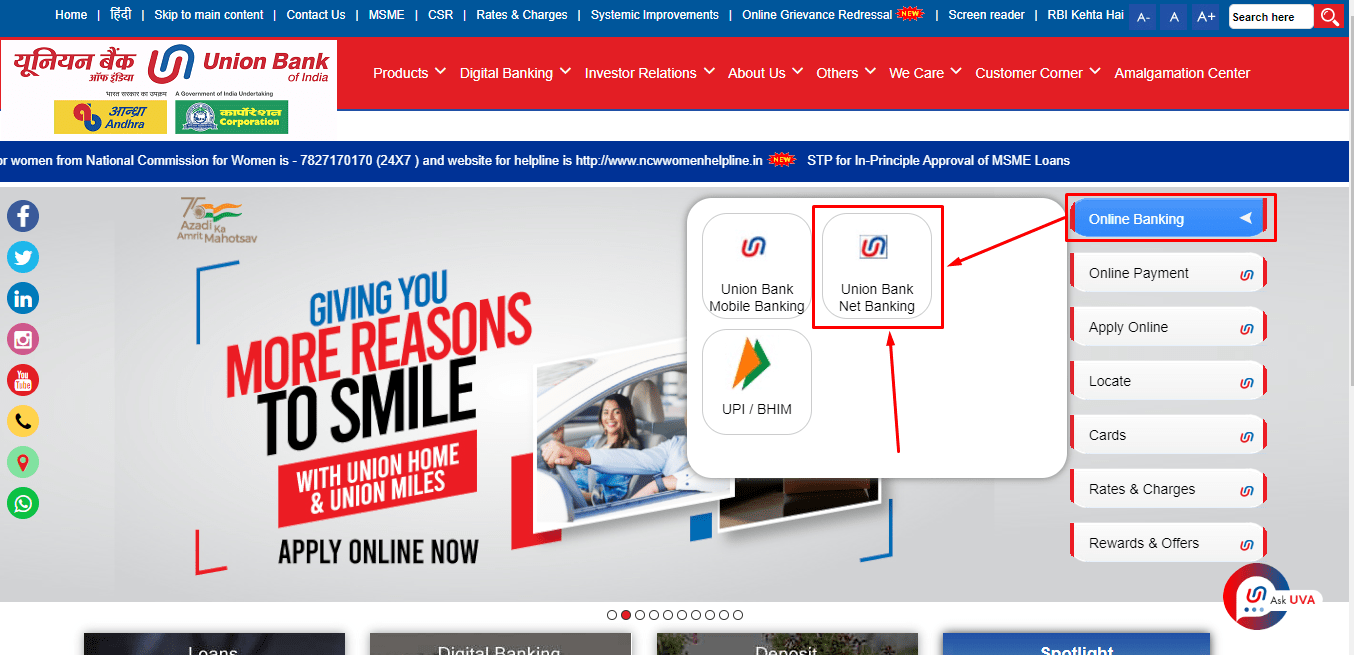

Step:2 Select the ‘Online Banking’‘ category present on the side right of the webpage and click on the ‘Union Bank Net Banking’ option.

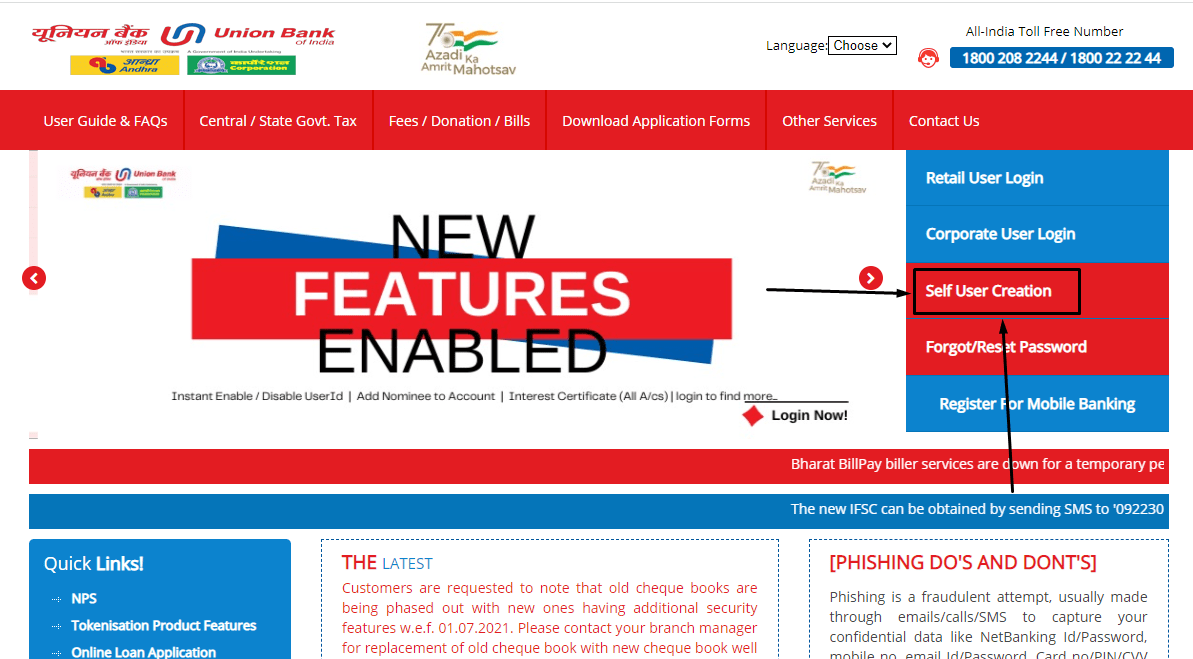

Step:3 After choosing the ‘Union Bank Net Banking’ option, click on the ‘Self User Creation’ option.

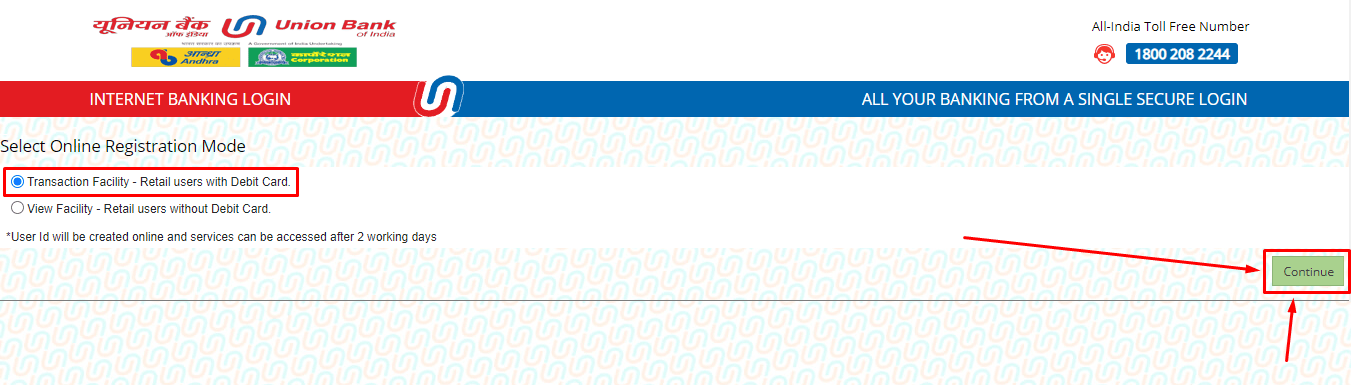

Step : 4 A new page will appear consisting of two options for online registration mode payment:-

- Facility for the transaction: Retail individual with Debit Card.

- Facility to view: Retail individual without Debit Card.

Therefore, click on the ‘Continue’ button.

