Honourable Finance Minister Nirmala Sitharaman presented the Union Budget 2025 on February 1st, setting the stage for India’s economic priorities. But as the nation eagerly tunes in, what dominates the browser search history today?’

Five core priorities topped the live budget 2025 discussions driving the government’s vision. These were:

- Accelerating Growth: Strengthening key sectors to sustain high GDP expansion

- Securing Inclusive Development: Welfare programs for rural and urban India

- Invigorating Private Sector Investments: Encouraging businesses, startups, and MSMEs

- Uplifting Household Sentiments: Measures to ease financial burdens

- Enhancing Spending Power: Empowering India’s rising middle class

The minister mentioned that the Union Budget 2025 focuses on “GYAN” Garib, Yuva, Annadata, and Nari. From revised budget 2025 income tax slabs offering relief to taxpayers to strategic investments in housing, manufacturing, and digital innovation, the budget reflects a forward-thinking approach.

With the Union Budget income tax live, let’s simplify the big updates and see what’s in it for you, businesses, and the economy.

Table of contents

- Key Highlights of Budget 2025

- Sector-Wise Impact of Union Budget 2025

- Real Estate: A Major Push with SWAMIH Fund 2.0

- Income Tax & Personal Finance: Big Relief for Middle Class

- Infrastructure & Connectivity: Expanding India’s Growth Engine

- Corporate & Business Taxation: Easing Compliance & Promoting Growth

- Science, Technology & Innovation: India’s Digital Leap

- Agriculture & Rural Development: Support for Farmers

- Union Budget 2025 Live Reactions & Analysis

- Final Thoughts: What This Budget Means for India

Key Highlights of Budget 2025

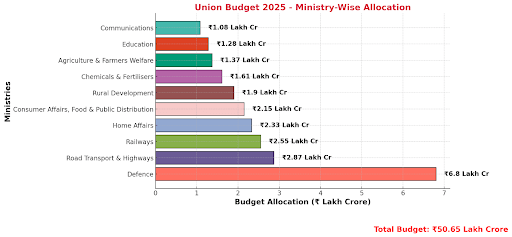

The Union Budget 2025 introduces transformative measures across taxation, infrastructure, real estate, and technology to drive growth, investments, and financial inclusion. Below are the major highlights:

| Category | Major Announcements |

| Income Tax |

|

| Senior Citizens | Tax deduction on interest income increased from ₹50,000 to ₹1 lakh. |

| TDS on Rent | The annual limit increased from ₹2.4 lakh to ₹6 lakh. |

| Infrastructure & Transport |

|

| Real Estate | SWAMIH Fund 2.0 launched with ₹15,000 crore to complete stalled housing projects. |

| Technology & AI | ₹500 crore was allocated for an AI Center of Excellence for education and research. |

| Employment & Industry | Footwear & Leather Focus Product Scheme: 22 lakh jobs, ₹1.1 lakh crore in exports, ₹4 crore in revenue expected. |

| Research & Development | 10,000 fellowships under PM Research Fellowship for tech innovation (IITs & IISc). |

| Agriculture & Rural Development |

|

Sector-Wise Impact of Union Budget 2025

The Union Budget 2025 brings a well-balanced approach to boost economic growth, create jobs, improve infrastructure, and support various industries. Here’s how different sectors will benefit from this year’s budget:

Real Estate: A Major Push with SWAMIH Fund 2.0

The real estate sector gets a much-needed boost with the introduction of SWAMIH Fund 2.0, which will help complete stalled housing projects. This move will relieve homebuyers waiting for their properties and improve market confidence for developers and investors.

Key Announcements:

- ₹15,000 crore was allocated to finish stalled real estate projects.

- PM Awas Yojana (Urban & Rural) Significant tax relief will benefit taxpayers.

- Tax rebates make consumer-friendly ownership more affordable.

- Expected increase in real estate demand and stable property prices

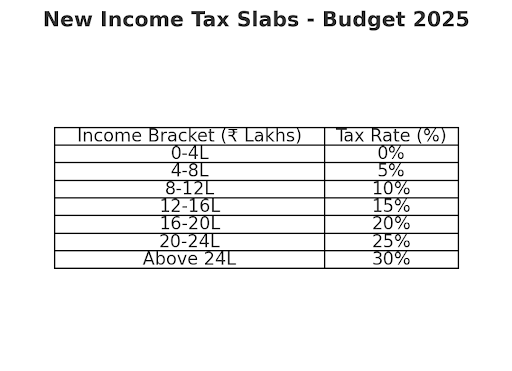

Income Tax & Personal Finance: Big Relief for Middle Class

Taxpayers will benefit from significant tax relief, making this a consumer-friendly budget. The New Tax Regime ensures that income up to ₹12 lakh remains tax-free, giving individuals higher savings and increased spending power.

What Does 12 Lakh Rebate Mean for You?

- Under the new tax regime, the government increased zero income tax rebates for earnings up to ₹12 lahks from ₹7 lakhs earlier.

- Revised tax slabs offer lower rates for a wider income range.

- Standard deduction increased, reducing taxable income for salaried employees.

- Senior citizens’ tax deduction on interest income raised from ₹50,000 to ₹1 lakh.

- TDS on rent limit increased from ₹2.4 lakh to ₹6 lakh, reducing tax compliance.