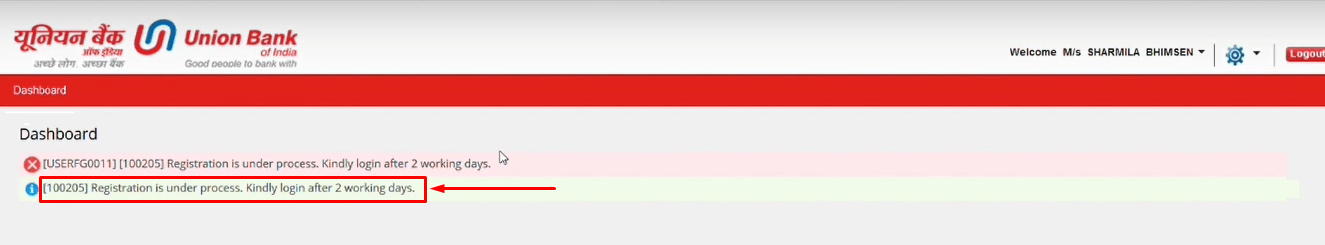

Note: Within two working days, the user ID will be activated.

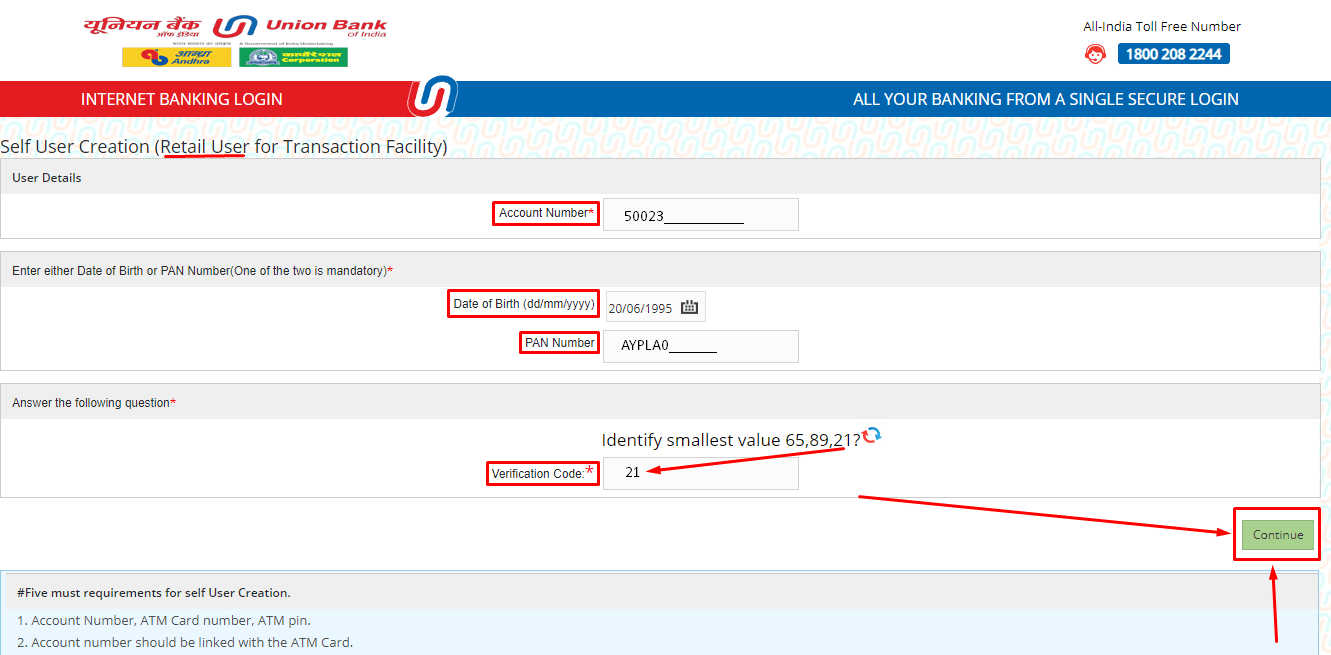

Step:6 Fill in the details:

- Bank Account Number

- Date of Birth (DOB)

- Permanent Account Number (PAN)

- Verification code

Once the details are filled in, click on the ‘Continue’ button.

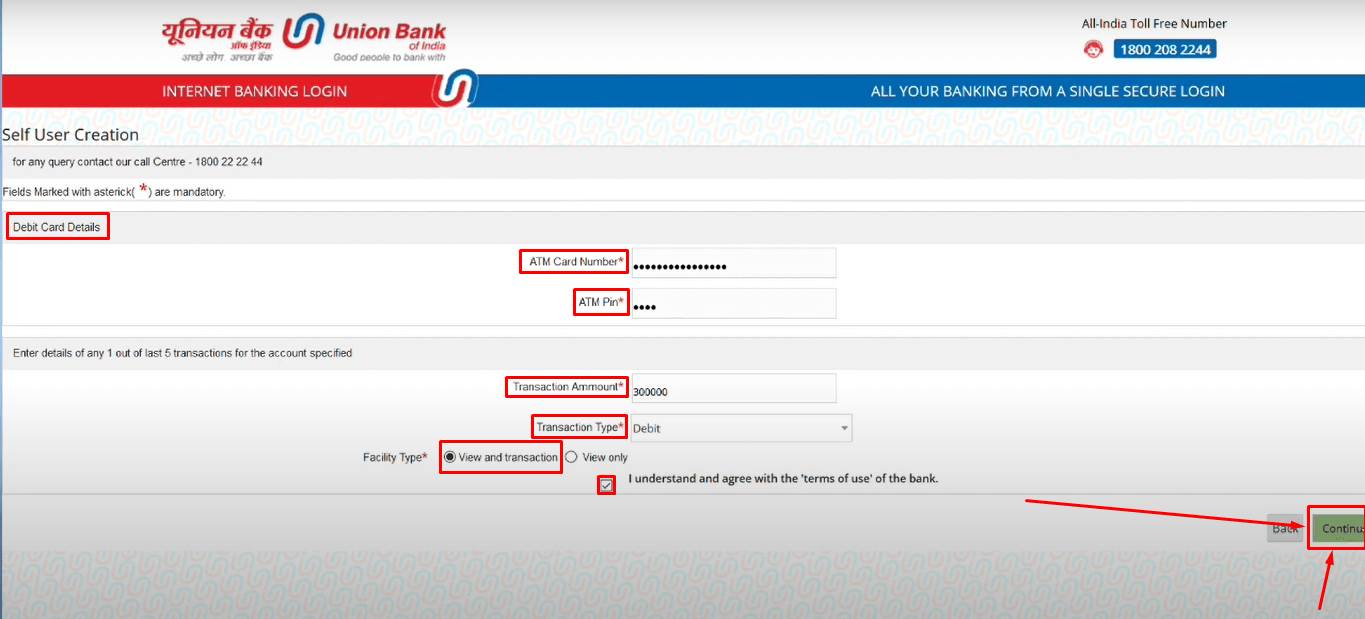

Step: 7 Enter the debit card’s credentials and PIN number. Check the terms and conditions and click on the ‘Continue‘ button.

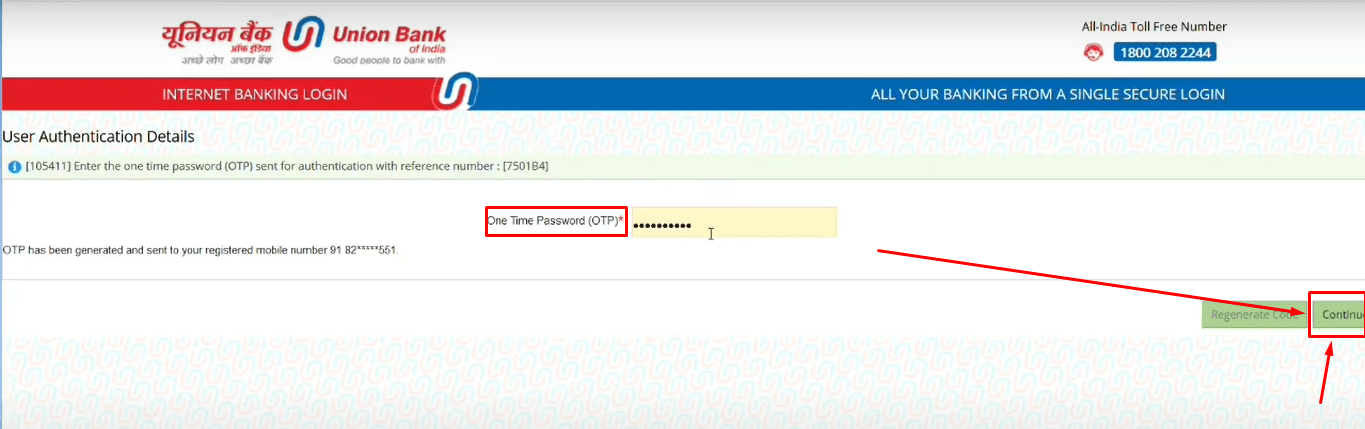

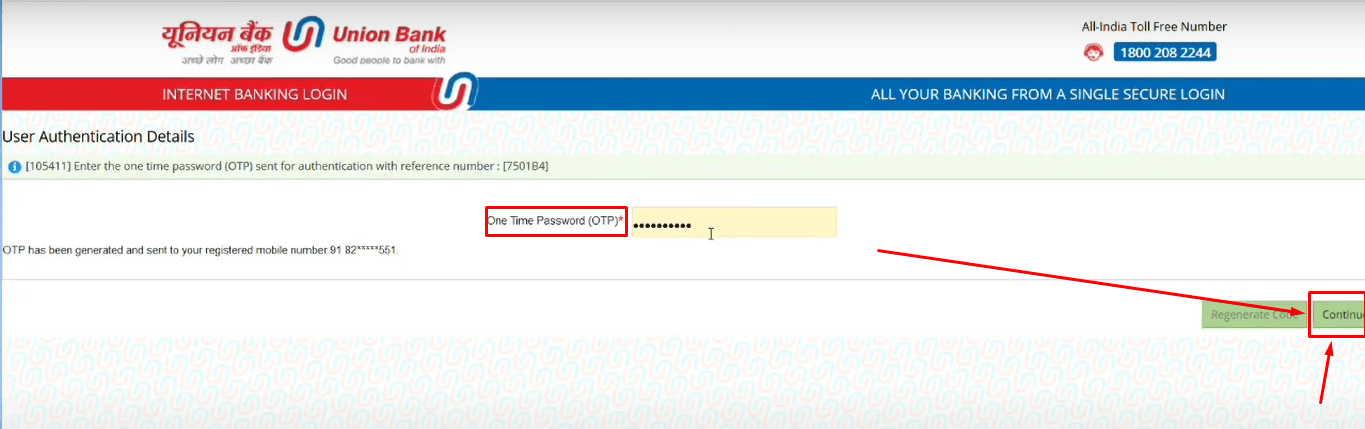

Step:8 Fill the details, and enter a valid ‘OTP’ that you have received on your registered mobile number and click on the ‘Continue’ button.

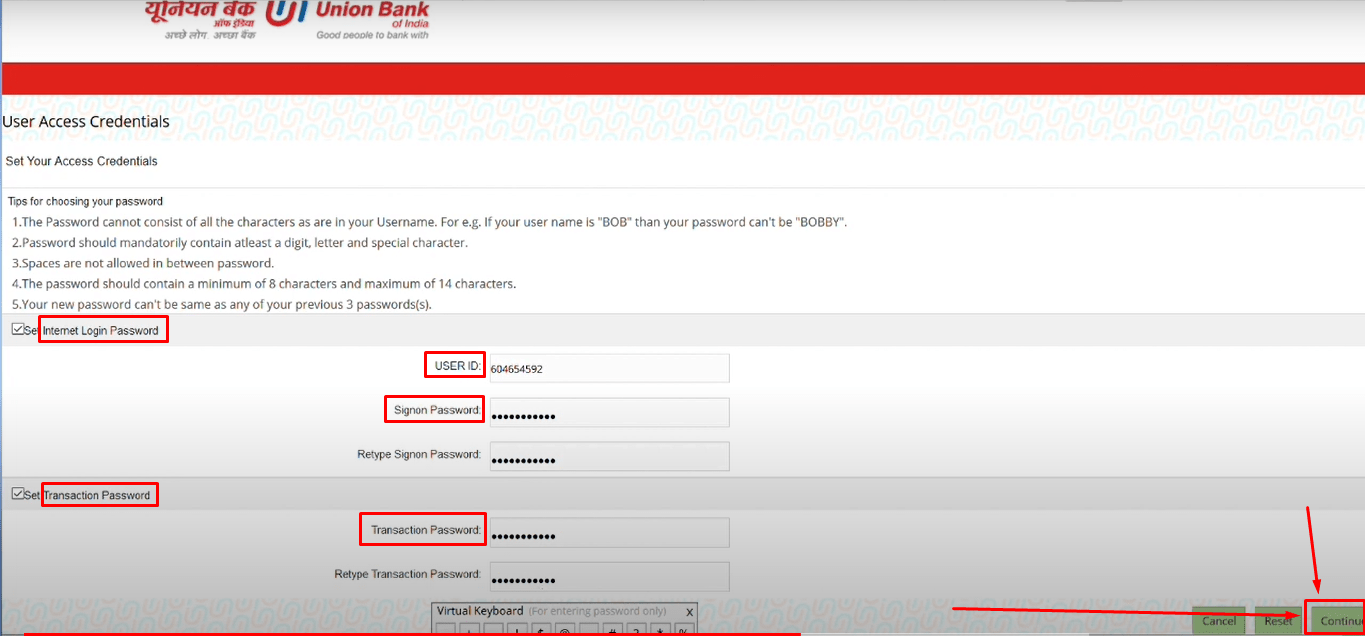

Step: 9 A new page will appear ‘User Access Credentials’. Create the ‘Internet login Password’ and ‘Transaction Password’ to make the payment. Then, click on the ‘Continue’ button.

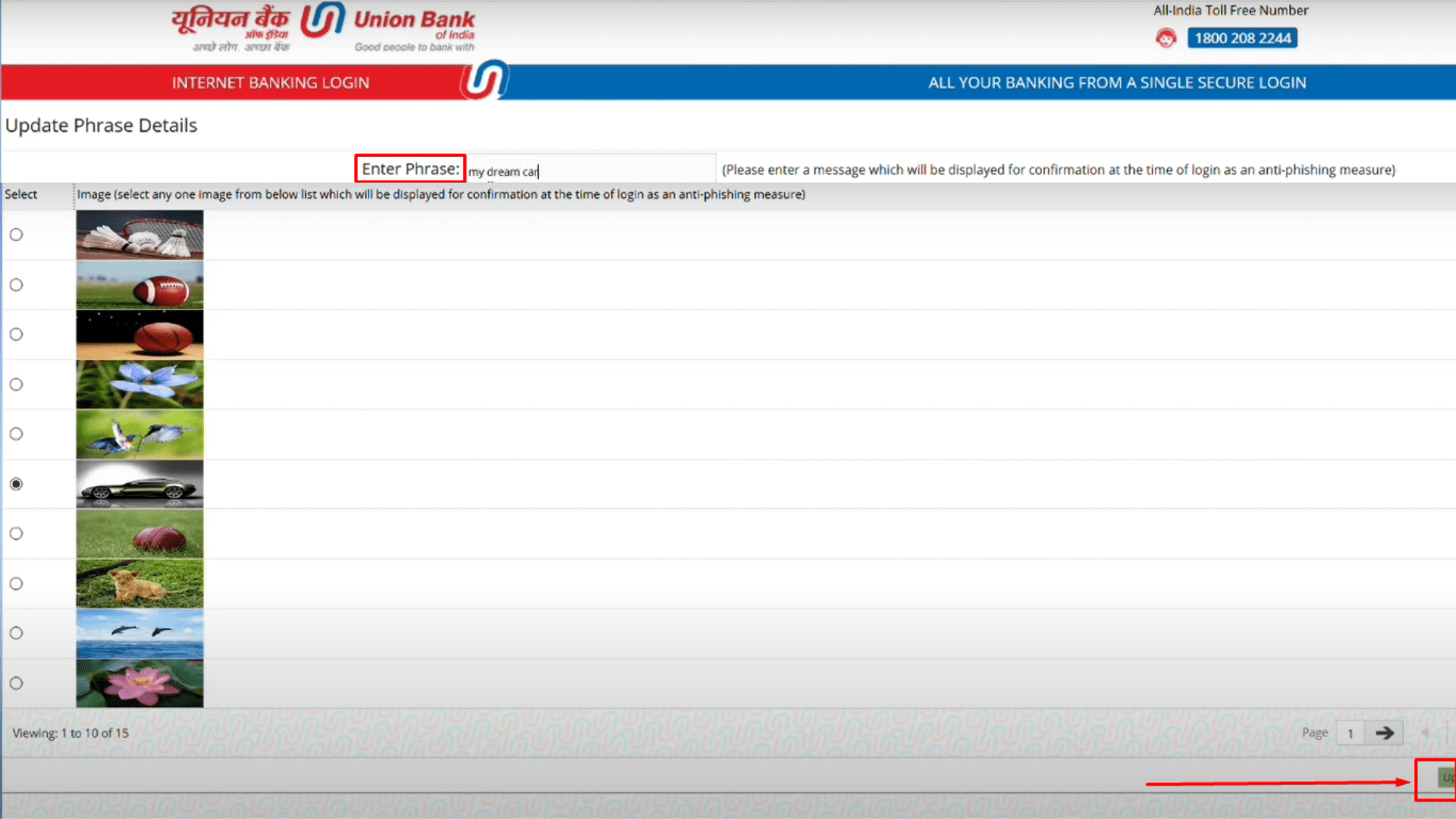

Step : 10 After creating the password, you can use Internet banking. Fill out the ‘Internet banking login’ credentials and click on the ‘Agree’ button.