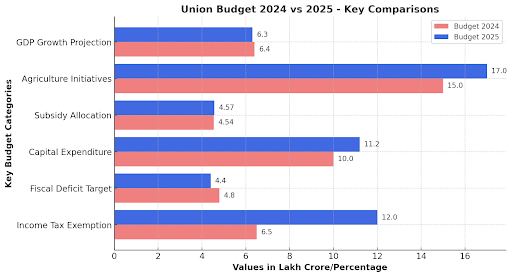

Infrastructure & Connectivity: Expanding India’s Growth Engine

The Union Budget 2025 prioritises regional development through infrastructure expansion, banking reforms, and economic initiatives to boost local industries. Bihar receives a special focus on establishing the Makhana Board, which aims to enhance the production, processing, and exports of the region’s famous fox nuts. Additionally, IIT Patna’s infrastructure expansion is expected to drive advanced technological research and innovation.

Developing a greenfield airport and new road projects worth ₹26,000 crores will enhance connectivity and boost trade, tourism, and industrial activity across key economic zones. Banking reforms have also been introduced under the redesigned PM Swadhinin initiative. These include improved bank loans and the launch of UPI-linked credit cards with a ₹30,000 cap, making digital transactions more accessible to small businesses and individuals.

Key Announcements:

- ₹11.2 trillion was allocated for highways, metro projects, and urban infrastructure.

- UDAN 2.0 will introduce 120 new regional airports, which are expected to serve four crore passengers in 10 years.

- Modernisation of Indian Railways, with investments in electrification and green energy

- Public-Private Partnership (PPP) projects to attract private investment in infrastructure

Corporate & Business Taxation: Easing Compliance & Promoting Growth

The budget introduces corporate tax reforms to support businesses, startups, and MSMEs, making compliance easier and boosting investments. The government also provides export incentives to strengthen India’s global trade presence.

Key Announcements:

- New corporate tax slabs were introduced to simplify taxation.

- Relaxation of GST compliance norms for MSMEs and startups

- Incentives for export-driven industries, particularly manufacturing, AI, and renewable energy

- Boost for the footwear and leather industry, expected to generate:

- 22 lakh new jobs

- ₹1.1 lakh crore in exports

- ₹4 crore in additional revenue

Science, Technology & Innovation: India’s Digital Leap

With the world advancing AI, the government has allocated funds to establish a Center of Excellence in AI, focusing on education, research, and training.

Key Announcements:

- ₹500 crore was allocated for an AI Center of Excellence for education and research.

- 10,000 scholarships under the PM Research Fellowship for tech and innovation

Agriculture & Rural Development: Support for Farmers

The agriculture sector gets support through increased credit availability and modernised farming techniques under the Dhan-Dhaanya Krishi Yojana. Farmers, dairy producers, and fishermen will benefit from higher loan limits under the Kisan Credit Card scheme.

Key Announcements:

- Dhan-Dhaanya Krishi Yojana was launched to promote modern agriculture techniques.

- Kisan Credit Card (KCC) loan limit increased to ₹5 lakh, making credit easily accessible.

Union Budget 2025 Live Reactions & Analysis

Government & Political Reactions

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has been positioned as a middle-class relief and investment-driven budget. Prime Minister Narendra Modi highlighted the income tax exemption of up to ₹12 lakh as a key measure to boost disposable income and consumption. The government expects private investment and job creation to accelerate as a result. However, opposition leaders, including Rahul Gandhi, criticised the budget for prioritising corporate benefits over rural welfare, calling it pro-rich and lacking solutions for rising unemployment and inflation.

Market & Industry Response

Stock markets saw mixed movements, with consumer goods stocks rising by 2.5% on expectations of increased spending. In comparison, infrastructure and capital goods sectors fell by 1.8% due to lower-than-expected capital expenditure. The ₹15,000 crore SWAMIH Fund 2.0 for real estate is expected to unlock 1 lakh delayed housing units, benefiting homebuyers and developers. Analysts, however, question whether the funding is sufficient to address India’s massive stalled project backlog worth ₹2.5 lakh crore.

Public Sentiment

People widely appreciated the income tax revision, which benefits nearly four crore salaried individuals and increases their net savings by ₹50,000-₹1 lakh annually. The TDS threshold for rent, raised to ₹6 lakh, will ease compliance for 2.7 lakh rental property owners. While the UDAN 2.0 scheme aims to add 120 new regional air destinations, past data suggests only 40% of planned UDAN routes are operational, raising concerns over timely execution.

Expert Opinions & Analysis

Economists highlight that while tax cuts will boost short-term consumption, lower capital expenditure at ₹11.2 trillion may slow long-term infrastructure growth. The ₹500 crore AI research initiative aims to enhance India’s digital economy, but experts argue global AI leaders invest over ₹20,000 crore annually, making India’s allocation relatively modest. The budget’s short-term relief measures are well received, but questions remain about fiscal discipline, job creation, and execution efficiency.

Final Thoughts: What This Budget Means for India

The Union Budget 2025 is a pro-growth, pro-investment, and pro-consumer budget that focuses on:

✔ Reducing tax burdens and increasing disposable income.

✔ Boosting infrastructure & real estate with strategic investments.

✔ Encouraging businesses & startups with lower compliance costs.

✔ Expanding India’s digital and AI landscape for future-ready innovation.

✔ Supporting rural and agricultural sectors with better credit facilities.

With these bold reforms and high-impact policies, Budget 2025 aims to steer India toward long-term economic stability and sustainable growth.