Step: 11 Enter the valid ‘Captcha’ and select the ‘Update’ button.

Note: To get activated, the bank will take the next 24 hours to validate the method. Once the process begins, a confirmation code will be sent to your registered email ID and contact number. You can log in after 48 hours using your credentials.

Union Bank of India Net Banking Login Process

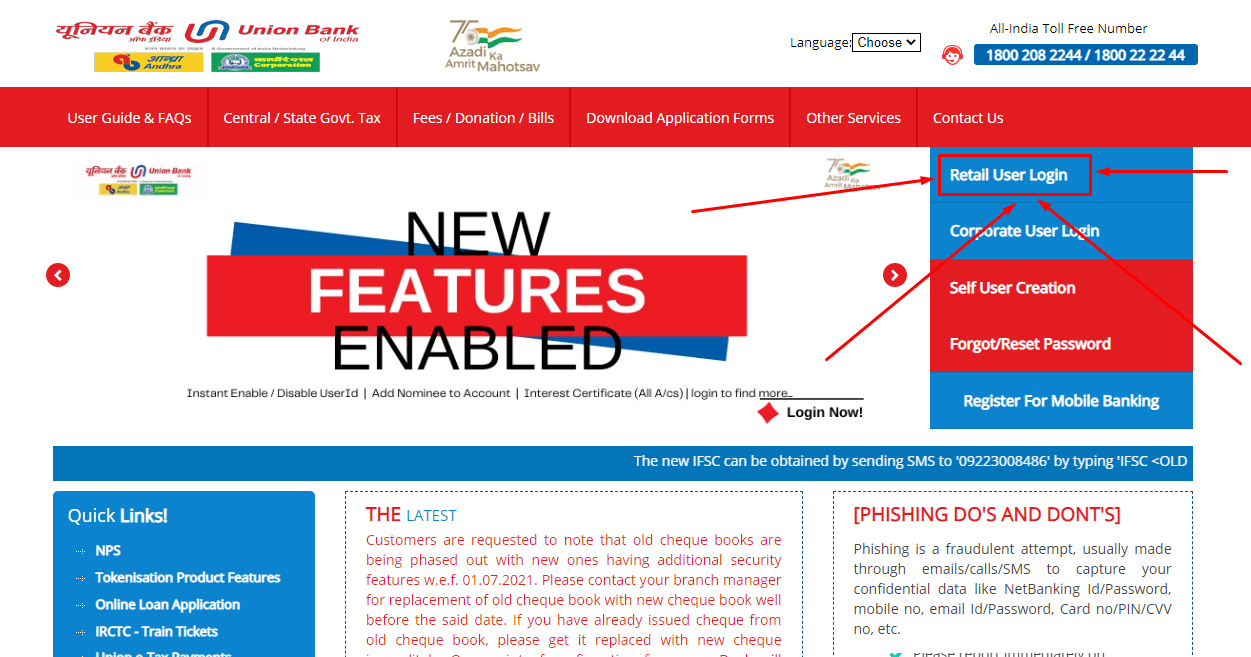

Union Bank of India provides Netbanking facility for both; Retail User Login and Corporate User Login.

Users can Login into their account by following the Union Bank of India Login steps mentioned below:-

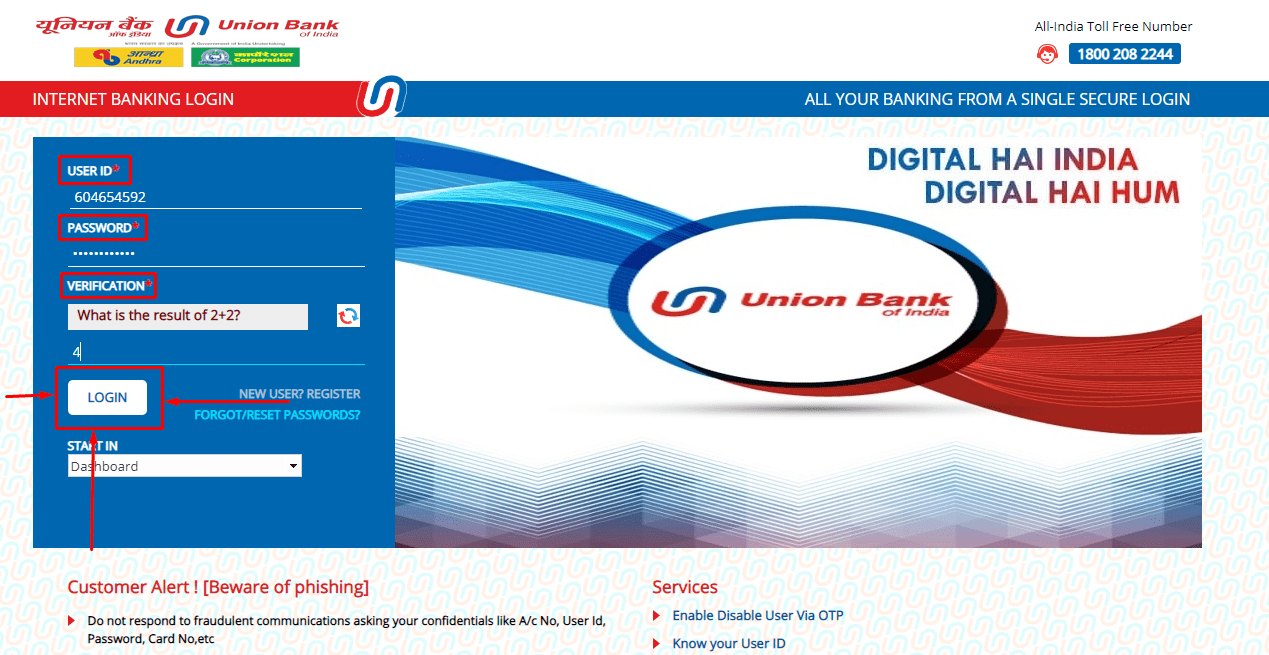

Step:1 Visit the official website for ‘Union Bank of India Retail Login’.

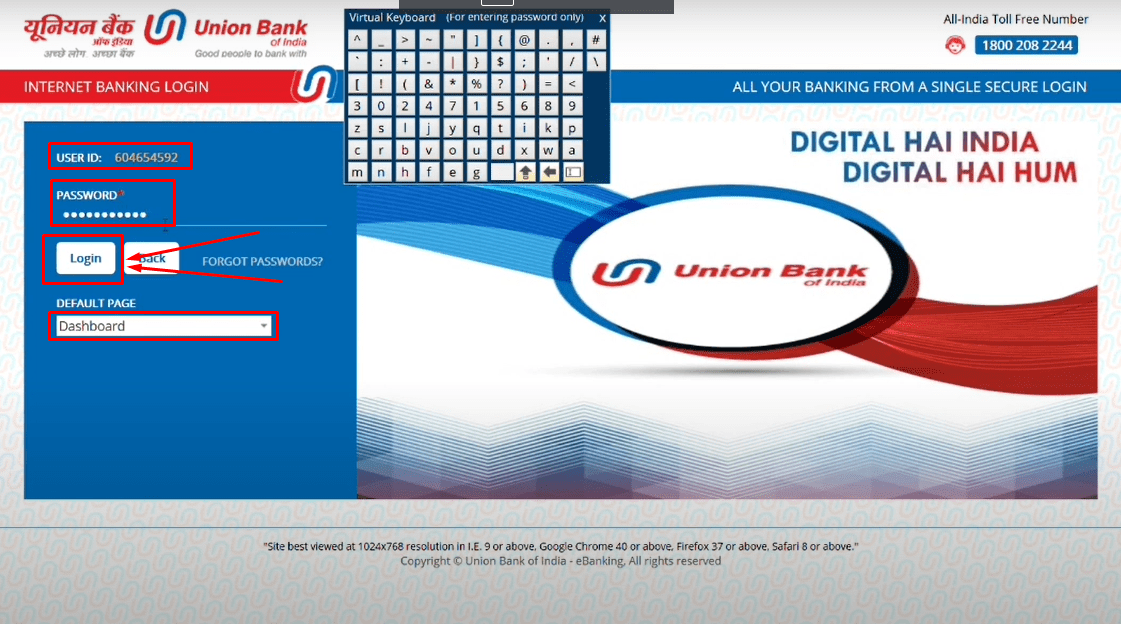

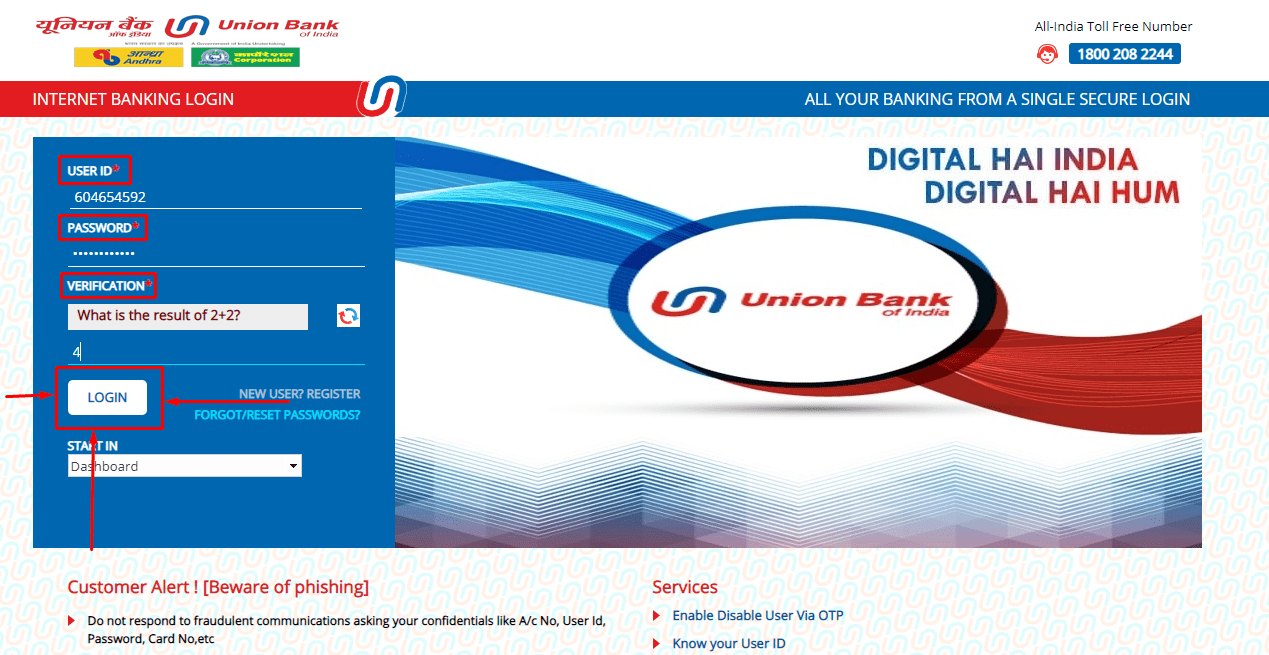

Step:2 Fill in the credentials such as user ID and password.

Step:3 After filling in the details, it will ask for the verification code, which you will receive on your registered contact number and email id.

Step:4 Finally, you are set to go for Union Bank Retail Login after submitting the OTP received on registered mobile number and clicking on the ‘Login’ option.

How to Reset Union Bank of India Login Password?

If you want to reset or change your Union Bank of India login password, follow these steps:-

Two methods are described in detail to restore your Union Bank of India Net Banking login password. The steps are as follows:-

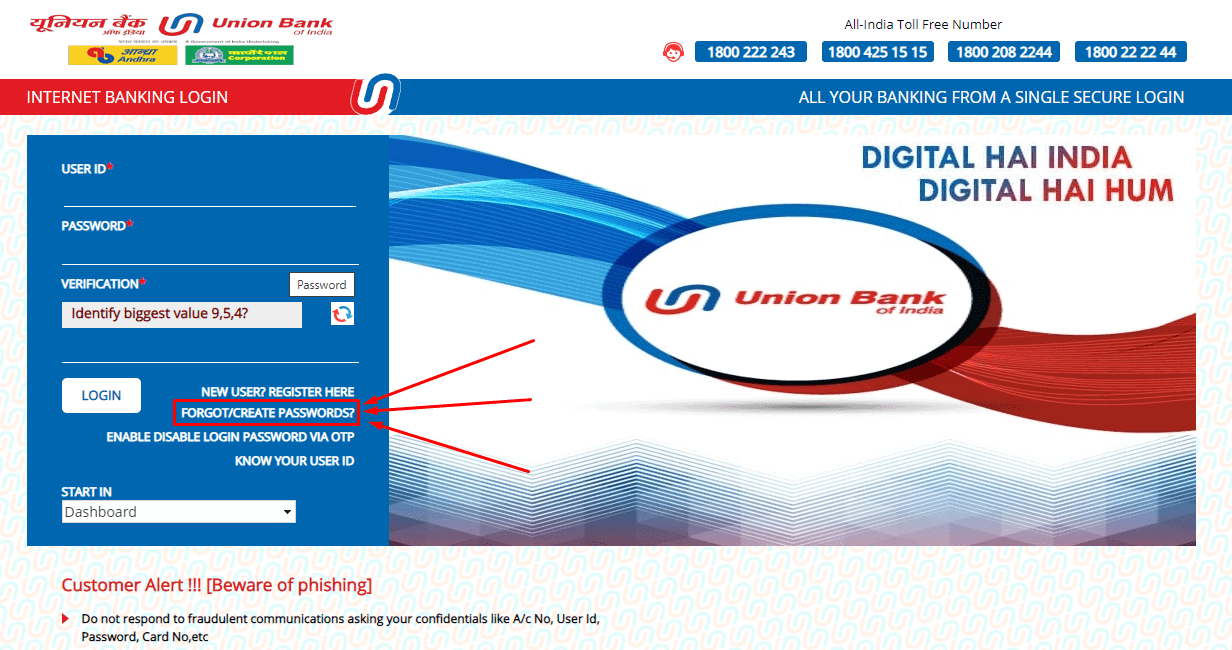

- Go to the official portal of the Union Bank.

- Click on ‘Online Banking‘, present on the side right of the website.

- A box will pop up on the left side. Select the ‘Union Bank Banking‘ option.

- Choose the ‘Forgot/Reset Password‘ option, present on the right side of the webpage.

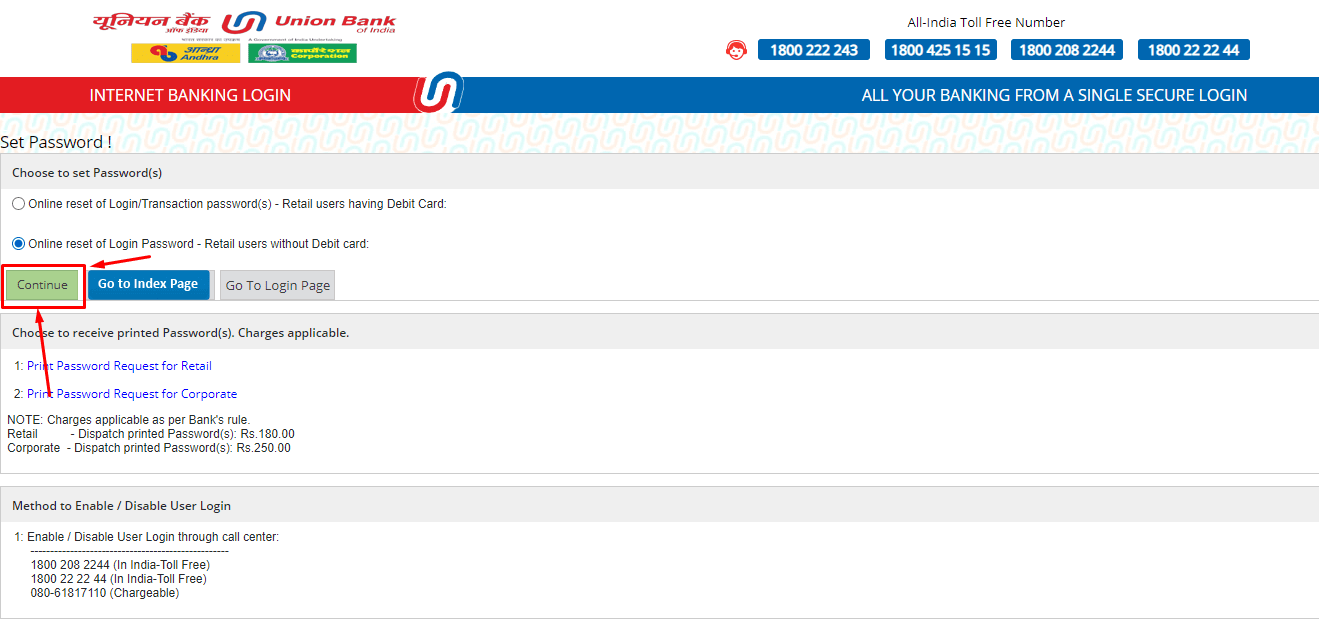

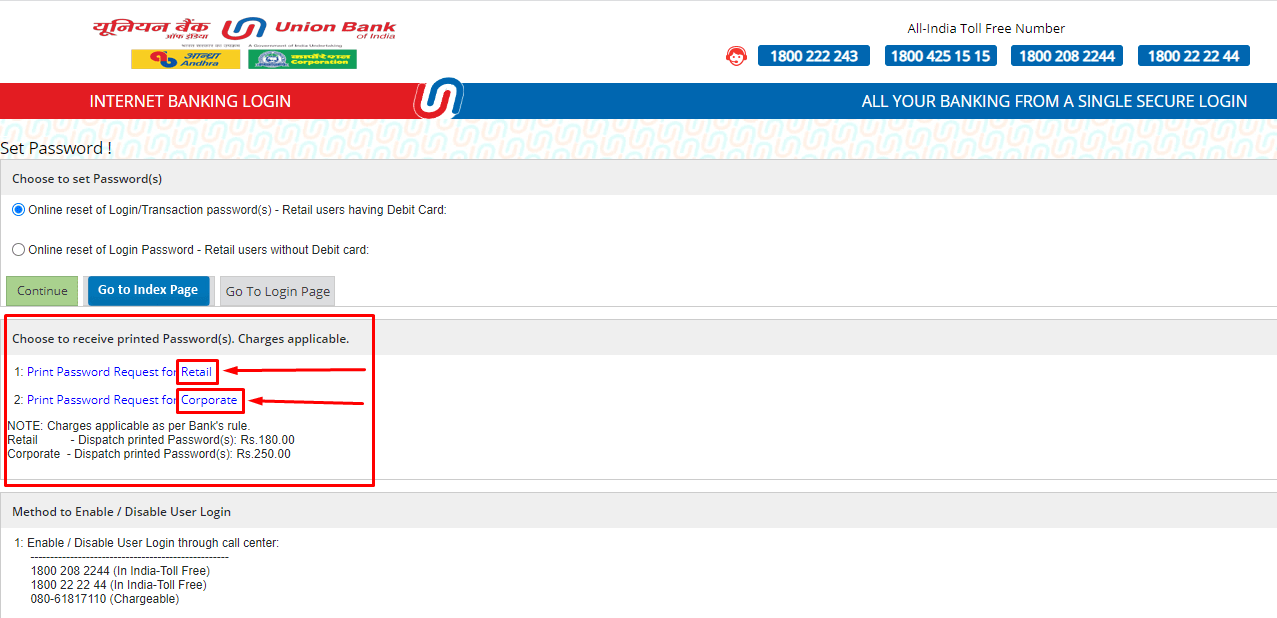

- A page consisting of two methods will appear:-

- Online reset of login/transaction password(s): Retail users have a debit card.

- Online reset of login password: Retail users without a debit card.

Choose according to your requirements.

- You can receive printed Passwords (s) through two applicable charges.

- Print Password Request for Retail for retail users.

- Print Password Request for Corporate for corporate users.

Note: Charges are applicable according to the bank’s guidelines.

- Retail: Printed Passwords via Despatch cost INR 180.00.

- Corporate: Printed Passwords via Despatch cost INR 250.00.

UBI Net Banking Features & Benefits

- Payment Transactions Data: With online banking, you may easily see your bank account’s payment records. It is beneficial for keeping track of your savings account payments and any anomalies.

- Access to Bank Statements: Users can utilise the internet banking service to see and get print of their transactions statements.

- Funds transfer: The bank can transfer money digitally. It is considered one of the most important features of online banking services. People can use this service not just to transfer funds but also to transfer funds to other Indian banks. However, this service provides proper security to the users.

- Types of payments mode: Account Holders of Union Bank can swiftly do the transactions to non-Union Bank account holders. It can be done by using two major methods, NEFT and RTGS. Both methods can be performed digitally, and these techniques are safe. It also allows for speedy money transfers.

- Direct or indirect payments: People can make indirect or direct transactions from their accounts using online internet banking services. The guidelines are straightforward to follow.

Services Available at UBI Net Banking

Union Bank’s net banking makes services easy and flexible for people. The table consists of some of the main services offered by Union Bank through its online banking facility.

| Account Details: Update and View | View account Statements | Show Mini Bank Statement | Transfer money within Union Bank | Easy Transactions to another bank’s account |

| Fill details for Nomination and PAN | Update details for Aadhaar Card | Change Log-in credentials | Requests for DD(Demand Draft) | Payment for NPS |

| Fill online application for Loan | Open: Fixed/Recurring account | e-Tax Payments for Union Bank | Bill transactions for utility | NEFT/RTGS: Timing & Charges |

| Open account via Online | Branch/ATM Locator | Stake in schebankmes especially for Government | Produce score for CIBIL | Provide Immediate Personal Loans |

| Show transactions for Calendar & E-instruction | Organise account: Demat | Train booking Tickets | Available Insurance | Online: Locker |

| OrganiseTrading | Perform charity | Put money into Mutual Funds | Easy Credit/Debit Card Bill transactions | Instant message Banking |

Methods to Enable/Disable UBI Net Banking Password

To enable and disable the method for UBI Net-Banking Password, some of the steps are mentioned below, which must be followed from the user’s registered mobile number.

For Retail Users

Enable: Type URET ENA (User ID) & send: 09223008485

Disable: Type URET DIS (User ID) & send: 09223008485

For Corporate Users

Enable: Type UCORP ENA (Corporation ID) (User ID) & send: 09223008485

Disable: Type UCORP DIS (Corporation ID) (User ID) & send: 09223008485

What is the Process to Transfer Funds via UBI Net Banking?

The following steps are mentioned below that enrolled net banking customers must take to send money:-

Step:1 Visit the official website (https://www.unionbankonline.co.in/).

Step:2 Select the ‘Retail Login’ option. If a user has a business account number, then choose ‘Corporate Login’.

Step:3 Fill in the credentials like user ID and password and click on the ‘Login’ option.

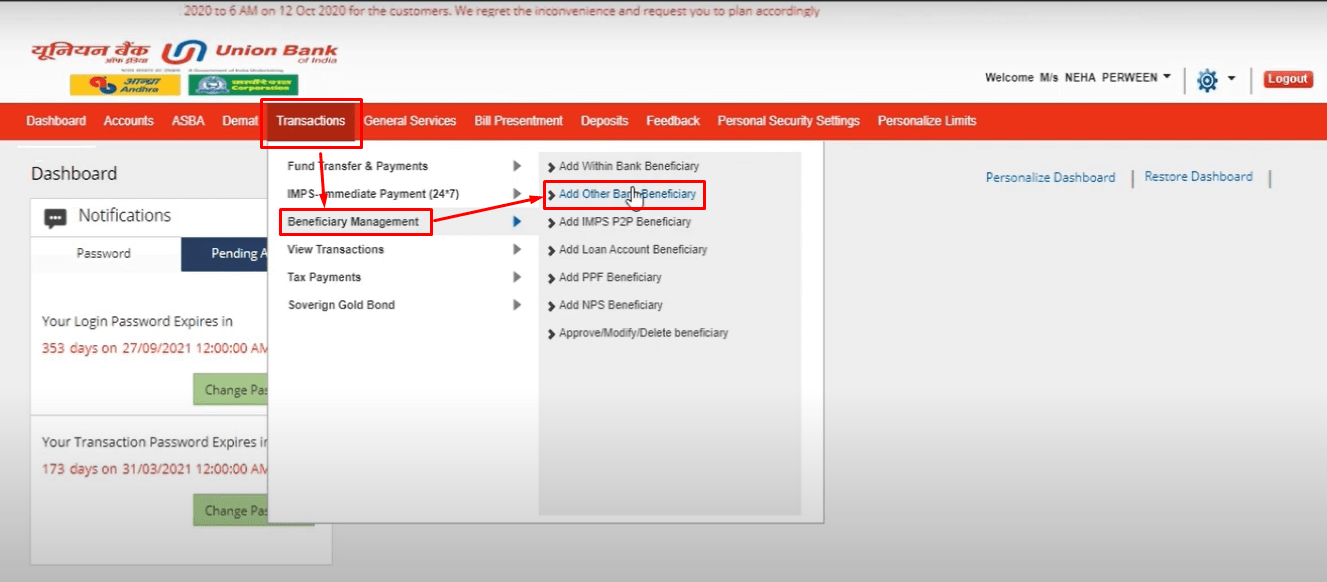

Step:4 Click on the ‘Transaction’ category, and a drop-down menu will appear.

Before making the payment, user need to add the beneficiary details under ‘Beneficiary Management’.

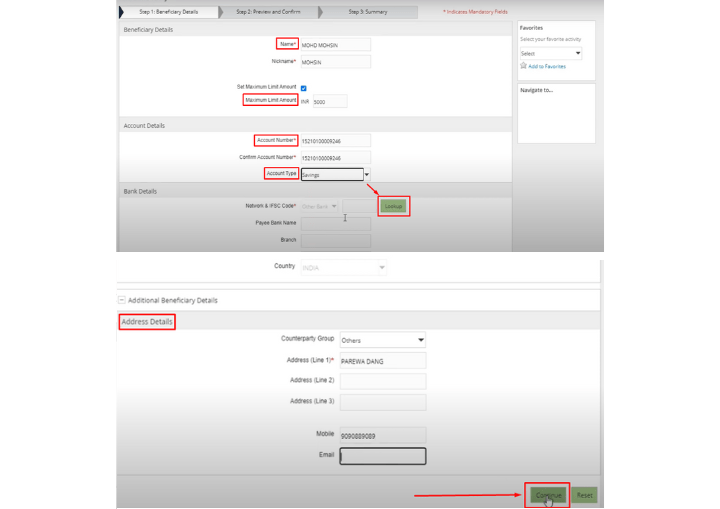

Step:5 Fill out the details for beneficiary and click on the’ Continue’ button.

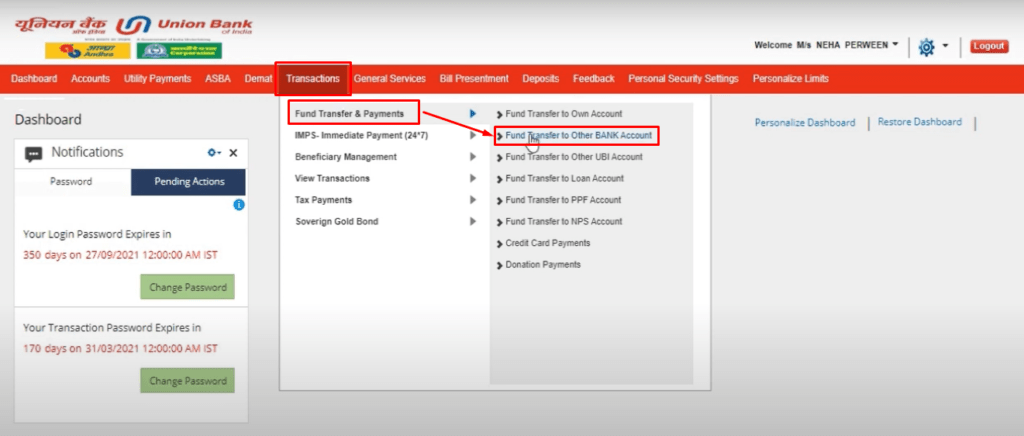

Select the ‘Fund Transfer & Payments’ option.

Step:6 On the right side, a box will appear consisting of several options for making payment. Choose options as per your choice.

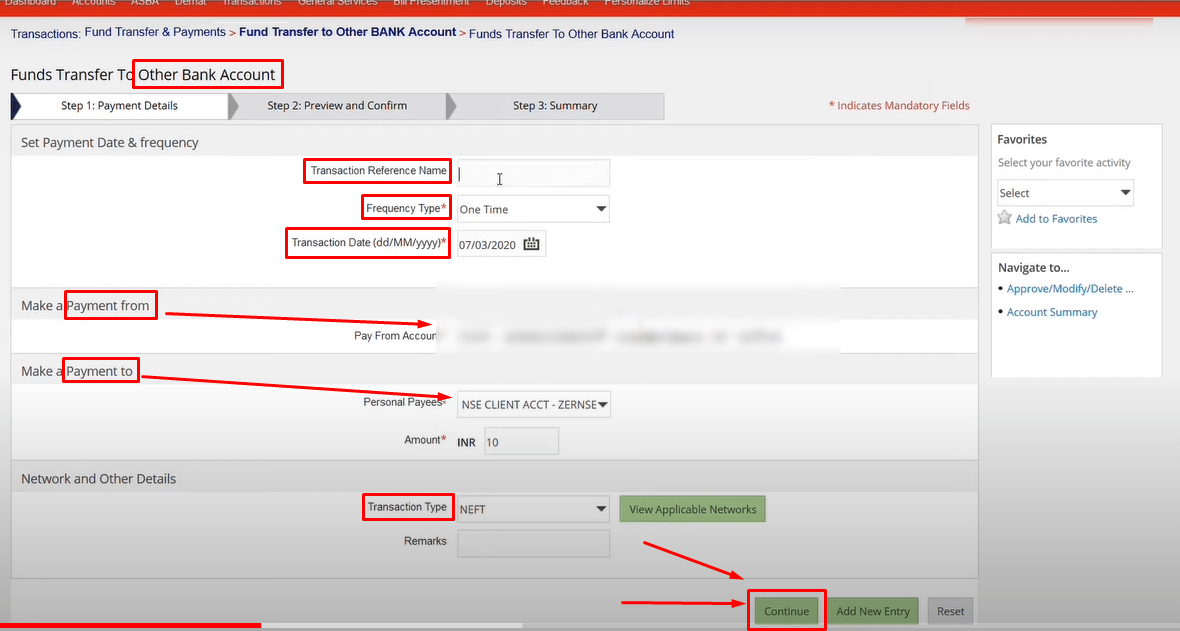

Step:7 For payment options, perform two basic steps payment details, preview and confirm.

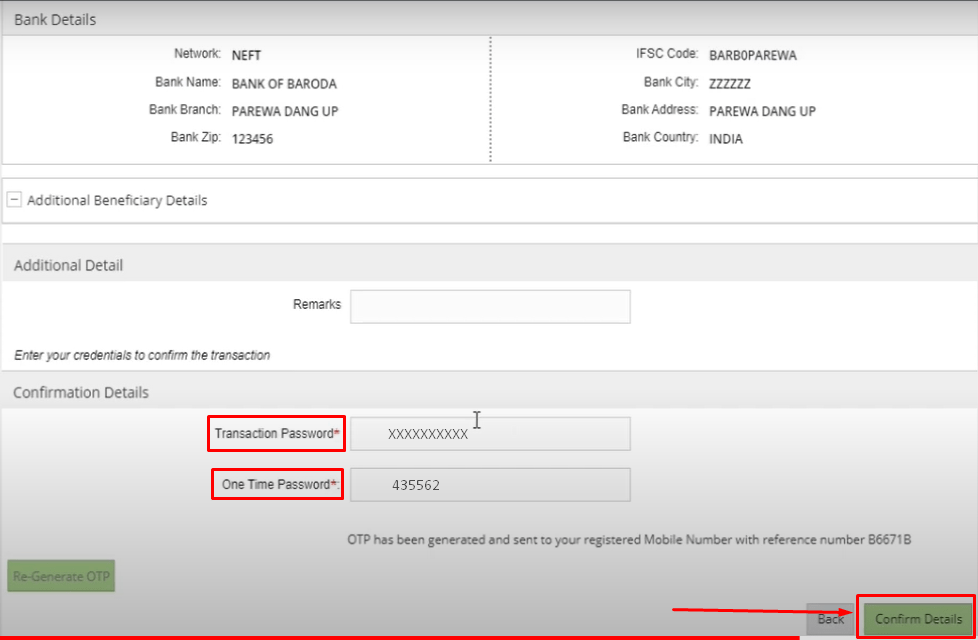

Step:8 Enter the details such as amount, transaction date, and transaction types like ‘IMPS’ or ‘NEFT/RTGS’.

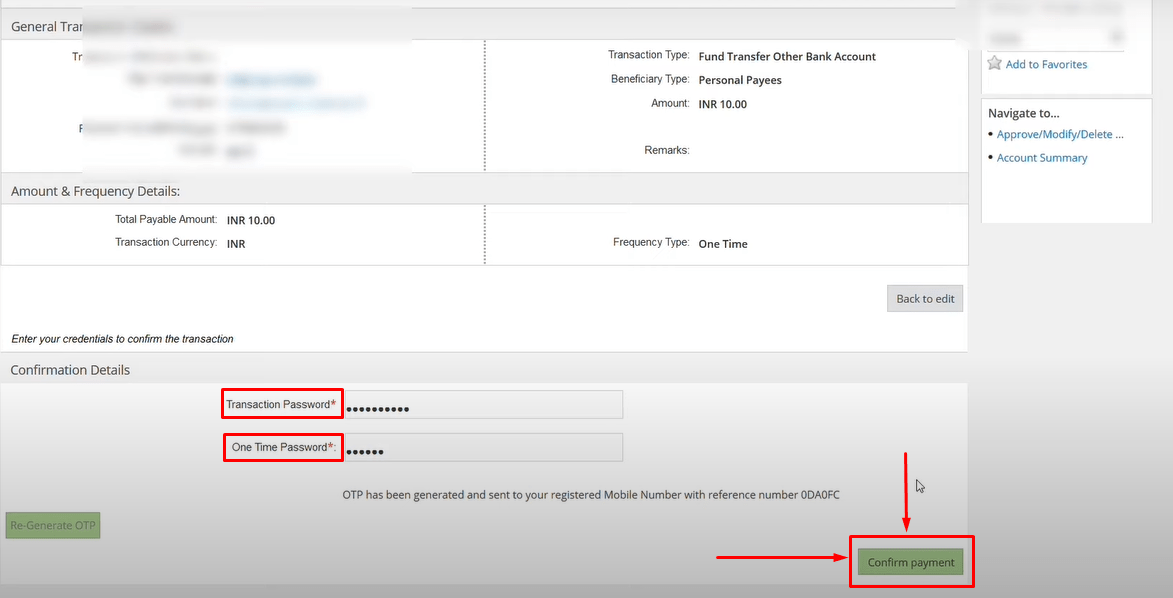

Step:9 Click on the ‘Continue’ option for payment confirmation.

Step:10 In order to receive the valid OTP, fill out the registered phone number and email id and click on the ‘Confirm Payment’ button.

How To Pay Credit Card Bills Online In Union Bank Of India Net Banking?

To maintain your good credit score, it is important to pay your credit card bills before the due date. To ensure the same, the Union Bank of India provides several methods to pay your credit dues. You can use any of the methods at your convenience and pay the credit card bills. The different modes are as follows:-

The facility of Auto-Debit:

The auto-debit service saves your efforts and time in remembering your due credit card payment day every month. You have to pay to the Union Bank of India.

For using the auto-debit service you have to submit the StandingInstructions at the nearest branch of Union Bank of India branch to remove the sum from your current or savings account in Union Bank of India. Furthermore, make sure to keep an adequate balance in your account.

Using Net Banking:

You can use the UBI facility of net banking to pay your due payment for credit card bills by using a debit card from your Union Bank of India current or savings account.

Using NEFT / IMPS:

You can use the NEFT / IMPS transaction service to pay the credit card dues. Enter the 16-digit UBI card number in the account number text field as the beneficiary account and use the IFSC code for making a UBI credit card payment.

Using RTGS:

You can use the RTGS service from your bank account to pay the Union Bank of India credit card dues. Make sure to mention the card details, mobile number, email address, and IFSC code.

With Bill Desk:

You can pay your credit card dues using Bill Desk. For this you have to follow the link:-https://pgi[dot]billdesk[dot]com/pgidsk/pgmerc/ubicard/UBI_card[dot]jsp

Via Visa Money Transfer:

By using the Visa Money Transfer facility, you can pay your credit card dues to the UBI bank.

By ATM:

You can use your Union Bank of India credit card to pay the dues at any of the Union Bank of India ATMs.

What are the Transactions Limits under UBI Net Banking?

According to the Union Bank guidelines, making payments has some limits. To make transactions, some of the major documents are required to be:-

- The IFSC (Indian Financial System Code) of the branch

- Beneficiary’s name with the account number

- Payable amount

The table represents the total number of transactions with charges.

| Transaction Amount (INR) | Tax(INR) |

| Till 10,000 | 2.50 plus |

| Above 10,000 but below one lakh | 5 plus |

| Above One lakh but below Two lakhs | 15 plus |

| Above two lakhs | 25 plus |

Note: Timings to transfer funds via NEFT:

Monday to Friday: 8 a.m. to 6:30 p.m.

Saturday: 8 a.m. to 6:30 p.m. only on the 1st & 3rd Saturdays.

Sunday: Off. However, users can make transactions via IMPS.

UBI Net Banking Customer Care

Any queries related to online banking or complaints, the bank provides 24*7 customer support.

To enable password through the call centre:-

Toll-Free Number for Indian Citizens

1800-208-2244 / 1800-22-22-44

Contact number: 91+ 080-61817110

You May Also Like

Frequently Asked Questions (FAQ’s):-

Q1. How to check the balance by using UBI Net Banking?

Ans: Users of UBI can check their balance once they have finished the enrollment process. To check their balance, they will need a registered user ID and password. Customers can use the net banking service to review their balance, make payments, get account statements, and pay their credit card payments, among other things.

Q2. How can I activate Net banking in Union Bank without ATM?

Ans: Any customer without having an ATM cum debit card can create their internet banking ID and passwords. They have to use the Self User Creation module on the official website of the Union Bank of India.

Q3. Does Union Bank charge for Internet Banking?

Ans: No, it is completely free to use online banking.

Q4. How can I activate UBI mobile banking?

Ans: You can activate UBI mobile banking by dialling *826# from the registered mobile number linked to your bank account. Further Select 1 to activate the UnionMobile services.

Q5. How To Check Union Bank Of India Balance Online?

Ans: To check the Union Bank Of India Balance online you can connect with the customer care of Union Bank of India or give a call on the Toll-Free Number for Indian citizens 1800-208-2244 / 1800-22-22-44. The other contact number is Contact number: 91+ 080-61817110.

Q6. I am a Non-Resident Indian [NRI]. Can I get Internet banking services?

Ans: NRE / NRO savings bank accounts allow to be open but only on some conditions according to the India guidelines. For example, after filling in the credentials, a confirmation message will be sent to the Global NRI Centre in India for verification.